- Japan

- /

- Auto Components

- /

- TSE:5992

Returns On Capital Signal Tricky Times Ahead For Chuo SpringLtd (TSE:5992)

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Chuo SpringLtd (TSE:5992), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Chuo SpringLtd is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0084 = JP¥843m ÷ (JP¥121b - JP¥20b) (Based on the trailing twelve months to December 2023).

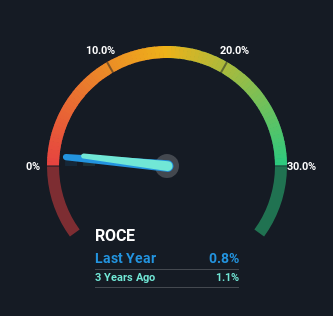

Thus, Chuo SpringLtd has an ROCE of 0.8%. In absolute terms, that's a low return and it also under-performs the Auto Components industry average of 7.1%.

Check out our latest analysis for Chuo SpringLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Chuo SpringLtd's past further, check out this free graph covering Chuo SpringLtd's past earnings, revenue and cash flow.

What Can We Tell From Chuo SpringLtd's ROCE Trend?

In terms of Chuo SpringLtd's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 0.8% from 4.1% five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

The Key Takeaway

In summary, despite lower returns in the short term, we're encouraged to see that Chuo SpringLtd is reinvesting for growth and has higher sales as a result. These trends are starting to be recognized by investors since the stock has delivered a 31% gain to shareholders who've held over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

On a separate note, we've found 1 warning sign for Chuo SpringLtd you'll probably want to know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5992

Chuo SpringLtd

Engages in the manufacture and sale of springs, control cables, construction materials and equipment, and automotive accessories in Japan, North America, China, and Asia The company offers chassis springs, such as coil springs, stabilizers, leaf springs, torsion bars, and ODDS, an on demand disconnectable stabilizer; and precision springs, including precision coil springs, valve springs, heat resistant springs, power back door springs, spiral spring, wire springs, knitted mesh spring, and assembly products.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives