- Japan

- /

- Auto Components

- /

- TSE:6473

JTEKT (TSE:6473): Assessing Valuation After a Strong 40% Year-to-Date Share Price Rally

Reviewed by Simply Wall St

JTEKT (TSE:6473) has quietly delivered a strong run, with the share price climbing about 10% over the past month and roughly 15% in the past 3 months, catching more investors’ attention.

See our latest analysis for JTEKT.

That momentum sits on top of a much bigger move, with the share price now at ¥1,698.5 and a year to date share price return above 40%, while one year total shareholder return is approaching 70%, suggesting confidence in both earnings resilience and future growth.

If JTEKT’s recent gains have you rethinking the auto space, this could be a good moment to explore other auto manufacturers that might be setting up for their next leg higher.

With JTEKT trading just below analyst targets yet implying a sizable intrinsic discount, the gap between market price and estimated value looks wide. This raises the question: is this a genuine buying opportunity, or is future growth already priced in?

Price-to-Earnings of 27.5x: Is it justified?

On a price-to-earnings basis, JTEKT’s 27.5x multiple at a ¥1,698.5 share price screens as expensive relative both to its peers and to its own fair ratio.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings. This makes it a central yardstick for mature, profit generating auto component businesses like JTEKT.

In JTEKT’s case, the current 27.5x price-to-earnings ratio sits well above the estimated fair price-to-earnings of 19.7x. This implies the market is pricing in stronger earnings power than the fair ratio suggests and potentially paying a premium for the company’s forecast profit growth.

That premium looks even more stretched against benchmarks. The 27.5x price-to-earnings ratio is markedly higher than the JP Auto Components industry at 9.9x and the broader peer average at 11.2x, pointing to a valuation that reflects expectations far beyond the sector norm.

Explore the SWS fair ratio for JTEKT

Result: Price-to-Earnings of 27.5x (OVERVALUED)

However, cyclicality in global auto demand and execution risk around JTEKT’s diversified, capital-intensive operations could quickly unravel today’s premium valuation narrative.

Find out about the key risks to this JTEKT narrative.

Another View Using Our DCF Model

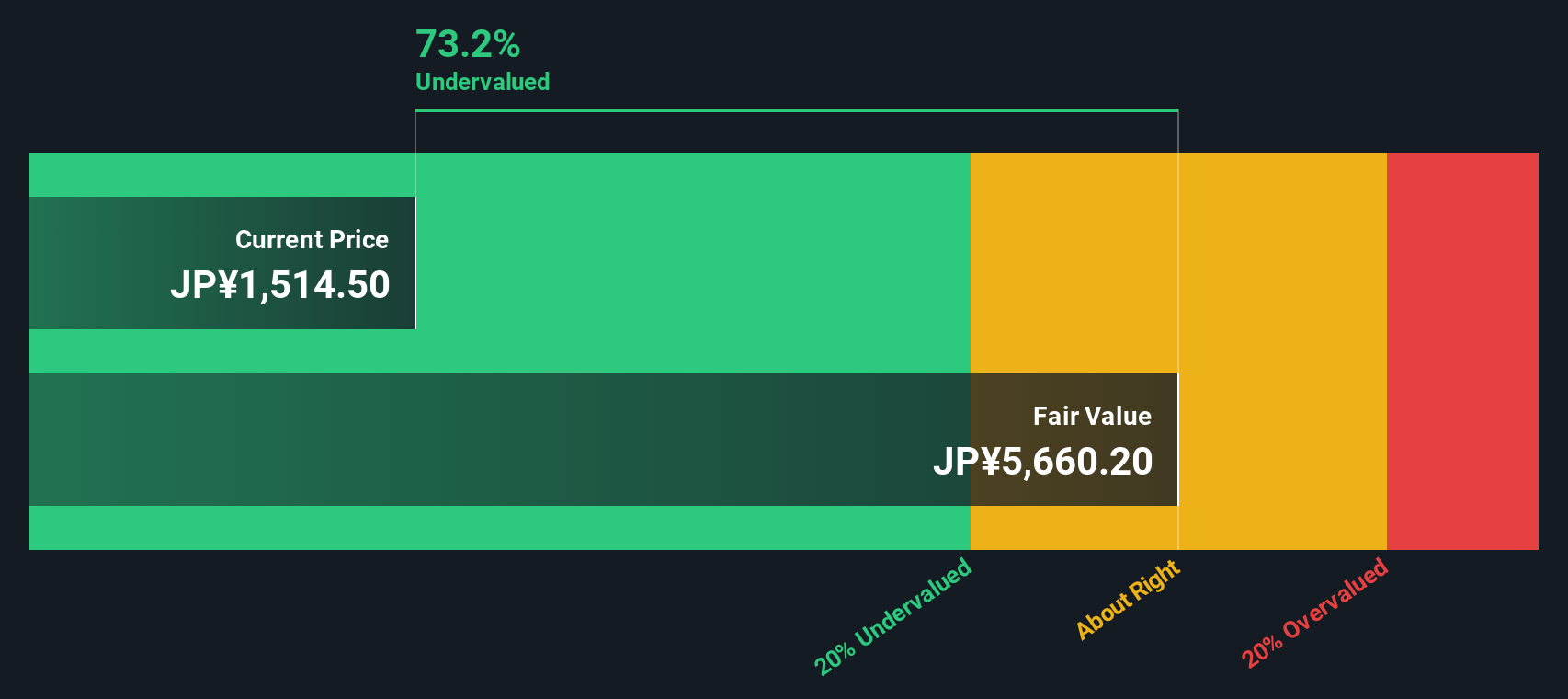

While the price-to-earnings ratio flags JTEKT as expensive, our DCF model paints a very different picture. It suggests the shares are trading about 59% below an estimated fair value of ¥4,120.4. If both signals are right, is the market underestimating the long term cash flow story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JTEKT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JTEKT Narrative

If you see the story differently or prefer to test your own assumptions, you can quickly build a custom view in just a few minutes: Do it your way.

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next big swing, give yourself more options by using the Simply Wall Street Screener to uncover focused, data driven ideas that others may be missing.

- Capture potential multibaggers early by scanning these 3576 penny stocks with strong financials built on improving fundamentals and strengthening balance sheets.

- Target mispriced opportunities by reviewing these 925 undervalued stocks based on cash flows where cash flows and valuation signals point to attractive entry points.

- Position ahead of financial innovation waves with these 81 cryptocurrency and blockchain stocks tapping into businesses advancing blockchain infrastructure and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026