Toyota (TSE:7203): Examining Valuation as Shares Gain 11% Over the Past Month

Reviewed by Simply Wall St

Toyota Motor (TSE:7203) shares have been trading in a narrow range, prompting investors to revisit the company’s fundamentals and recent returns. Over the past month, the stock posted an 11% gain. This has drawn curiosity about what is powering the momentum.

See our latest analysis for Toyota Motor.

Momentum has clearly picked up for Toyota Motor, with its 1-month share price return of 11.4% adding to a steady climb and catching the eye of market watchers. Despite some fluctuations over the year, Toyota’s total shareholder return sits at an impressive 24% for the past 12 months. This puts it solidly ahead of the broader market and highlights how perceptions of growth and stability are powering interest in the stock right now.

If you’re keeping an eye on movement among automakers, it’s a great moment to discover See the full list for free.

But with Toyota Motor’s recent run and consistent long-term returns, the question becomes clear: is there still an undervaluation at play here, or is the market simply getting ahead of itself and pricing in further growth?

Most Popular Narrative: 0.9% Undervalued

Toyota Motor’s narrative-driven fair value of ¥3,228 stands just above its last close at ¥3,198. Investors are now scrutinizing what underpins this slender gap and what could tip the scales next.

Toyota's investment in internal battery production, including various types of batteries for electric and hybrid vehicles, could bolster long-term revenue and margins. By optimizing battery production and technology, Toyota positions itself competitively in the growing electrified vehicle market.

Want to peek behind the curtain of this near-fair valuation? The whole narrative hangs on bold moves in technology and operational breakthroughs, plus some financial gymnastics that go beyond plain expectations. What big assumptions did analysts bake in? There’s a surprising leap of faith in Toyota’s profit profile you might not expect.

Result: Fair Value of ¥3,228 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential production halts or unfavorable exchange rates remain key risks that could challenge Toyota’s profit outlook and change the current market narrative.

Find out about the key risks to this Toyota Motor narrative.

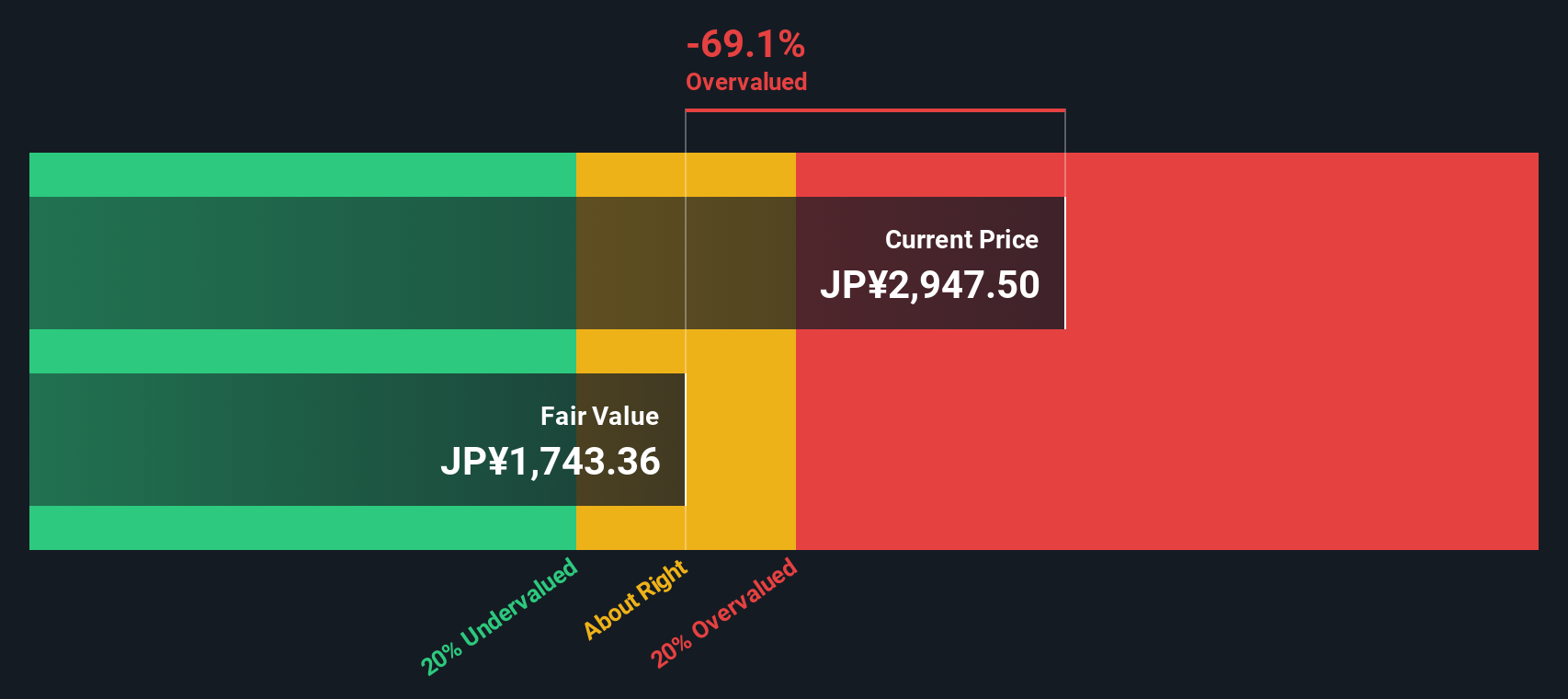

Another View: SWS DCF Model Weighs In

While analyst narratives suggest Toyota Motor could be slightly undervalued, the SWS DCF model tells a different story. According to our discounted cash flow calculation, the fair value for Toyota stands much lower than the current price, pointing instead to overvaluation. Valuation perspectives clearly diverge depending on the method, so which approach truly best captures the underlying business reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Motor Narrative

If you see the story differently, or want to draw your own conclusions from the data, you can build a fresh narrative in just a few minutes. Do it your way

A great starting point for your Toyota Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead by tapping into exceptional opportunities others might overlook. Use the Simply Wall Street Screener to spot compelling stocks in fast-moving sectors before they get crowded.

- Unlock stable passive income potential by starting your search with these 15 dividend stocks with yields > 3% offering yields above 3% for robust, consistent returns.

- Spot high-upside potential as you browse these 882 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Access future-shaping innovation and disruptive trends right now by checking out these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives