Does Subaru’s Ongoing ¥50 Billion Buyback Clarify Its Capital Strategy For Investors (TSE:7270)?

Reviewed by Sasha Jovanovic

- Subaru Corporation recently reported progress on its August 2025 share repurchase program, having bought back over 12.5 million shares for approximately ¥39.16 billion through November 30, 2025.

- This ongoing buyback, which could reach up to 20.84 million shares or ¥50.00 billion by late December, signals a clear focus on capital returns to shareholders.

- Next, we will examine how Subaru’s active share repurchase program shapes its investment narrative and what it may mean for investors.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Subaru's Investment Narrative?

To own Subaru, you need to believe in a steady, cash-generative automaker that can convert a relatively low valuation and high‑quality earnings into consistent, if modest, growth and ongoing cash returns. The recent share repurchase progress, on top of higher dividends, reinforces a shareholder‑friendly capital return story but does not fundamentally change the near‑term catalysts, which still center on execution against FY2026 guidance and restoring margins after last year’s earnings contraction. The buyback slightly tightens the share count and may support earnings per share, yet it does not address underlying issues such as slower expected revenue and profit growth than the broader Japanese market, lower profitability than a year ago, and questions around board independence and governance turnover. For now, the news mainly amplifies Subaru’s existing capital allocation narrative rather than shifting its core risks.

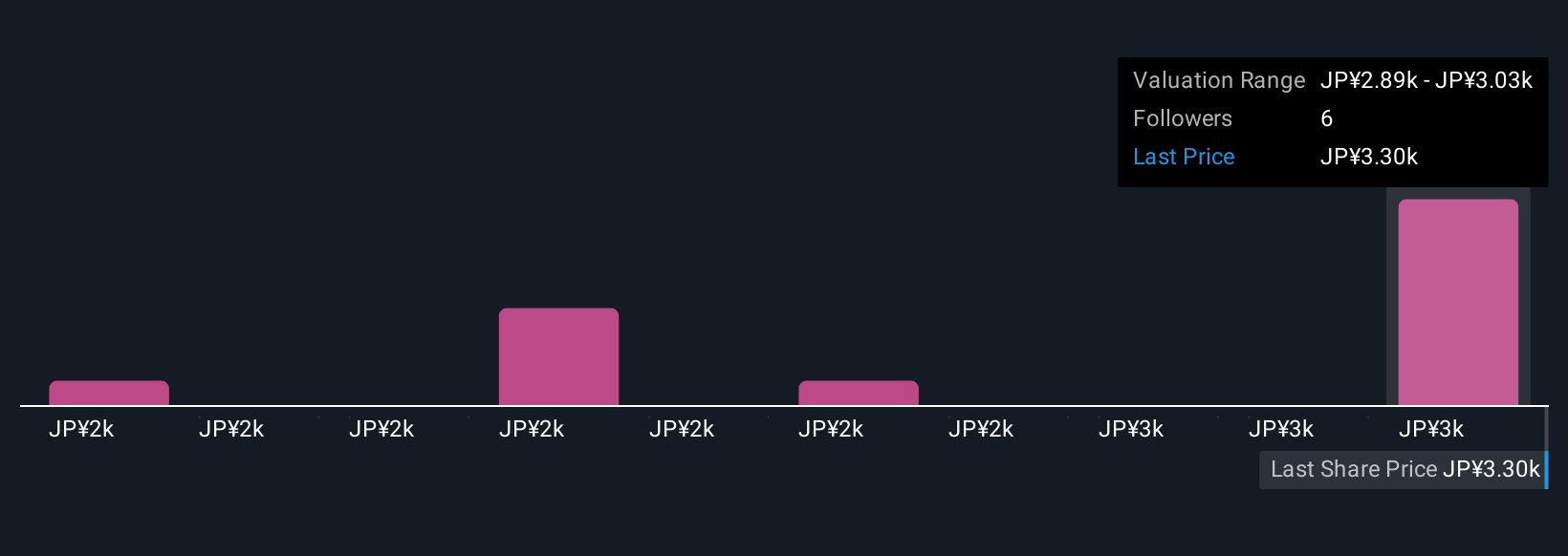

However, the combination of slower growth and governance concerns is something investors should not overlook. Subaru's share price has been on the slide but might be up to 45% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 4 other fair value estimates on Subaru - why the stock might be worth less than half the current price!

Build Your Own Subaru Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Subaru research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Subaru research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Subaru's overall financial health at a glance.

No Opportunity In Subaru?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026