Toyota Motor (TSE:7203) Is Up 6.6% After Unveiling Advanced Hybrid and EV Connectivity Suite

Reviewed by Sasha Jovanovic

- Toyota unveiled the next-generation 2026 RAV4 with new hybrid and plug-in hybrid options, advanced 5G connectivity, enhanced safety features, and a redesigned multimedia platform, while also expanding electric vehicle capabilities with the 2026 Toyota bZ, which benefits from improved range and wider DC fast-charging support through NACS compatibility.

- The introduction of Toyota's Arene Software Developed Vehicle platform and onboard 5G highlights the company's accelerated integration of software and connectivity innovation into its core product lines.

- We'll explore how Toyota's advancements in hybrid technology and connectivity could alter its growth and profitability outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Toyota Motor Investment Narrative Recap

To be a Toyota shareholder, you need to believe in the company's ability to leverage its global scale, embrace electrification, and innovate with hybrid and software-driven technologies. While the launch of the 2026 RAV4, featuring next-generation hybrid, plug-in hybrid, and software enhancements, strengthens Toyota's appeal, it is unlikely to materially affect the most important near-term catalyst: delivering on production recovery targets following prior halts. Risks from competitive pricing pressure and shifting sales mix, especially in North America, continue to warrant close attention.

Among Toyota’s recent moves, the broadened fast-charging capabilities and improved electric range of the 2026 Toyota bZ stand out as particularly aligned with industry catalysts. By making its BEV models compatible with a wider charging network and extending all-electric range, Toyota addresses a core challenge for electric vehicle adoption, supporting the company’s efforts to increase electrified sales and offset risks tied to traditional market pressures.

By contrast, investors should not overlook the ongoing risk of sudden production halts stemming from...

Read the full narrative on Toyota Motor (it's free!)

Toyota Motor's outlook forecasts ¥52,446.5 billion in revenue and ¥3,866.3 billion in earnings by 2028. This assumes a 3.0% annual revenue growth rate, but a decrease of ¥898.8 billion in earnings from the current ¥4,765.1 billion.

Uncover how Toyota Motor's forecasts yield a ¥3222 fair value, a 3% upside to its current price.

Exploring Other Perspectives

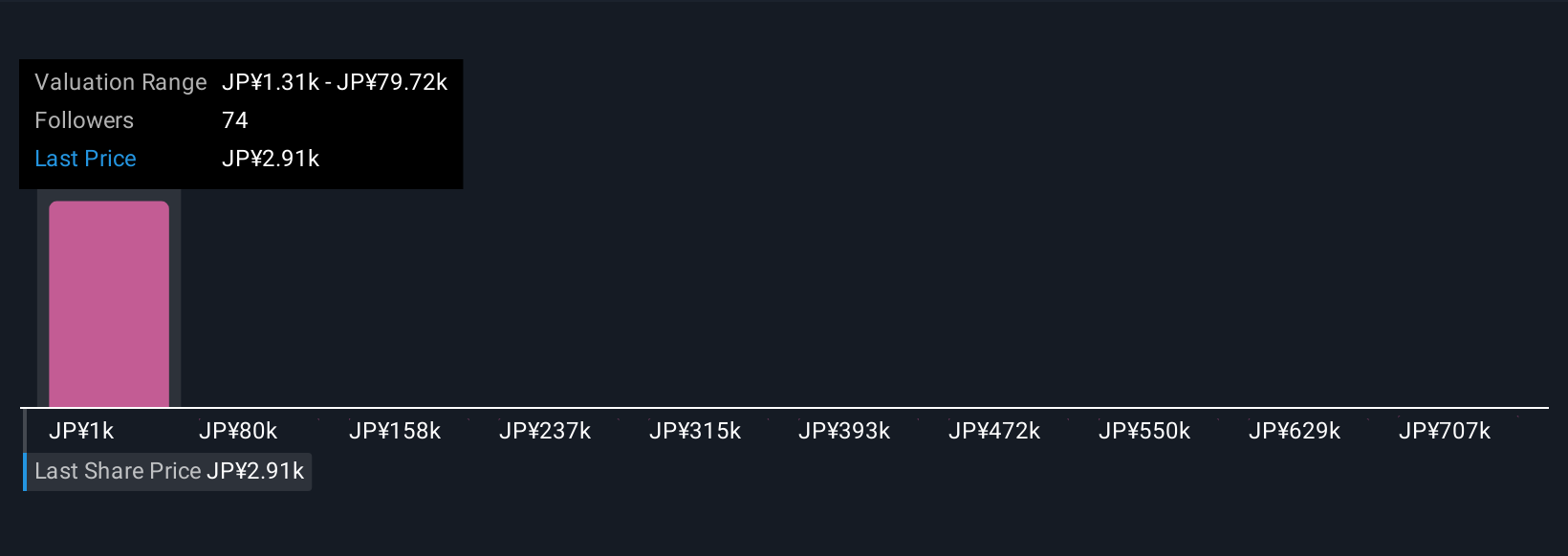

Five individual Simply Wall St Community members see Toyota’s fair value estimates ranging from ¥1,309.71 to ¥3,700. Production recovery remains a central factor that could affect whether the company meets its growth targets.

Explore 5 other fair value estimates on Toyota Motor - why the stock might be worth as much as 18% more than the current price!

Build Your Own Toyota Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toyota Motor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Toyota Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toyota Motor's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives