How Honda’s Strategic Stake in Enedym May Reshape Its Electrification Path (TSE:7267)

Reviewed by Sasha Jovanovic

- Earlier this month, Enedym Inc. announced that Honda Motor Co., Ltd. had invested in the company to accelerate development of its advanced electric motor technologies, as part of Honda’s global innovation program.

- This move highlights Honda’s ongoing efforts to advance electrification and partner with startups at the forefront of next-generation powertrain solutions.

- We’ll examine how Honda’s partnership with Enedym could influence its strategy toward electrification and long-term growth prospects.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Honda Motor Investment Narrative Recap

To own Honda Motor stock, you need confidence in its ability to adapt as mobility shifts toward electrification and software-driven vehicles, especially while its motorcycle business remains a key contributor and traditional auto profits face pressure. The recent investment in Enedym Inc. underlines Honda’s pursuit of electric powertrain innovation, but it does not meaningfully alter the most immediate risk, recurring losses and margin pressure in its EV segment, where competitive and fiscal challenges remain substantial.

Among Honda’s recent announcements, its delay in building an EV value chain in Canada stands out as closely related to this Enedym partnership. This move highlights the tension between investing in next-generation technologies and the need to manage persistent losses and slower-than-expected EV adoption, factors likely to remain central catalysts as Honda’s electrification strategy evolves.

Yet even with new partnerships, it is important for investors to consider how recurring EV losses and growing competition could...

Read the full narrative on Honda Motor (it's free!)

Honda Motor's narrative projects ¥22,320.2 billion revenue and ¥855.5 billion earnings by 2028. This requires 1.1% yearly revenue growth and a ¥217.7 billion increase in earnings from ¥637.8 billion today.

Uncover how Honda Motor's forecasts yield a ¥1744 fair value, a 8% upside to its current price.

Exploring Other Perspectives

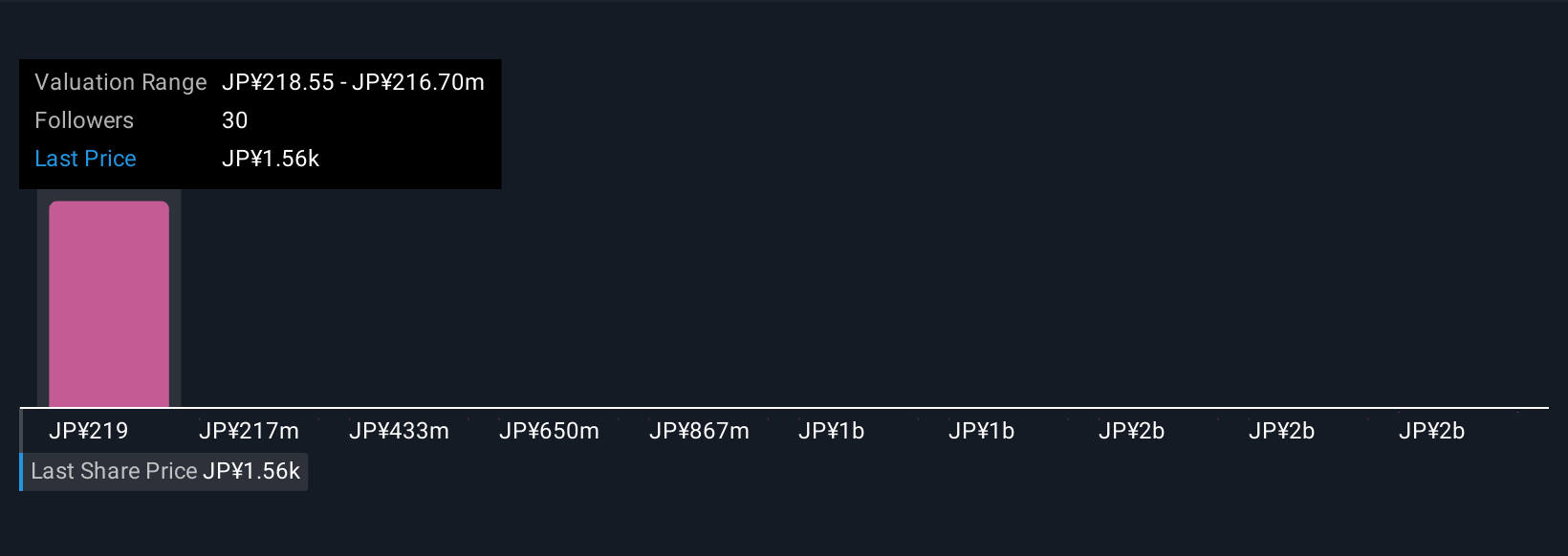

Simply Wall St Community members offered four fair value estimates for Honda Motor ranging from ¥218.55 to ¥1,744.38 per share. While opinions vary, persistent EV profitability risks could limit upside, making it valuable to compare these perspectives in light of Honda’s evolving strategy.

Explore 4 other fair value estimates on Honda Motor - why the stock might be worth as much as 8% more than the current price!

Build Your Own Honda Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Honda Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Honda Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Honda Motor's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives