Yamaha Motor (TSE:7272): Valuation Check After New Nikon Life Sciences Collaboration

Reviewed by Simply Wall St

Yamaha Motor (TSE:7272) just teamed up with Nikon Instruments to showcase its CELL HANDLER 2 system at Nikon’s BioImaging Lab in greater Boston, giving investors a fresh angle on the company’s life sciences ambitions.

See our latest analysis for Yamaha Motor.

The Nikon collaboration gives investors a fresh reason to revisit Yamaha Motor, especially with the latest share price at ¥1,138.5 and a 30 day share price return of 3.27 percent, which may help stabilize sentiment after a weaker year to date share price return and a still respectable five year total shareholder return of 91.96 percent.

If this life sciences push has you thinking beyond traditional automakers, it could be a good moment to explore other auto manufacturers that may be reshaping their growth stories too.

But with shares trading near analyst targets after a strong multi year run yet a weaker recent performance, is Yamaha Motor quietly undervalued today, or is the market already factoring in its next chapter of growth?

Most Popular Narrative Narrative: 10% Undervalued

With Yamaha Motor last closing at ¥1,138.5 against a narrative fair value of ¥1,140, the story hinges on whether ambitious earnings upgrades can stick.

The integration of the RV business with the golf car business to form the Outdoor Land Vehicle (OLV) business will focus on efficient operations and cost reductions, positioning the company for higher revenue and narrowing deficits, thus potentially improving operating income.

Read the complete narrative. Read the complete narrative.

Want to see what happens when modest revenue growth, rising margins and a lower future earnings multiple are combined in one valuation blueprint? The narrative spells it out.

Result: Fair Value of ¥1140 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent raw material inflation and a slower than hoped recovery in Marine demand could easily pressure margins and derail those optimistic earnings upgrades.

Find out about the key risks to this Yamaha Motor narrative.

Another Lens on Valuation

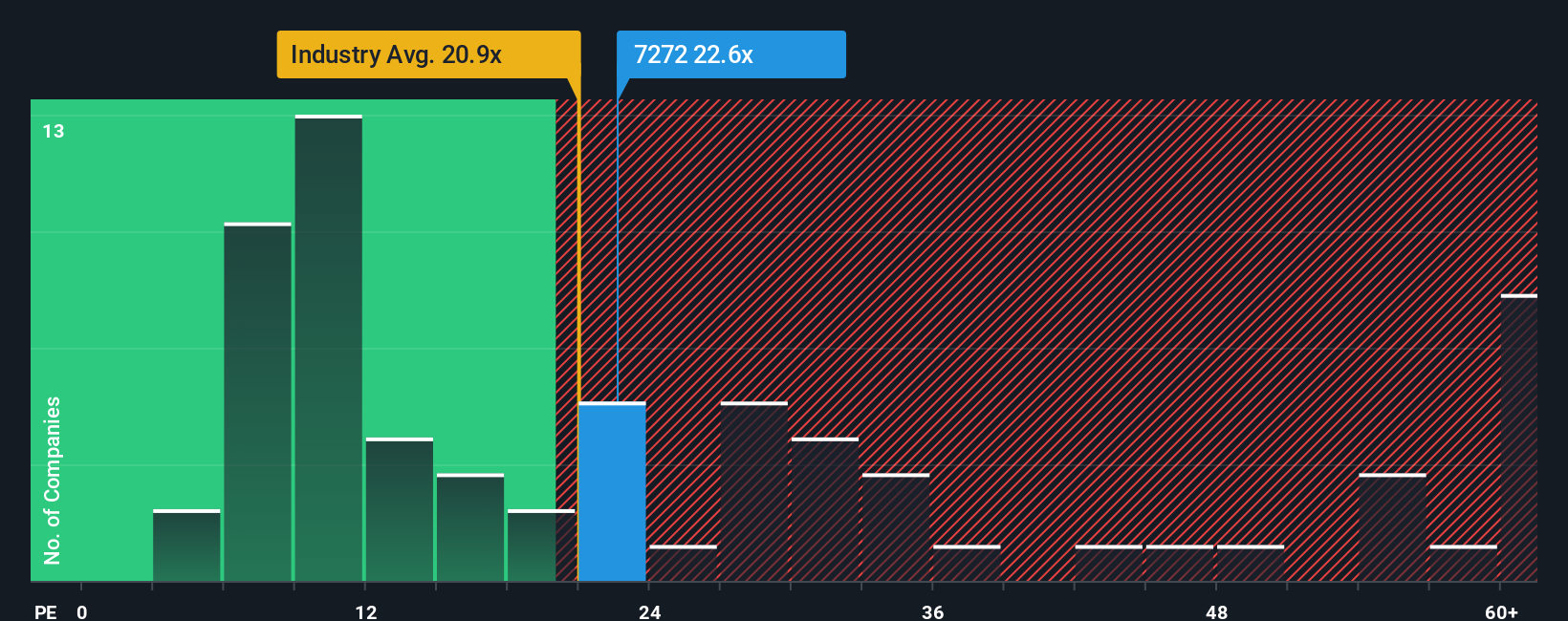

While the narrative suggests Yamaha Motor is about 10 percent undervalued versus its ¥1,140 fair value, the earnings multiple tells a sharper story. At a 71.7x P E against an Asian auto average of 18.6x and a fair ratio of 24.3x, the stock screens as richly priced rather than cheap. Is the market overpaying for the growth story, or are the models underestimating it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Motor Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes, Do it your way

A great starting point for your Yamaha Motor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single stock. Use the Simply Wall Street Screener to pinpoint focused opportunities that match your strategy before the market catches on.

- Lock in potential income streams by scanning these 15 dividend stocks with yields > 3% that may help strengthen your portfolio’s cash flow.

- Target mispriced opportunities with these 906 undervalued stocks based on cash flows that our models suggest the market has not fully recognized yet.

- Position yourself early in transformative innovation by reviewing these 28 quantum computing stocks shaping the next wave of computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026