Should You Reconsider Toyota After Recent Electric Vehicle Strategy Push and Share Price Surge?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Toyota Motor’s stock price truly reflects its value, you are not alone. Many investors are asking the same question right now.

- After an impressive 24.3% gain over the past year (and a 152.3% return in five years), Toyota’s recent 3% rise this week is catching the eye of growth-focused investors and those watching for shifting risk perceptions.

- Recently, headlines have spotlighted Toyota’s bold moves in electric vehicle innovation and their partnerships to ramp up production. This increased industry attention is fueling both excitement and conversation about how the company’s strategy might affect its future prospects.

- On our valuation checks, Toyota currently scores 3 out of 6, suggesting there is more to uncover beyond surface-level ratios. This article will dive into that, while saving the best perspective on assessing true value for the end.

Find out why Toyota Motor's 24.3% return over the last year is lagging behind its peers.

Approach 1: Toyota Motor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and then discounting them back to today’s value. This approach helps investors understand whether a stock’s price aligns with the underlying cash generation potential of the business.

For Toyota Motor, the DCF uses a 2 Stage Free Cash Flow to Equity model. At present, Toyota’s last twelve months free cash flow came in at negative ¥467 billion. However, analysts anticipate strong improvements, projecting free cash flow to increase to ¥2,482 billion by 2030. Peer-reviewed forecasts cover the next five years, while estimates after that are extrapolated.

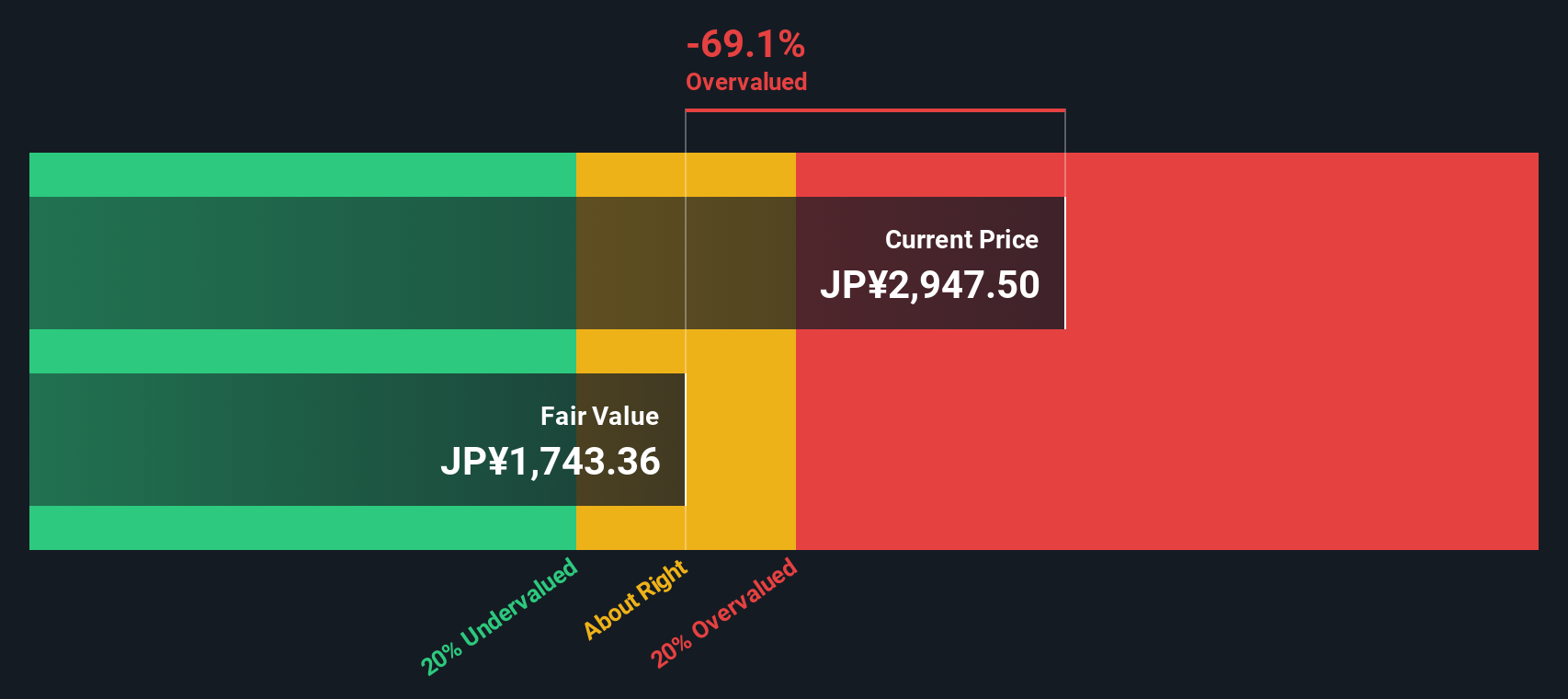

Looking further at the projections, Toyota’s free cash flow is expected to steadily grow over the next decade. Discounted cash flow estimates suggest robust long-term potential. Using these cash flow figures, the model calculates a fair value per share of ¥1,679.

When compared to Toyota’s current share price, this calculation implies the stock is trading at an 86.7% premium. This means the shares are well above their estimated intrinsic value based on future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Toyota Motor may be overvalued by 86.7%. Discover 925 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Toyota Motor Price vs Earnings (PE Ratio)

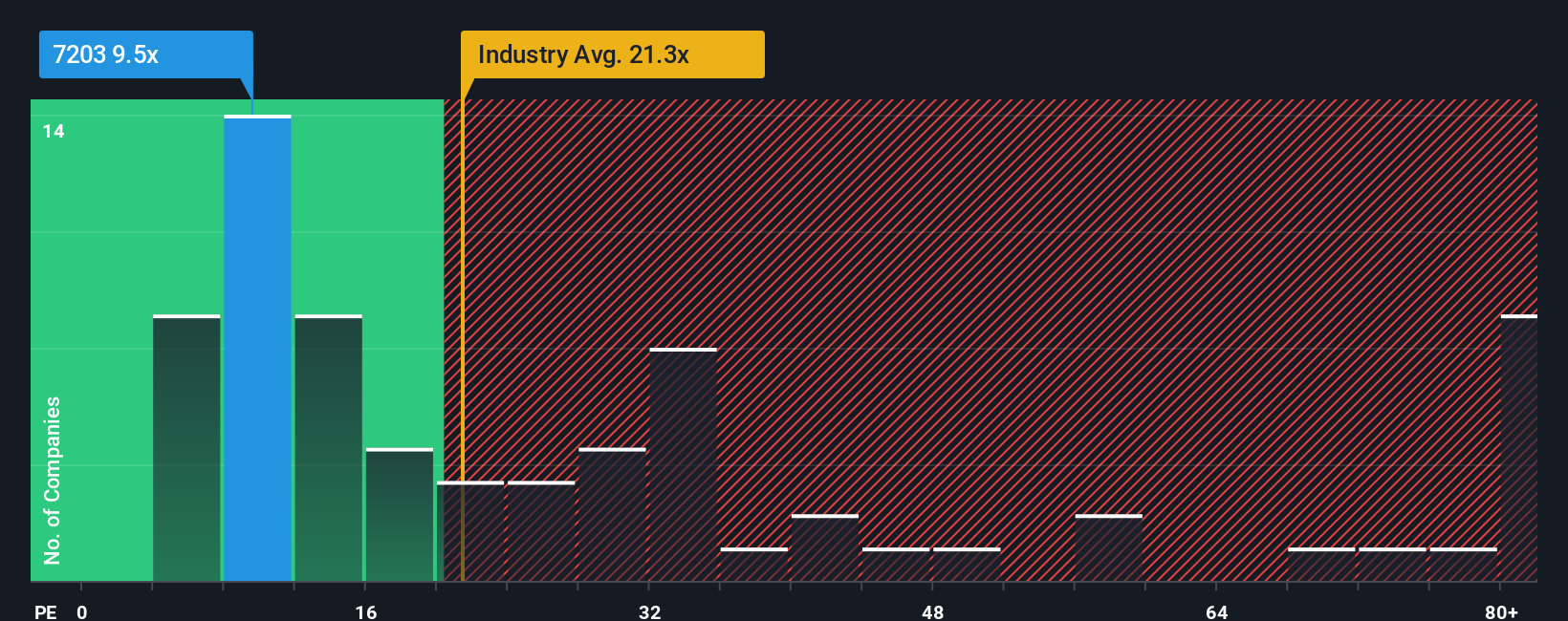

For profitable companies like Toyota Motor, the price-to-earnings (PE) ratio is a widely trusted way for investors to judge whether a stock is attractively valued. By comparing a company’s current share price to its per-share earnings, the PE ratio helps investors quickly assess how much they are paying for those profits.

Growth expectations and risk play a big role in determining what a reasonable PE ratio should be. High-growth companies or those with steady earnings quality often command higher PE ratios. Added risks, whether from market volatility or financial leverage, can drive the number lower.

At present, Toyota trades at a PE ratio of just 8.8x. This is below both the broader Auto industry average of 18.7x and the direct peer group, which averages 10.6x. These numbers suggest Toyota is cheaper than many comparable companies, possibly reflecting lower market expectations or unique risks.

Simply Wall St’s proprietary “Fair Ratio” offers a more nuanced benchmark by incorporating specific factors such as Toyota’s earnings growth outlook, profit margin, size, and sector risks. Unlike a simple industry average or peer comparison, the Fair Ratio for Toyota stands at 16.4x, much higher than its current multiple. This suggests the market is not fully appreciating Toyota’s strengths and future prospects.

Since Toyota’s actual PE ratio is well below the Fair Ratio, the valuation appears compelling for investors seeking reasonable entry points.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toyota Motor Narrative

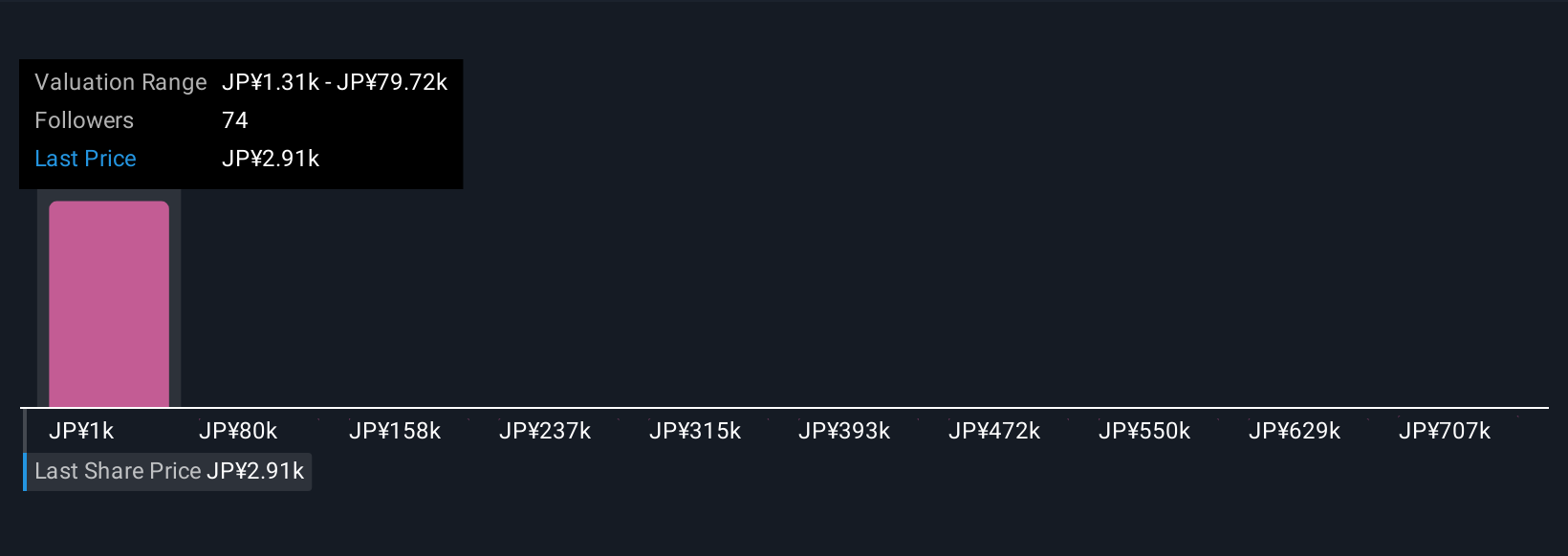

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are a uniquely powerful tool that let you define your own, tailored story for a company by connecting your view of Toyota Motor’s business developments, industry changes, and future outlook directly to a personalized financial forecast and fair value estimate.

With Narratives, you can easily translate your perspective of Toyota’s opportunities or risks into concrete assumptions about future revenue, earnings, and profit margins. This approach takes you beyond static ratios and lets you see how your beliefs impact valuation. Millions of investors already use Narratives through Simply Wall St’s Community page, where the tool guides you through the process with step-by-step simplicity.

Narratives make buy and sell decisions more actionable by dynamically comparing your derived Fair Value to Toyota’s current share price. You can react if the story changes with fresh news or updated earnings. For example, one investor’s bullish Narrative for Toyota Motor, factoring in new EV launches and operational efficiency, points to a fair value of ¥3,400, while a more cautious outlook focused on competition and profit margin risks yields ¥2,400. By exploring different Narratives, you gain clarity on what data and outlook you’re truly investing in.

Do you think there's more to the story for Toyota Motor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success