- Japan

- /

- Auto Components

- /

- TSE:6937

The Furukawa Battery Co., Ltd.'s (TSE:6937) Share Price Not Quite Adding Up

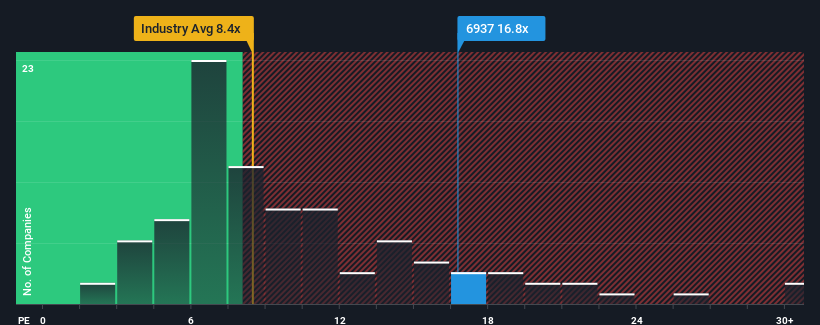

With a price-to-earnings (or "P/E") ratio of 16.8x The Furukawa Battery Co., Ltd. (TSE:6937) may be sending bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for Furukawa Battery as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Furukawa Battery

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Furukawa Battery's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 223% gain to the company's bottom line. Still, incredibly EPS has fallen 29% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 9.8% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Furukawa Battery is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Furukawa Battery revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Furukawa Battery (1 shouldn't be ignored!) that you need to be mindful of.

Of course, you might also be able to find a better stock than Furukawa Battery. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6937

Furukawa Battery

Manufactures and sells storage batteries in Japan and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives