- Japan

- /

- Auto Components

- /

- TSE:7259

Reassessing Aisin (TSE:7259): Is the Stock’s Strong Recent Run Still Leaving Valuation Upside?

Reviewed by Simply Wall St

Why Aisin Stock Is Back on Investors Radar

Aisin (TSE:7259) has been quietly grinding higher this year, and the latest leg up is catching the attention of value focused investors as they revisit the auto supplier’s earnings power and long term transition story.

See our latest analysis for Aisin.

With the share price now around ¥2,783.5, Aisin’s strong year to date share price return of 57.04 percent and hefty 1 year total shareholder return of 70.80 percent signal momentum building behind its transition narrative rather than fading.

If Aisin’s run has you rethinking the auto space, this could be a good moment to explore other auto manufacturers via auto manufacturers and see what the market might be overlooking.

Yet with Aisin trading above consensus targets but still screening as materially undervalued on intrinsic metrics, investors face a key question: is this rally just catching up to fundamentals or already baking in the next leg of growth?

Price-to-Earnings of 12x: Is it justified?

On a price-to-earnings ratio of roughly 12x, Aisin screens as cheaper than peers but a touch pricey versus the broader auto components industry.

The price-to-earnings multiple compares today’s share price with the company’s per share earnings. It is a simple way to gauge how much investors pay for each unit of profit in a cyclical, earnings driven sector like auto components.

For Aisin, the 12x multiple looks modest given that earnings grew 479.2 percent over the past year. That surge is far above the company’s more muted 5 year earnings growth trend and forecasts of mid single digit profit expansion ahead. The market appears to be assigning a discount to the recent earnings spike while still recognising stronger profitability and high quality earnings compared to its own history.

Relative to the JP Auto Components industry average of 9.8x, Aisin trades at a premium, suggesting investors are willing to pay more than for the sector overall. However, the multiple still sits below both the estimated fair price-to-earnings ratio of 14.1x and the peer average of 16.7x, leaving room for the market to re rate the stock if its improving margins and profit growth prove sustainable. Explore the SWS fair ratio for Aisin

Result: Price-to-Earnings of 12x (UNDERVALUED)

However, investors still face execution risk in Aisin’s EV transition, as well as potential margin pressure if global auto demand slows more sharply than expected.

Find out about the key risks to this Aisin narrative.

Another Angle on Value

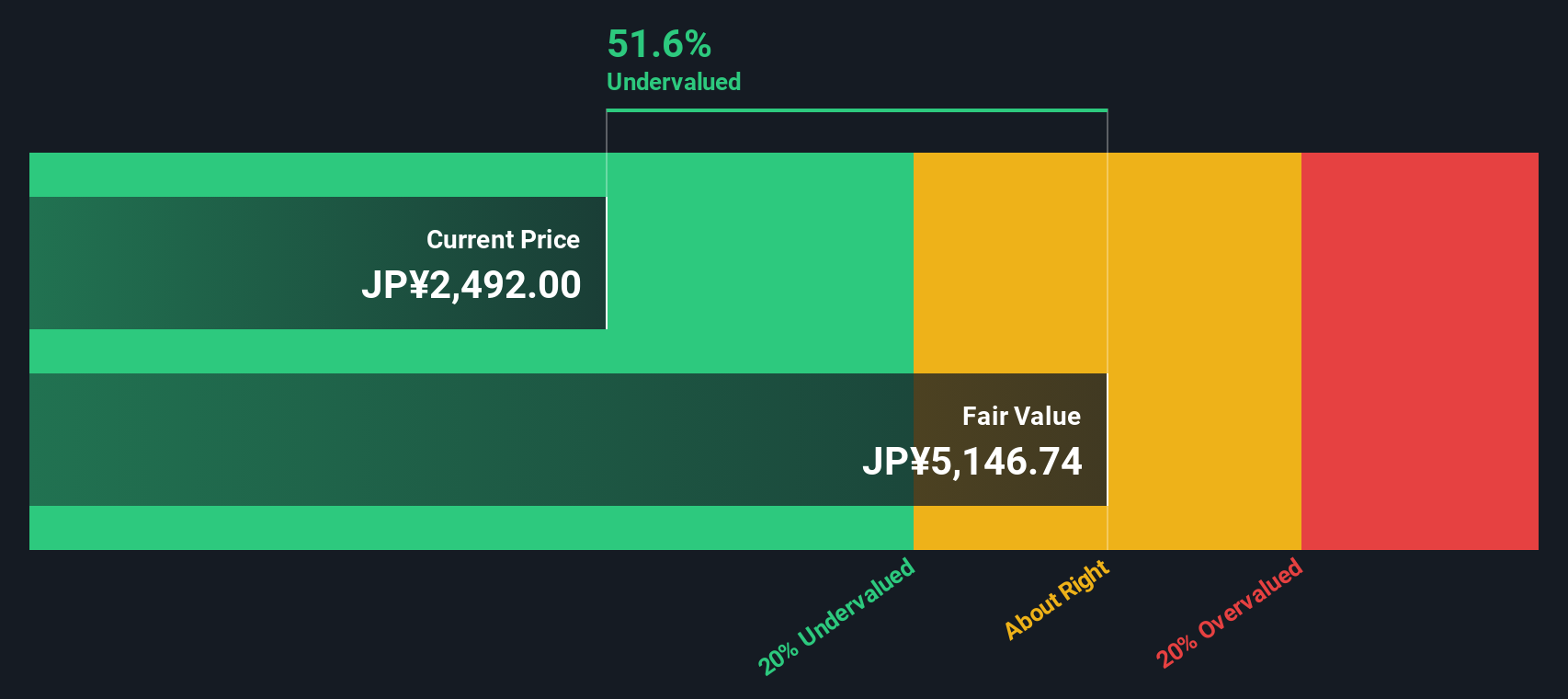

Our DCF model paints a different picture. With Aisin trading around ¥2,783.5 against an estimated fair value of roughly ¥4,937, it screens as deeply undervalued. If cash flows are even roughly right, is the market still underestimating this transition story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aisin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aisin Narrative

If our view does not quite match yours, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way

A great starting point for your Aisin research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by scanning fresh stock ideas on Simply Wall Street’s screener, where data backed opportunities update faster than headlines.

- Seize potential market mispricings by running through these 908 undervalued stocks based on cash flows that pair compelling cash flow profiles with attractive entry prices.

- Ride powerful secular trends by targeting these 26 AI penny stocks poised to benefit from accelerating adoption of intelligent automation and data driven decision making.

- Strengthen your income strategy by reviewing these 14 dividend stocks with yields > 3% that combine higher yields with balance sheets built to handle economic shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7259

Aisin

Manufactures and sells automotive parts, lifestyle, and energy and wellness related products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026