Nissan (TSE:7201): Weighing the Automaker’s Latest Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Nissan Motor (TSE:7201) shares have been in focus recently as investors digest fresh performance data and weigh the company’s ongoing turnaround efforts. Over the past month, the stock has slipped 8% as sentiment in the automobile sector shifts.

See our latest analysis for Nissan Motor.

While Nissan Motor’s shares have faced selling pressure with a 1-day share price return of -2.75% and a 30-day decline of 8.1%, the story is bigger than just short-term volatility. The stock’s momentum has been challenged this year, with a year-to-date share price return of -27.9%. The total shareholder return over the past year stands at -14.6%. This suggests that recent events and ongoing restructuring efforts are yet to convince investors of a sustained turnaround, and that risk perception remains heightened despite moments of optimism earlier in the year.

If you want to see how other automakers are faring in today’s shifting auto market, it’s worth exploring See the full list for free.

With shares trading well below recent highs and mixed signals coming from both financial metrics and analyst targets, investors are left wondering if Nissan Motor is now undervalued or if the market has already priced in its recovery potential.

Most Popular Narrative: Fairly Valued

Nissan Motor's last closing price of ¥342.6 is nearly identical to the most widely followed narrative's fair value estimate of ¥336, suggesting little upside or downside according to consensus expectations. This reflects a market at an impasse, weighing incremental growth potential against ongoing headwinds for the company.

Deeper global partnerships and scaling via the Renault-Mitsubishi alliance, along with ongoing collaborations with other automakers (e.g. Honda), are expected to yield further R&D and manufacturing efficiencies, shared platform utilization, and technology advancements. This supports long-term margin expansion through enhanced economies of scale.

What hidden assumptions are powering this fair value? The full narrative reveals surprising productivity targets and bold turnaround math that could reshape Nissan’s future performance. Wondering which alliances, technology bets, and margin estimates are driving consensus? You’ll want to see what’s fueling this projection.

Result: Fair Value of ¥336 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses in China and ongoing cash flow challenges could undermine Nissan's recovery. These issues raise doubts about its path to margin improvement.

Find out about the key risks to this Nissan Motor narrative.

Another View: Challenging the Consensus

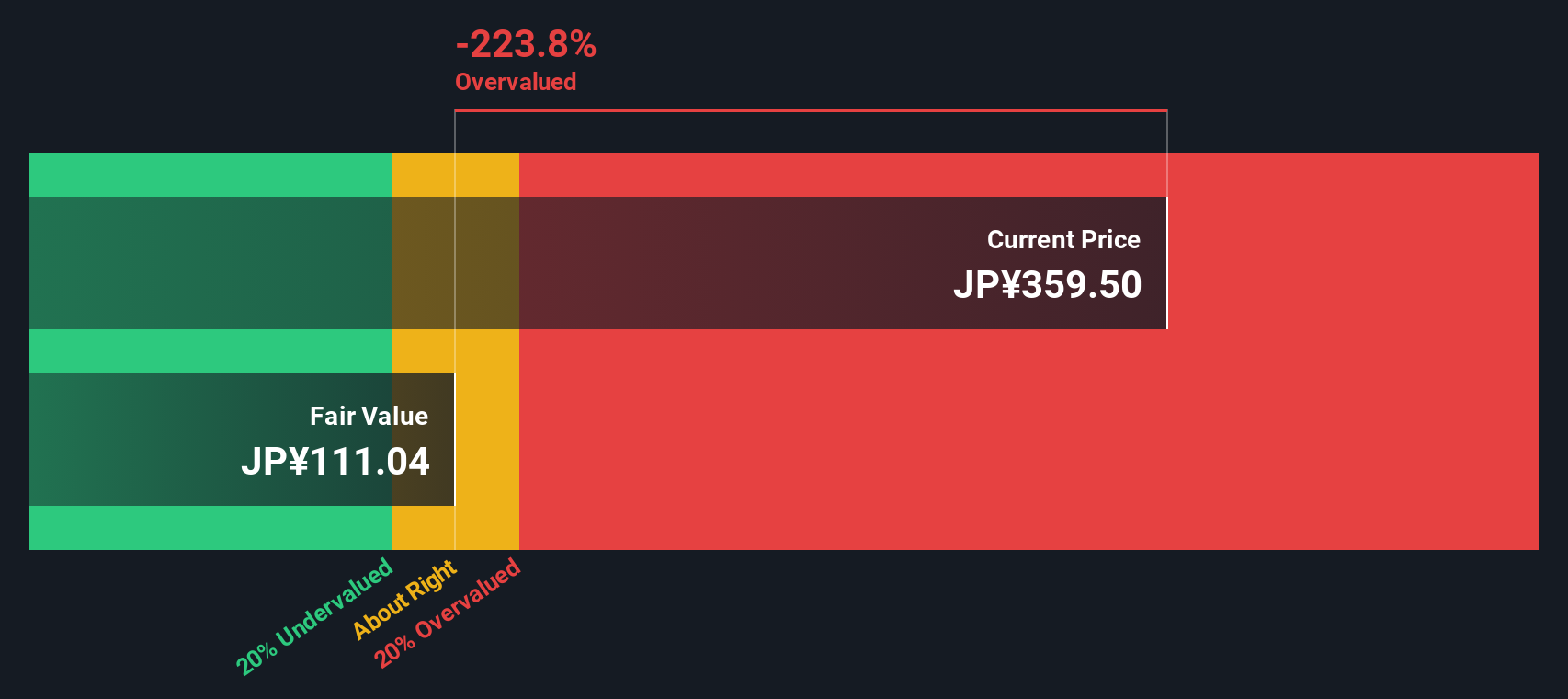

While multiples signal Nissan Motor is trading at good value compared to its peers and industry, our DCF model tells a different story. Based on discounted future cash flows, Nissan appears overvalued at current prices. With both methods pointing in opposite directions, which outlook will the market believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nissan Motor Narrative

If you’d rather dig into the numbers yourself or believe a different story is emerging, it only takes a few minutes to create your own perspective. Do it your way

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay a step ahead by evaluating fresh trends and untapped opportunities. Don’t miss out on these standout stock ideas that could reshape your portfolio:

- Grab the potential for rapid growth in technology by tapping into these 26 AI penny stocks, a collection of companies at the forefront of artificial intelligence innovation.

- Boost your payments and digital exposure by checking out these 81 cryptocurrency and blockchain stocks, where firms are shaping the future of blockchain and next-generation financial infrastructure.

- Accelerate your returns by focusing on these 840 undervalued stocks based on cash flows, using strong cash flows to spot stocks flying under the radar that might be primed for a move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives