Should Yamaha Motor's (TSE:7272) New Electric Scooters in India Prompt Investors to Revisit the EV Story?

Reviewed by Sasha Jovanovic

- Yamaha Motor recently announced the launch of two new electric scooters in India: the in-house developed AEROX E and the EC-06, which was created in collaboration with River Mobility Private Limited.

- This dual launch signals Yamaha's commitment to premium electric mobility and highlights its ongoing strategic push toward carbon neutrality in emerging markets.

- We'll now explore how Yamaha's introduction of premium electric scooters in India could influence the company's broader investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Yamaha Motor Investment Narrative Recap

To believe in Yamaha Motor as a shareholder, you have to buy into its ability to drive premiumization in motorcycles, especially through launches like the new electric scooters in India, despite raw material and labor cost pressures. While the AEROX E and EC-06 launches align with Yamaha’s strategy to expand in emerging markets and reach carbon neutrality, they are not expected to materially shift the company’s most important near-term catalyst: deriving more value and efficiency from its core Motorcycle and OLV segments. The biggest risk remains margin pressures from input cost increases, something these launches only partially address.

Among Yamaha’s recent announcements, the board’s approval to acquire Robotics Plus Limited is particularly intriguing. While not directly related to the scooter launches, it signals Yamaha’s ongoing push to diversify revenue streams and invest in high-growth technology businesses, complementing its focus on cost efficiency and new product rollouts in motorcycles.

But with costs rising and profit margins under pressure, investors also need to consider...

Read the full narrative on Yamaha Motor (it's free!)

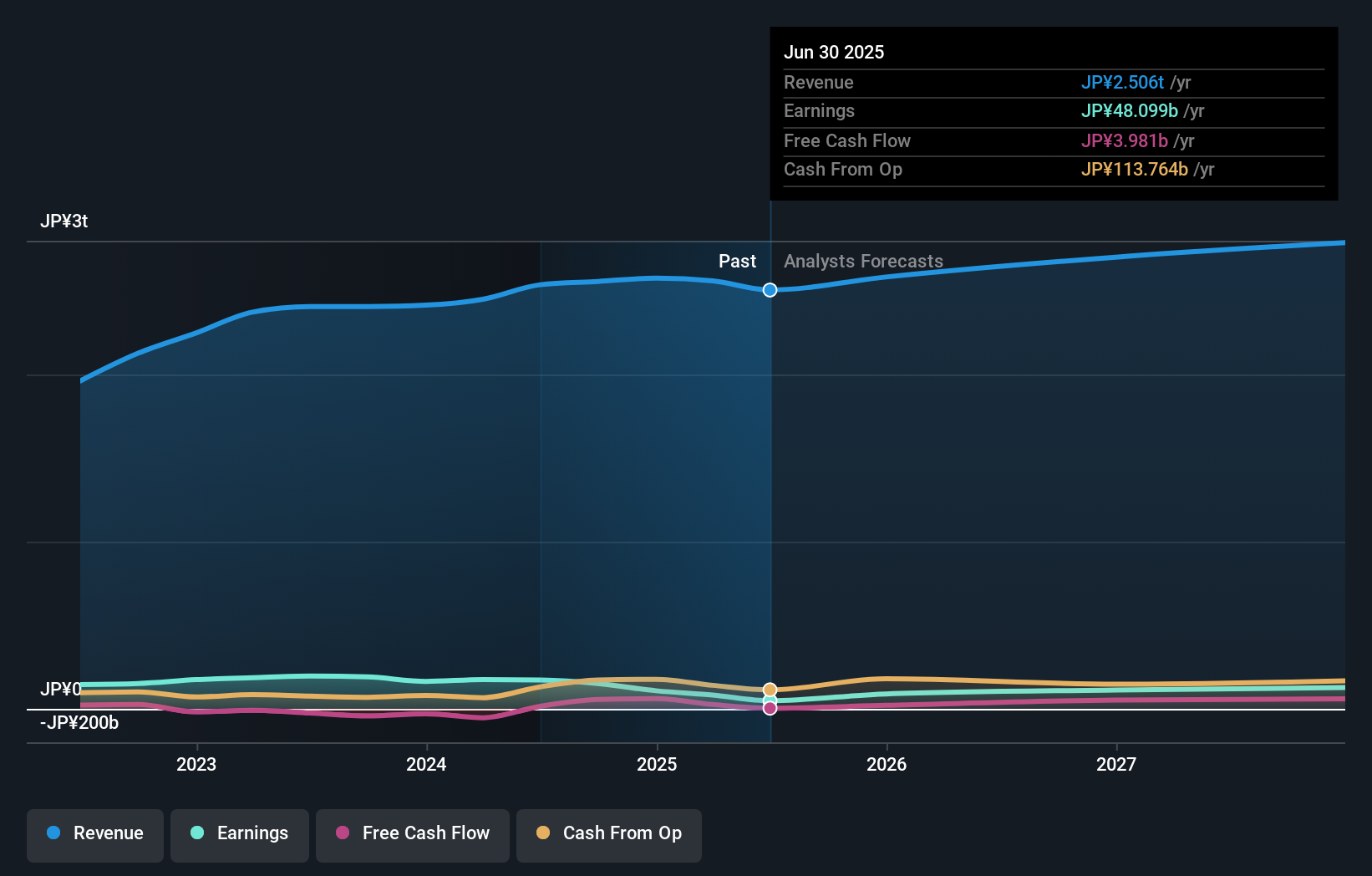

Yamaha Motor's outlook forecasts revenues of ¥2,750.6 billion and earnings of ¥143.6 billion by 2028. This is based on analysts' assumptions of 3.2% annual revenue growth and represents an increase in earnings of ¥95.5 billion from the current ¥48.1 billion.

Uncover how Yamaha Motor's forecasts yield a ¥1140 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community contributors provided two fair value estimates for Yamaha Motor stock, spanning ¥1,140 to ¥1,224.88. While opinions are split, persistent raw material and labor cost increases hold real implications for both short term earnings and the market’s confidence in profit growth forecasts, make sure you review several views before deciding for yourself.

Explore 2 other fair value estimates on Yamaha Motor - why the stock might be worth just ¥1140!

Build Your Own Yamaha Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamaha Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Yamaha Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamaha Motor's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives