Isuzu Motors Valuation in Focus After Recent 2.8% Monthly Price Gain

Reviewed by Simply Wall St

If you have been eyeing Isuzu Motors lately and wondering whether it is the right time to dive in or hold back, you are definitely not alone. This stock has quietly moved its way into some interesting territory for both cautious investors and more adventurous types alike. Over just the past week, Isuzu dipped slightly by 1.0%, but over the last month, it crept up 2.8%, hinting at an underlying resilience even as global market sentiment continues to shift. Year-to-date, the picture is a bit more challenging with a 7.9% drop. However, zooming out to a longer lens shows gains of 4.0% over the past year and a striking 27.7% over three years. If you happened to hold Isuzu for five years, you would be sitting on a remarkable 148.3% return.

Of course, the big question is whether these moves truly reflect the company’s worth or if there is more value waiting to be uncovered. Looking at six classic valuation checks, Isuzu Motors scores a three, which means it is undervalued in exactly half of the metrics. This points to some upside but also signals that there are factors worth considering before making a move.

Next, I will break down how Isuzu stacks up using different valuation perspectives. At the end of the article, I will also share an even sharper, more holistic way to assess a stock’s true value.

Why Isuzu Motors is lagging behind its peersApproach 1: Isuzu Motors Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company's future cash flows and then discounting them back to their present value. This provides an insight into what the business is truly worth today. For Isuzu Motors, this model projects free cash flow over the next decade, using both analyst forecasts and longer-term extrapolations for later years.

Currently, Isuzu Motors reports Free Cash Flow of ¥53.3 billion. Looking ahead, analysts estimate the company’s FCF could reach ¥82.0 billion by the year ending March 2029. Beyond the five-year analyst window, projected figures are provided by Simply Wall St, but become more uncertain as they rely on extended assumptions. The model uses these forecasts, spanning ten years, as the basis for its calculation.

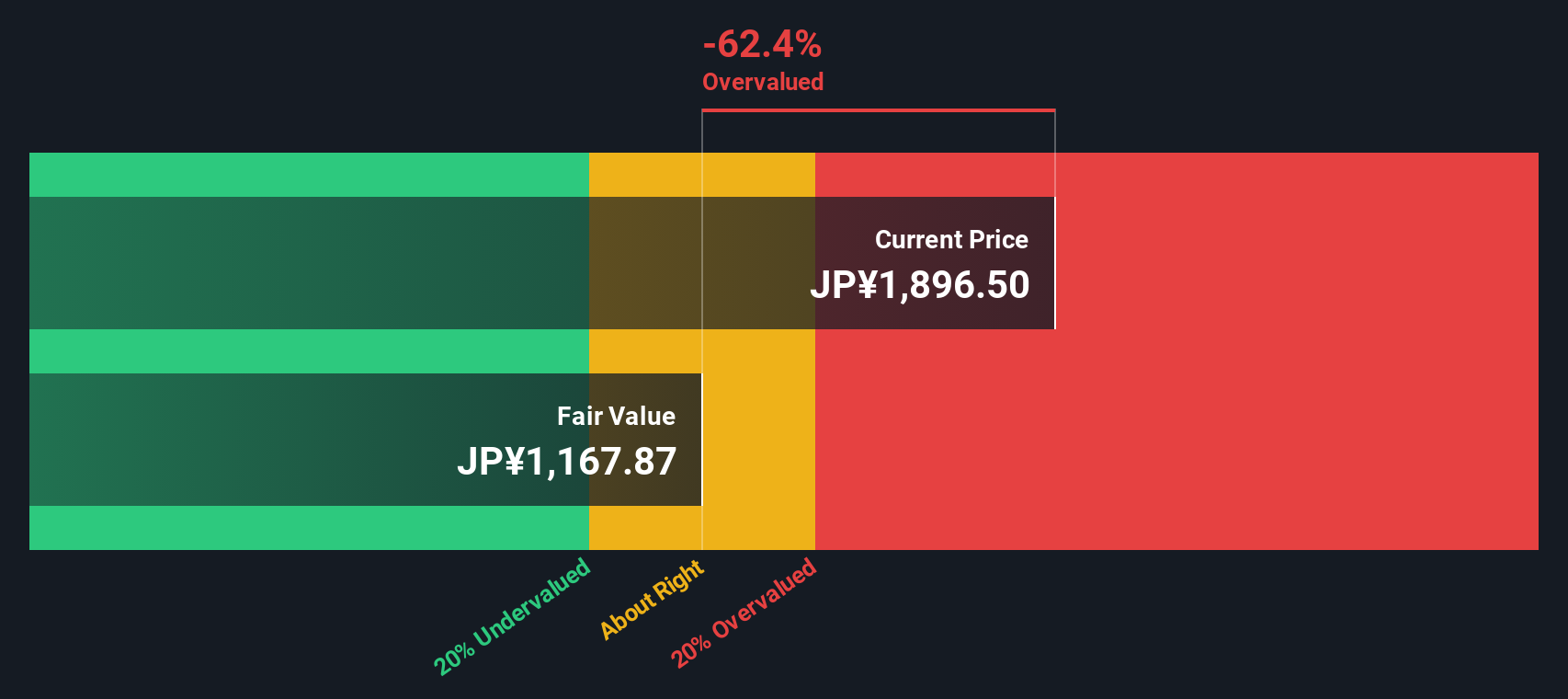

Based on these projections, the DCF analysis points to an intrinsic value of ¥1,040 per share. Compared to Isuzu’s current share price, this result suggests the stock is trading at a significant 90.0% premium above its fair value, which means it appears highly overvalued according to this method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Isuzu Motors.

Approach 2: Isuzu Motors Price vs Earnings

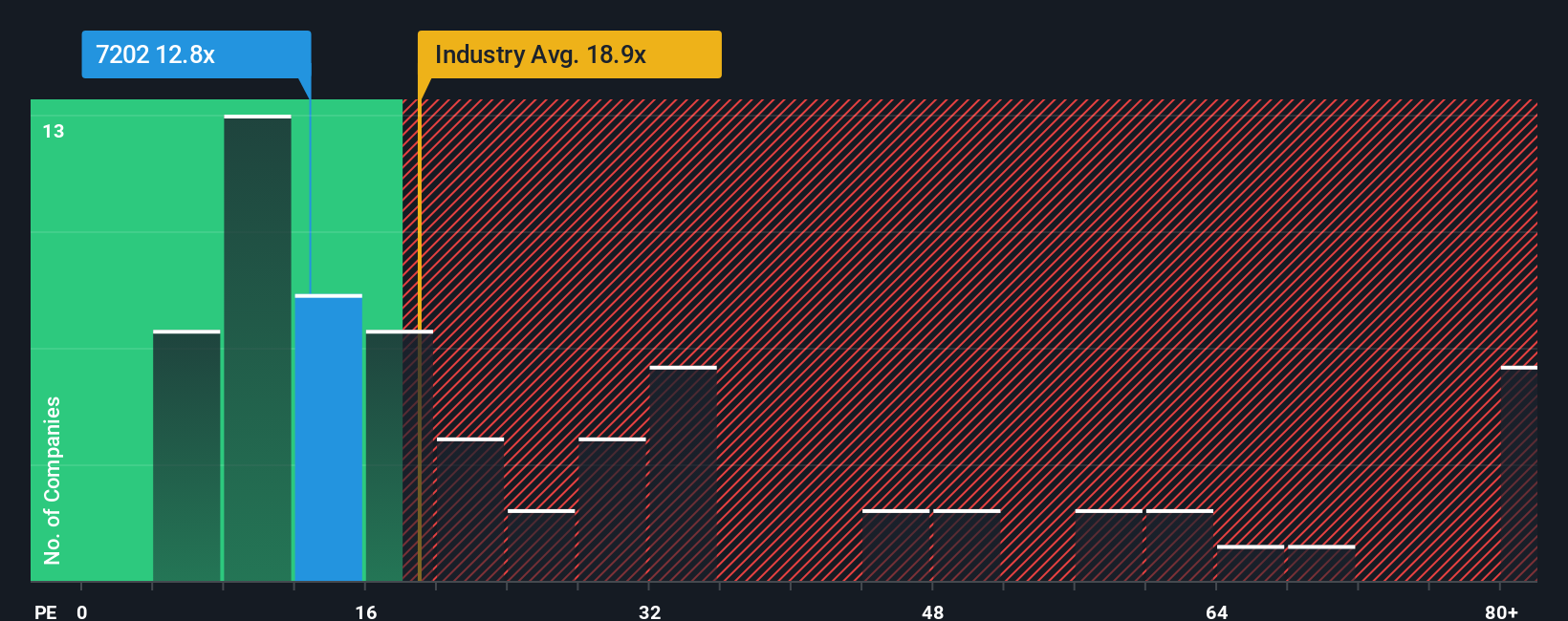

For established, profitable companies, the price-to-earnings (PE) ratio is a go-to valuation tool. It tells investors how much they are paying for each unit of earnings, making it a straightforward way to compare companies in the same sector. Growth expectations and risk play a big role in interpreting the PE ratio, since higher-growth or lower-risk firms can typically justify higher PEs, while slower-growing or riskier businesses trade at lower multiples.

Isuzu Motors currently trades on a PE ratio of 11.1x. By comparison, the average PE among listed Auto industry companies is 18.3x, and Isuzu’s peer group averages an even higher 23.4x. At first glance, this appears to put Isuzu at a significant discount.

However, Simply Wall St calculates a ‘Fair Ratio’ for each stock. For Isuzu, this Fair Ratio is 14.9x. Unlike a basic industry or peer comparison, the Fair Ratio factors in the specifics of Isuzu’s earnings growth, risk profile, profit margins, market capitalization, as well as broader industry trends. This offers a more customized and rigorous benchmark for what constitutes ‘fair value’ for Isuzu in particular.

With Isuzu’s actual PE ratio of 11.1x sitting notably below its Fair Ratio of 14.9x, the stock screens as undervalued using this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Isuzu Motors Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an innovative approach that allows you to build your own story around Isuzu Motors by blending your perspective on the company’s future, such as your assumptions about revenue, earnings, and margins, with a financial forecast to arrive at a personalized fair value.

Instead of relying solely on standard ratios, Narratives connect the dots between what’s happening in the real world and what those events mean for a stock’s price. This lets you see how your point of view stacks up against the numbers and other investors’ opinions. Narratives are easy to access and use and are available right in the Community page on Simply Wall St’s platform, trusted by millions of investors.

By comparing your Narrative’s fair value with the current share price, you can quickly spot opportunities to buy or sell and stay up to date as Narratives are automatically updated in response to new developments such as earnings releases or company news. For example, among Isuzu Motors investors, some believe market reach expansion and innovation will drive fair value up to ¥2,650, while others, concerned about costs or competition, see a fair value as low as ¥1,700. This demonstrates how Narratives help you make smarter, more informed decisions based on your personal outlook.

Do you think there's more to the story for Isuzu Motors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7202

Isuzu Motors

Manufactures and sells commercial vehicles, light commercial vehicles, and diesel engines and components worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives