- Japan

- /

- Auto Components

- /

- TSE:5334

How Niterra’s (TSE:5334) Share Buyback and Dividend Hike Could Shape Shareholder Value

Reviewed by Sasha Jovanovic

- On October 31, 2025, Niterra Co., Ltd. announced a share repurchase program of up to 7,200,000 shares, equivalent to 3.62% of its issued share capital, alongside an increase in interim and year-end dividend guidance for the fiscal year ending March 2026.

- This dual move highlights the company's focus on enhancing shareholder returns through both capital distribution and proactive capital management.

- With the board authorizing a ¥30,000 million buyback plan, we'll examine how Niterra's capital allocation strengthens its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

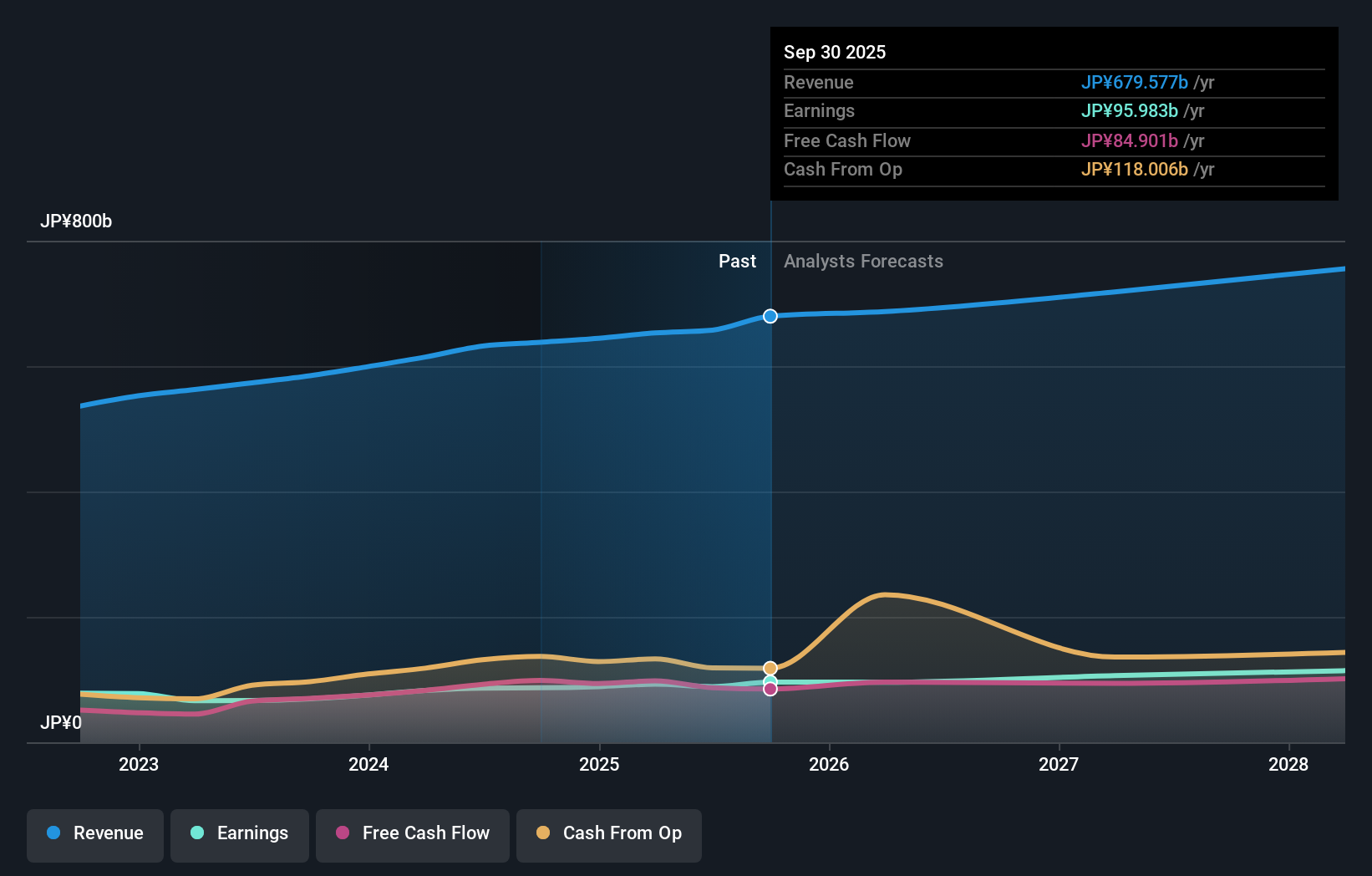

What Is Niterra's Investment Narrative?

To have conviction in Niterra as a shareholder, you’d want to believe in its ability to translate stable earnings and disciplined capital allocation into consistent value creation – even as growth trends for both revenue and profit are forecast to lag the broader market. The recent announcement of an expanded buyback and increased dividend signals the board’s intent to reward shareholders and manage excess capital, which could act as a positive short-term catalyst. However, this more aggressive capital return approach might also be a response to slower expected growth or fewer reinvestment opportunities, which would keep the biggest risk front and center: future earnings growth may not outpace the broader market or industry. If market sentiment sees these shareholder-focused moves as compensating for tepid future prospects, the catalyst may be muted compared to prior buyback cycles. But keep in mind: quick management action does not offset slower earnings growth risk.

Niterra's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Niterra - why the stock might be worth as much as ¥5710!

Build Your Own Niterra Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Niterra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Niterra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Niterra's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niterra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5334

Niterra

Manufactures and sells spark plugs and related products for internal-combustion engines and technical ceramics in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives