- Japan

- /

- Auto Components

- /

- TSE:5185

Fukoku Co.,Ltd.'s (TSE:5185) Shares Leap 29% Yet They're Still Not Telling The Full Story

The Fukoku Co.,Ltd. (TSE:5185) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 81% in the last year.

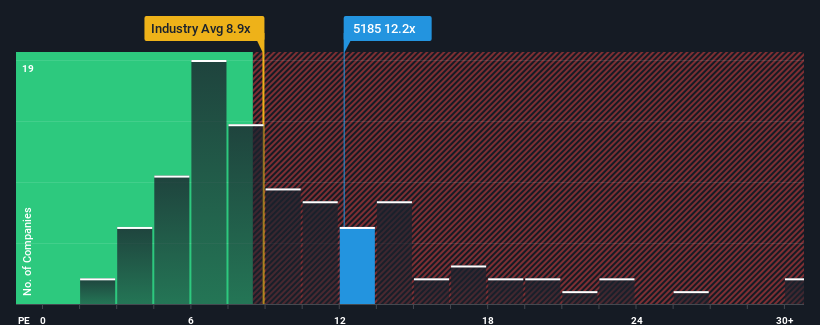

Although its price has surged higher, it's still not a stretch to say that FukokuLtd's price-to-earnings (or "P/E") ratio of 12.2x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

FukokuLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for FukokuLtd

Is There Some Growth For FukokuLtd?

FukokuLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 43% gain to the company's bottom line. The latest three year period has also seen an excellent 150% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the one analyst watching the company. With the market only predicted to deliver 9.6% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that FukokuLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

FukokuLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of FukokuLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for FukokuLtd with six simple checks.

You might be able to find a better investment than FukokuLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5185

FukokuLtd

Manufactures and sells rubber, metal and synthetic resin, and bio and medical related products in Japan, Southeast Asia, India, the United States, Europe, China, South Korea, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives