Yamaha Motor (TSE:7272): Does the Recent Momentum Reflect True Value?

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Yamaha Motor is considered fairly valued, with analysts suggesting that its current share price is closely aligned with its underlying financial performance and growth prospects.

The integration of the RV business with the golf car business to form the Outdoor Land Vehicle (OLV) business will focus on efficient operations and cost reductions. This positions the company for higher revenue and narrowing deficits, which could potentially improve operating income.

Are you ready to see what could tip the scales for Yamaha Motor? This story hinges on an ambitious business overhaul, fresh product launches, and a hotly debated set of financial targets. Can future earnings outshine the current price, or is the key to this valuation hidden in the company's bottom-line blueprint?

Result: Fair Value of ¥1,140 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising raw material costs and potential operational missteps could quickly challenge the optimistic outlook and change the perceived value of Yamaha Motor.

Find out about the key risks to this Yamaha Motor narrative.Another View: Is There More Than Meets the Eye?

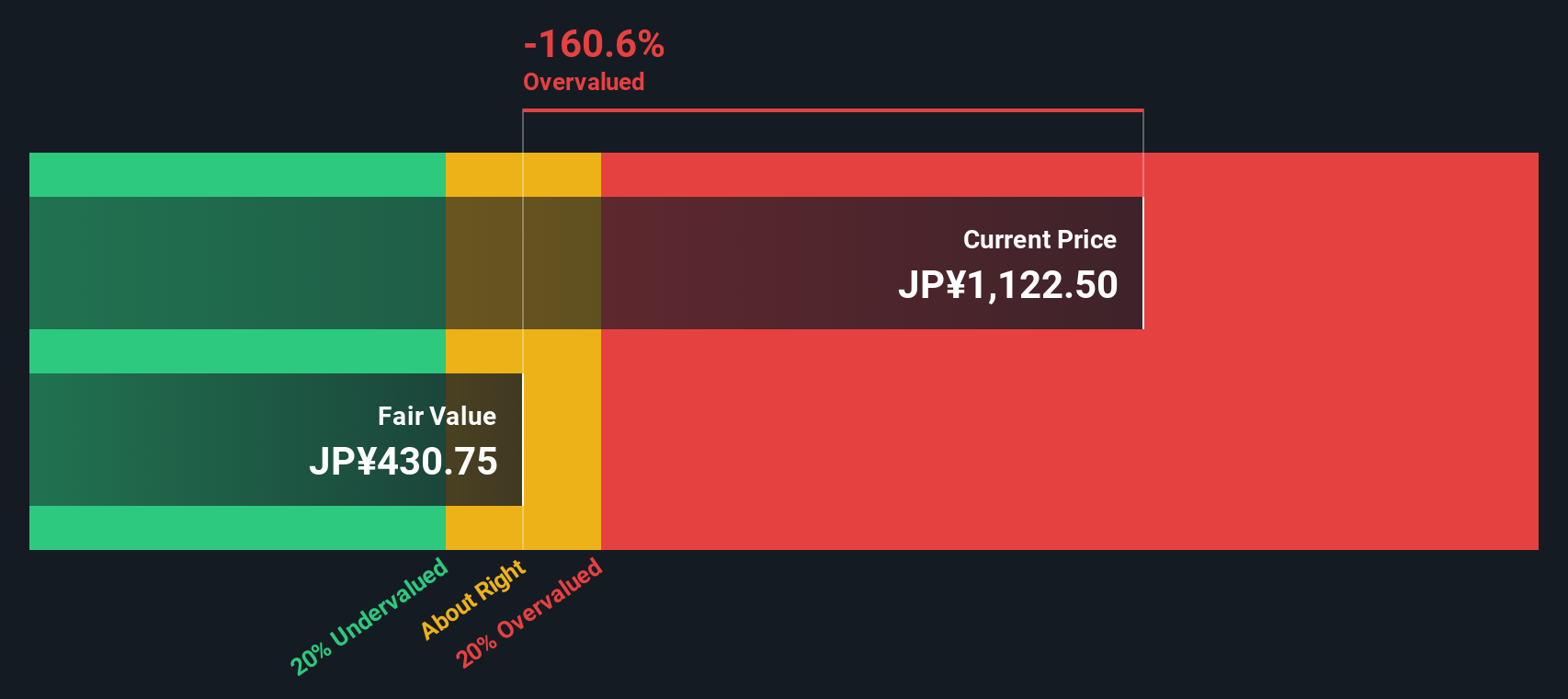

While analysts see Yamaha Motor as fairly priced based on its growth outlook, our DCF model suggests the stock could be trading above its intrinsic value. Could the market be overestimating its long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yamaha Motor Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily construct your own view in just a few minutes. Do it your way.

A great starting point for your Yamaha Motor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take your strategy up a notch by scoping out what’s happening beyond Yamaha Motor. You could be missing tomorrow’s winners if you stop here.

- Uncover potential in small-cap opportunities by scouting penny stocks with strong financials using the powerful insights of penny stocks with strong financials.

- Boost your search for passive income by finding dividend stocks with yields over 3 percent right now with dividend stocks with yields > 3%.

- Track down companies the market might be undervaluing today by tapping into stocks based on real cash flow strength with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives