A Fresh Look at Honda (TSE:7267) Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Honda Motor.

After a steady climb earlier in the year, Honda Motor’s share price momentum has faded recently, with a 7.5% decline over the past month and a year-to-date share price return of -3.9%. Despite the short-term volatility, long-term shareholders are still sitting on a solid 3.6% total return over the past year and an impressive 115% total shareholder return over five years. This serves as a reminder that bigger picture gains can withstand periodic sector shifts.

If you’re curious about where the next opportunities might be in the auto industry, it’s worth exploring See the full list for free.

This recent dip leaves investors to consider whether Honda Motor’s shares now represent an undervalued opportunity, or if the market has already taken into account all the company’s future growth potential. Is there value left on the table?

Most Popular Narrative: 13% Undervalued

Honda Motor’s last close at ¥1,517.5 sits significantly below the most popular narrative’s fair value target of ¥1,744. With the market still recalibrating, this view draws from a blend of future earnings growth and evolving sector drivers.

“Aggressive R&D and model adjustment in electrification and hybrid technology, including write-offs on non-competitive EVs and focus on next-generation hybrid components, signal a pivot to align product offerings with accelerating demand for lower-emission vehicles. This is expected to drive stronger revenue and margin expansion as Honda better matches consumer preference and regulatory requirements.”

What bold financial assumptions make up this bullish price target? It’s not just about hybrids and cost cuts. The growth blueprint hinges on major shifts in both revenue and margin expansion. See which future numbers drive this valuation bombshell.

Result: Fair Value of ¥1,744 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges from intensifying competition in Asia and losses in Honda’s EV business could quickly shift this narrative if they worsen.

Find out about the key risks to this Honda Motor narrative.

Another View: SWS DCF Model Offers a Different Take

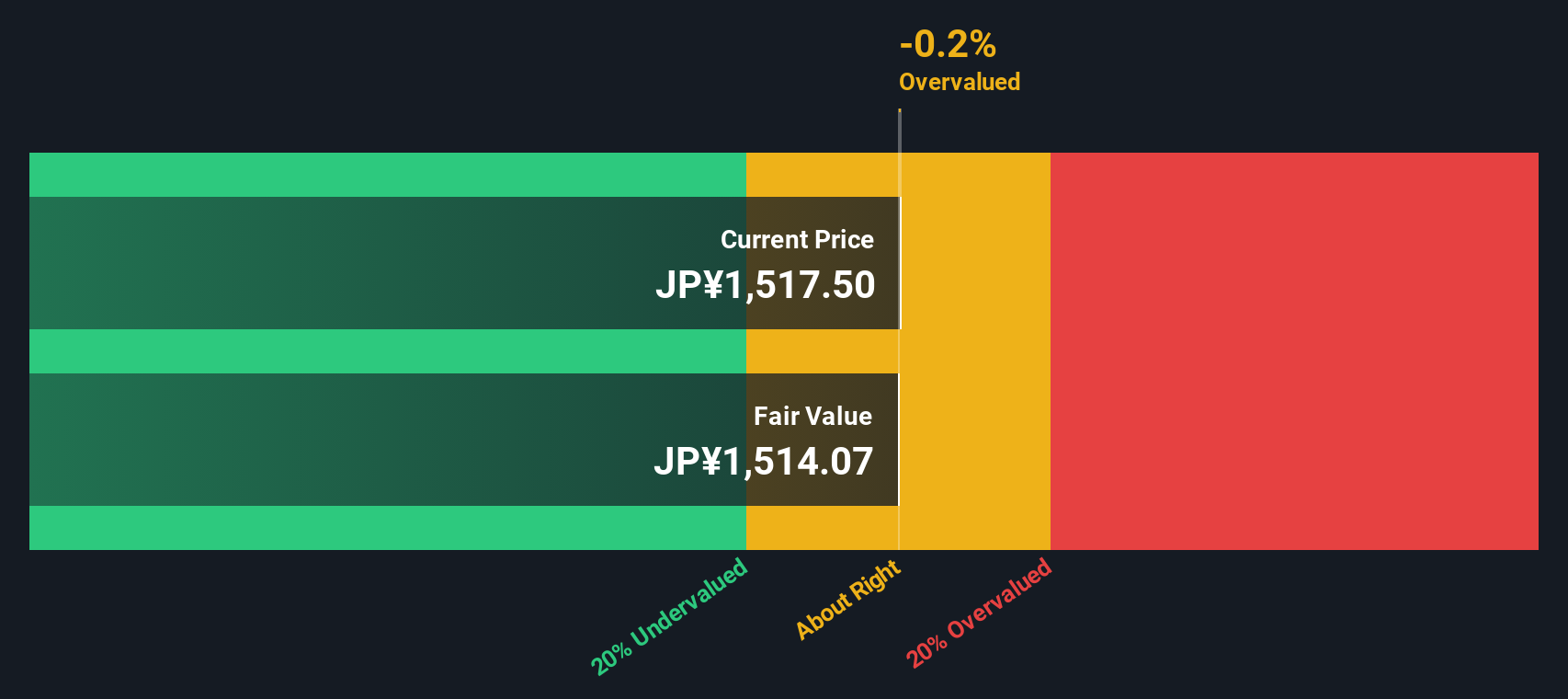

While some see Honda as undervalued based on multiples, our DCF model suggests the shares are trading very close to their intrinsic value. The current price is just a fraction above what long-term cash flows support. This narrow gap could signal there is less upside than it first appears. Is market caution justified or is it missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Honda Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Honda Motor Narrative

If you see things differently or want to dig into the data and craft your own angle, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Honda Motor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the familiar. Put your portfolio ahead with these handpicked stock ideas from the Simply Wall Street Screener. Opportunities like these move quickly, so check them out now before you miss the next potential breakout.

- Capitalize on high-yield opportunities and elevate your income by evaluating these 18 dividend stocks with yields > 3% offering strong dividends above 3%.

- Spot tomorrow’s winners by targeting undervalued stocks through these 878 undervalued stocks based on cash flows based on robust cash flow analysis.

- Join the transformation in healthcare technology by reviewing these 33 healthcare AI stocks at the forefront of medical innovation and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honda Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7267

Honda Motor

Develops, manufactures, and distributes motorcycles, automobiles, and power products in Japan, North America, Europe, Asia, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives