Nissan (TSE:7201) Valuation in Focus After Showcasing Grid-Ready EV Technology with PG&E Collaboration

Reviewed by Simply Wall St

Nissan Motor (TSE:7201) is getting attention after teaming up with PG&E and Fermata Energy to showcase automated frequency management at a California microgrid using Nissan LEAF vehicles and bidirectional EV chargers. This highlights Nissan’s position in next-generation energy resilience.

See our latest analysis for Nissan Motor.

Nissan’s recent technology collaborations have captured attention, but it’s worth noting that the 1-year total shareholder return remains at -10.5%. After a strong push around its energy initiatives, momentum has been choppy. The stock climbed over the last quarter yet remains down more than 23% year-to-date, indicating that investors are still weighing the company’s turnaround potential and longer-term prospects.

If Nissan’s strategy around electric vehicles and energy resilience has you curious, it’s a good moment to explore what’s happening with other auto manufacturers via our See the full list for free.

With recent innovation driving buzz, but the share price still struggling, investors are left to wonder whether Nissan is trading at a bargain or if expectations for a turnaround are already factored into the valuation.

Most Popular Narrative: 8% Overvalued

With Nissan trading slightly above the consensus fair value, last close was ¥363.5 compared to a narrative estimate of ¥336, market sentiment may be running ahead of the fundamentals. This sets the stage for the catalysts and tensions shaping analysts’ fair value outlook.

Accelerated EV launches and strong emerging market presence position Nissan for revenue growth and market share gains in established and high-growth geographies. Cost reduction, alliances, and focus on higher-margin, tech-enabled models are set to improve operating margins and drive sustained earnings expansion.

What makes this outlook so compelling? It is built around anticipated earnings transformation, bolder profit margins, and a future valuation multiple that raises eyebrows. Wondering which financial leap underpins this narrative? Unlock the full story to see the specifics fueling this bold projection.

Result: Fair Value of ¥336 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative free cash flow and intensifying competition in China could present challenges to Nissan’s turnaround and threaten the bullish narrative going forward.

Find out about the key risks to this Nissan Motor narrative.

Another View: Taking Stock Through the Price-to-Sales Lens

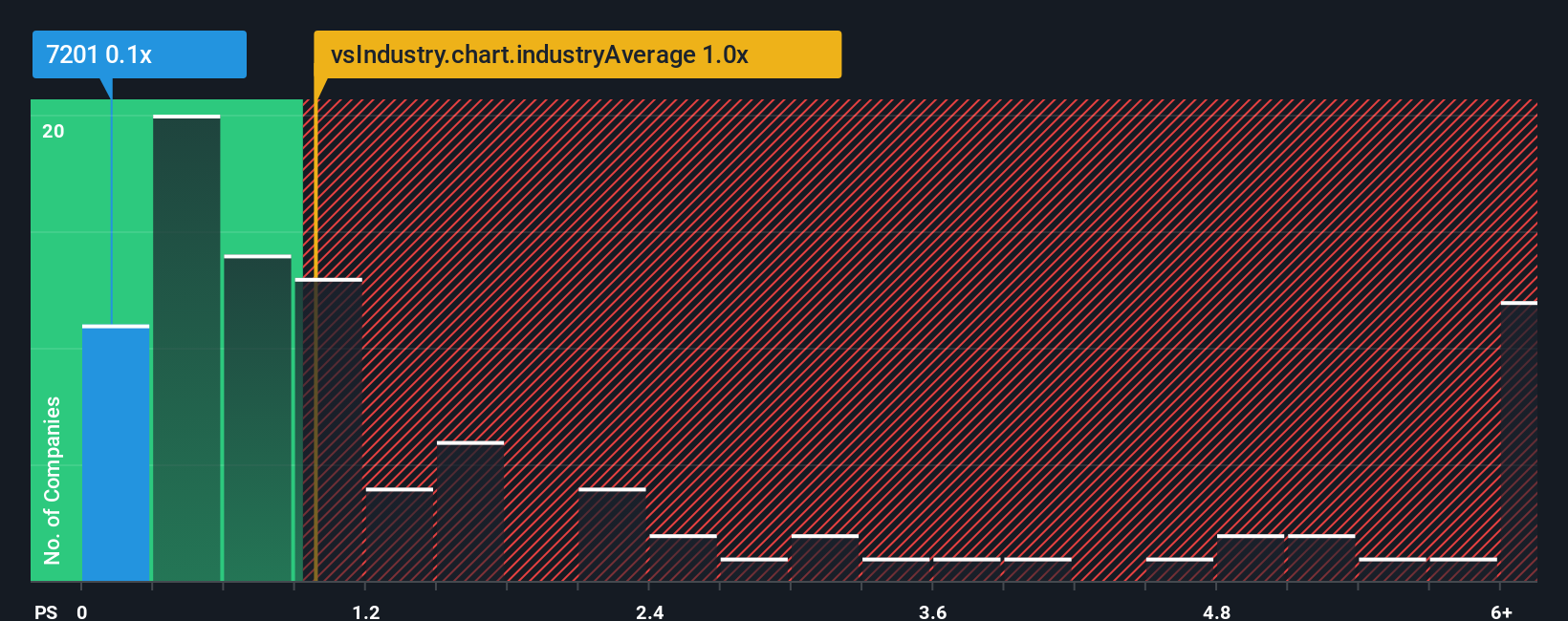

Switching gears from the analyst narrative, Nissan actually looks attractively priced on a sales basis compared with its sector. Its price-to-sales ratio is 0.1x, well below both industry (1x) and peer (0.3x) averages, and even under the fair ratio of 0.6x. This deep discount suggests the market is pricing in more bad news than the numbers may support. But does this valuation gap show real opportunity, or is it a sign of ongoing risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nissan Motor Narrative

Keep in mind, if you have a different perspective or want to see the numbers for yourself, you can shape your own view in just a few minutes: Do it your way

A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Why limit your investment universe? Gain the edge by acting on fresh ideas and tapping into stocks flying under most investors’ radar.

- Accelerate your wealth strategy by targeting growing companies with strong fundamentals using these 919 undervalued stocks based on cash flows that others may be overlooking right now.

- Unlock potential income streams for your portfolio and capitalise on reliable yields from these 17 dividend stocks with yields > 3% paying above 3%.

- Ride the AI wave by seizing opportunities in smart automation and future-ready tech through these 25 AI penny stocks before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives