Subaru (TSE:7270): A Fresh Look at Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Price-to-Earnings of 7.4x: Is it justified?

Subaru appears significantly undervalued based on its price-to-earnings (P/E) ratio, which stands at 7.4 times earnings. This is well below both the Japanese market average of 14.7x and the Asian auto industry average of 21x.

The price-to-earnings multiple is a fundamental valuation tool that helps investors understand how much they are paying for each yen of company earnings. For an established automaker like Subaru, a lower P/E ratio could suggest that investors are skeptical of future growth or are discounting potential risks. In comparison, a higher ratio would typically indicate optimism for sustained profits or expansion.

Given Subaru's P/E discount to both local and sector peers, the market may be underestimating its ability to deliver long-term shareholder value. The justification for this multiple will depend on whether recent performance and future prospects align with this low valuation. This may warrant a closer look at the company's earnings momentum and underlying fundamentals.

Result: Fair Value of ¥3,150 (ABOUT RIGHT)

See our latest analysis for Subaru.However, risks remain, including weak net income growth and a sizable decline from analysts' price targets. These factors could challenge the bullish outlook.

Find out about the key risks to this Subaru narrative.Another View: What Does the SWS DCF Model Say?

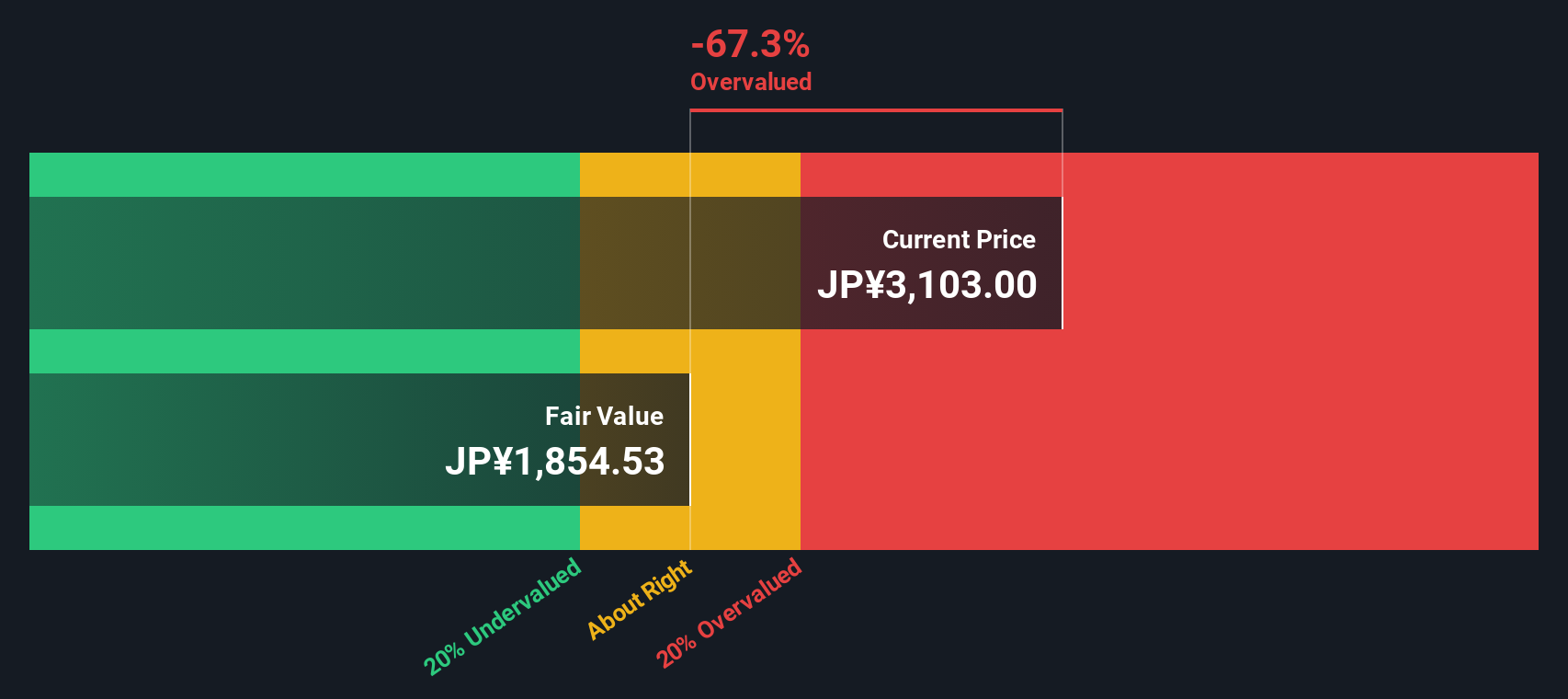

While the market approach based on earnings suggests Subaru looks attractively priced, our DCF model tells a different story. The model indicates the shares may be trading above their intrinsic value. Could expectations be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Subaru Narrative

If you feel there is more to Subaru’s story or prefer hands-on research, you can build your own view in just a few minutes, Do it your way.

A great starting point for your Subaru research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Confidently open up your investing horizons and capture new opportunities at the forefront of innovation and value. Don’t let standout stocks pass you by.

- Unlock value and spot hidden gems by tapping into the latest lineup of stocks trading below their intrinsic worth with undervalued stocks based on cash flows.

- Ride the next artificial intelligence wave by zeroing in on fast-rising companies at the heart of AI breakthroughs using AI penny stocks.

- Power up your portfolio with dependable income by targeting companies with strong yield potential through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives