- Japan

- /

- Auto Components

- /

- TSE:6209

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, investors are keenly observing the impact of interest rate adjustments and economic data on market indices. Amid these fluctuations, dividend stocks offer a potential avenue for stability and income, especially as they can provide regular returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Sumitomo Seika Chemicals Company (TSE:4008)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Seika Chemicals Company, Limited operates in the chemical industry, focusing on the production of functional chemicals and gases, with a market cap of ¥61.45 billion.

Operations: Sumitomo Seika Chemicals Company, Limited generates revenue from the production of functional chemicals and gases.

Dividend Yield: 4.2%

Sumitomo Seika Chemicals offers a dividend yield of 4.19%, placing it in the top 25% of JP market dividend payers, with stable and reliable payments over the past decade. However, dividends are not covered by free cash flows despite a low payout ratio of 20.1%. Recent share buybacks totaling ¥994.87 million aim to enhance shareholder returns and capital efficiency, while earnings grew by 19.8% last year, supporting its dividend strategy amidst ongoing financial commitments.

- Click here to discover the nuances of Sumitomo Seika Chemicals Company with our detailed analytical dividend report.

- The analysis detailed in our Sumitomo Seika Chemicals Company valuation report hints at an deflated share price compared to its estimated value.

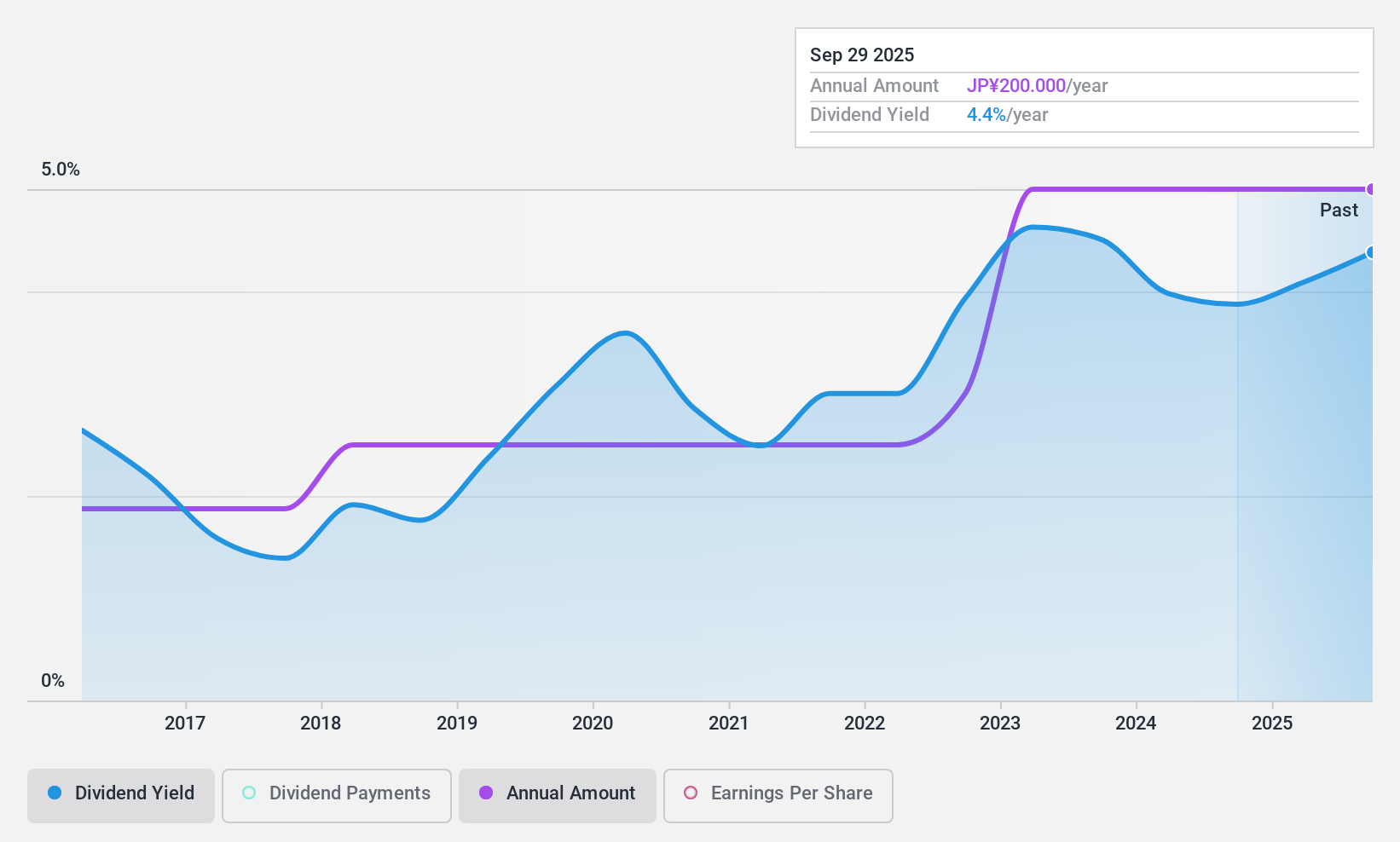

NPR-Riken (TSE:6209)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NPR-Riken Corporation, along with its subsidiaries, produces and markets automobile and marine engine parts both domestically in Japan and internationally, with a market cap of ¥68.52 billion.

Operations: NPR-Riken Corporation generates revenue from the manufacture and sale of automobile engine parts and marine engine parts in both domestic and international markets.

Dividend Yield: 5.8%

NPR-Riken's dividend yield of 5.85% ranks it among the top 25% in Japan, with dividends well-covered by earnings and cash flows due to low payout ratios of 6.7% and 30%, respectively. Despite growth over the past decade, dividends have been volatile and unreliable, with significant annual drops exceeding 20%. The stock trades at a notable discount to its estimated fair value, but large one-off items have affected recent financial results.

- Navigate through the intricacies of NPR-Riken with our comprehensive dividend report here.

- Our expertly prepared valuation report NPR-Riken implies its share price may be lower than expected.

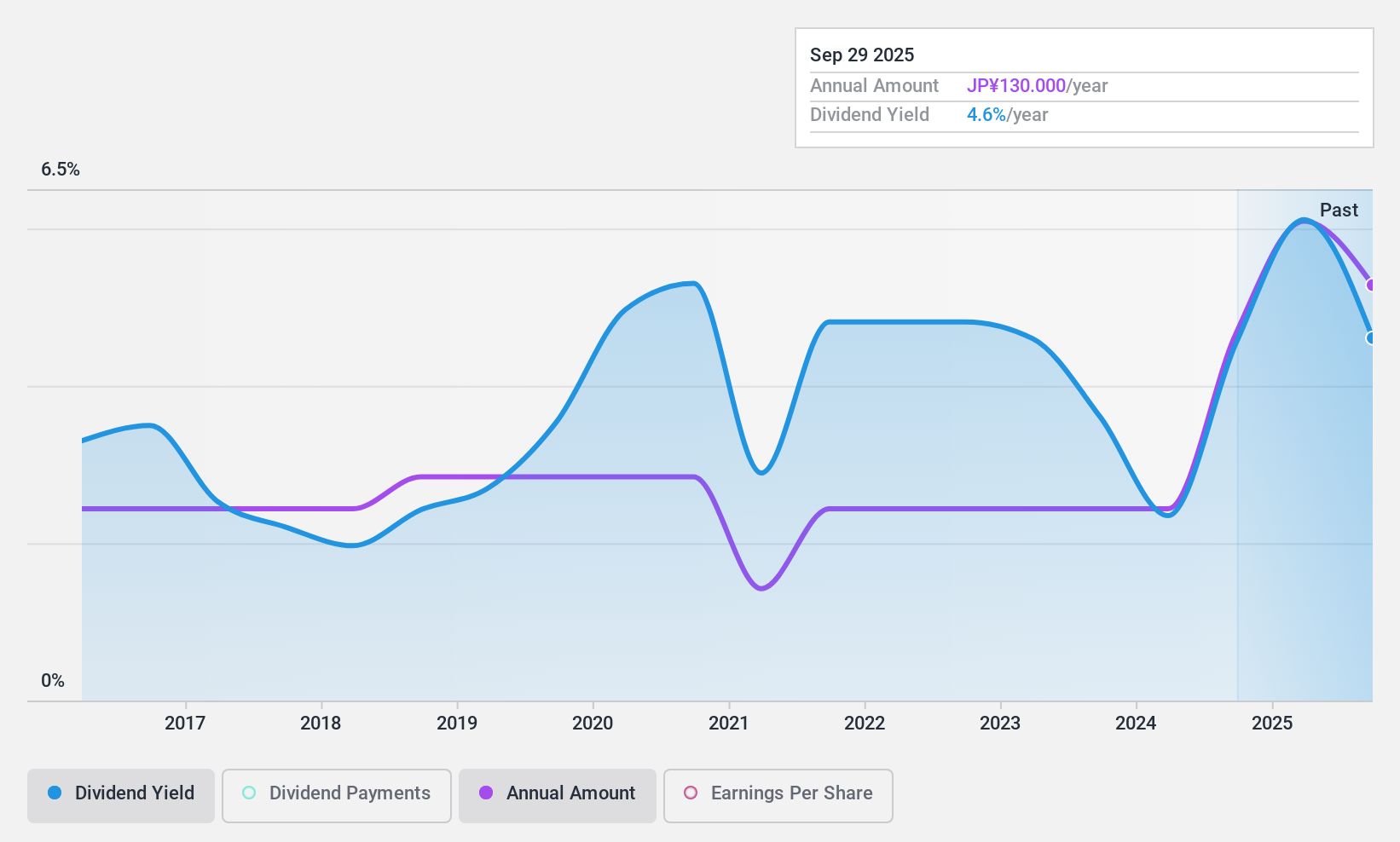

AIT (TSE:9381)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AIT Corporation operates as a comprehensive logistics company primarily in China and Southeast Asia, with a market cap of ¥396.10 billion.

Operations: AIT Corporation generates revenue through its comprehensive logistics operations primarily focused in China and Southeast Asia.

Dividend Yield: 4.6%

AIT's dividend yield of 4.63% places it in the top 25% of Japanese dividend payers, but its sustainability is questionable due to a high payout ratio of 95.4%, indicating dividends are not well-covered by earnings. Despite reasonable cash flow coverage with a cash payout ratio of 59.9%, dividends have been volatile over the past decade. Recent announcements affirm stable payouts, maintaining JPY 40 per share for the second quarter as in previous years.

- Delve into the full analysis dividend report here for a deeper understanding of AIT.

- Our comprehensive valuation report raises the possibility that AIT is priced lower than what may be justified by its financials.

Where To Now?

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1930 more companies for you to explore.Click here to unveil our expertly curated list of 1933 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NPR-Riken might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6209

NPR-Riken

Manufactures and sells automobile engine parts, marine engine parts, and other products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives