- Japan

- /

- Diversified Financial

- /

- TSE:8596

Top Dividend Stocks Including FUJIKURA COMPOSITES And Two More

Reviewed by Simply Wall St

As global markets navigate the complexities of fluctuating interest rates and political uncertainties, investors are increasingly drawn to dividend stocks for their potential to provide steady income amidst volatility. In this context, a good dividend stock is typically characterized by a strong financial foundation and consistent payout history, making it an appealing option for those seeking stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

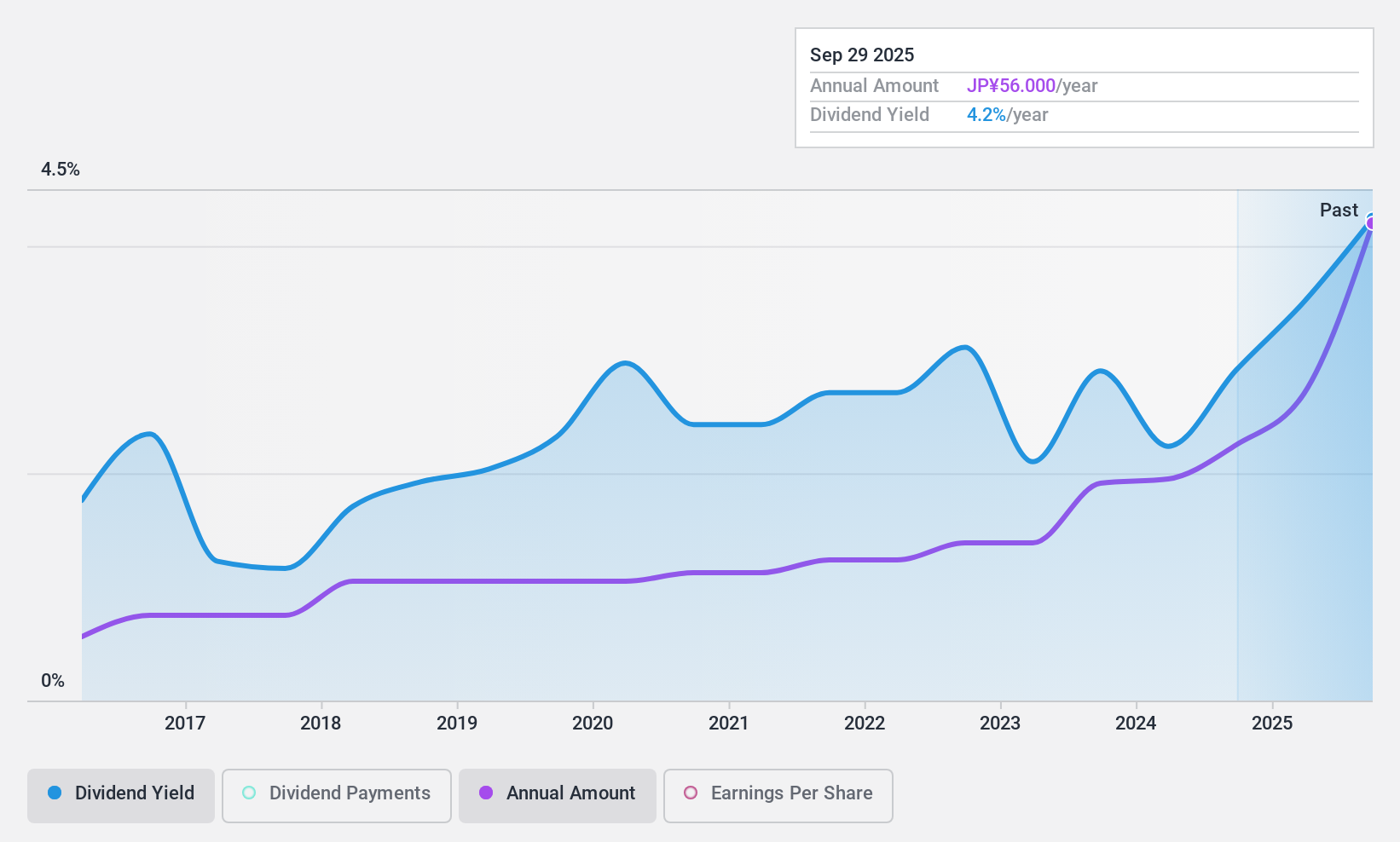

FUJIKURA COMPOSITES (TSE:5121)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FUJIKURA COMPOSITES Inc. produces and sells industrial rubber components in Japan with a market cap of ¥29.59 billion.

Operations: FUJIKURA COMPOSITES Inc.'s revenue segments include Sporting Goods at ¥11.59 billion, Industrial Materials at ¥22.74 billion, and Fabric Processed Products at ¥3.93 billion.

Dividend Yield: 4.1%

Fujikura Composites offers a dividend yield of 4.14%, placing it in the top 25% of JP market dividend payers. The dividends are well-covered by earnings and cash flows, with payout ratios of 37.9% and 30.3%, respectively. However, the company has a history of volatile dividends over the past decade, recently reducing its dividend from JPY 35 to JPY 32 per share for both interim and year-end payments for fiscal year ending March 2025.

- Unlock comprehensive insights into our analysis of FUJIKURA COMPOSITES stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of FUJIKURA COMPOSITES shares in the market.

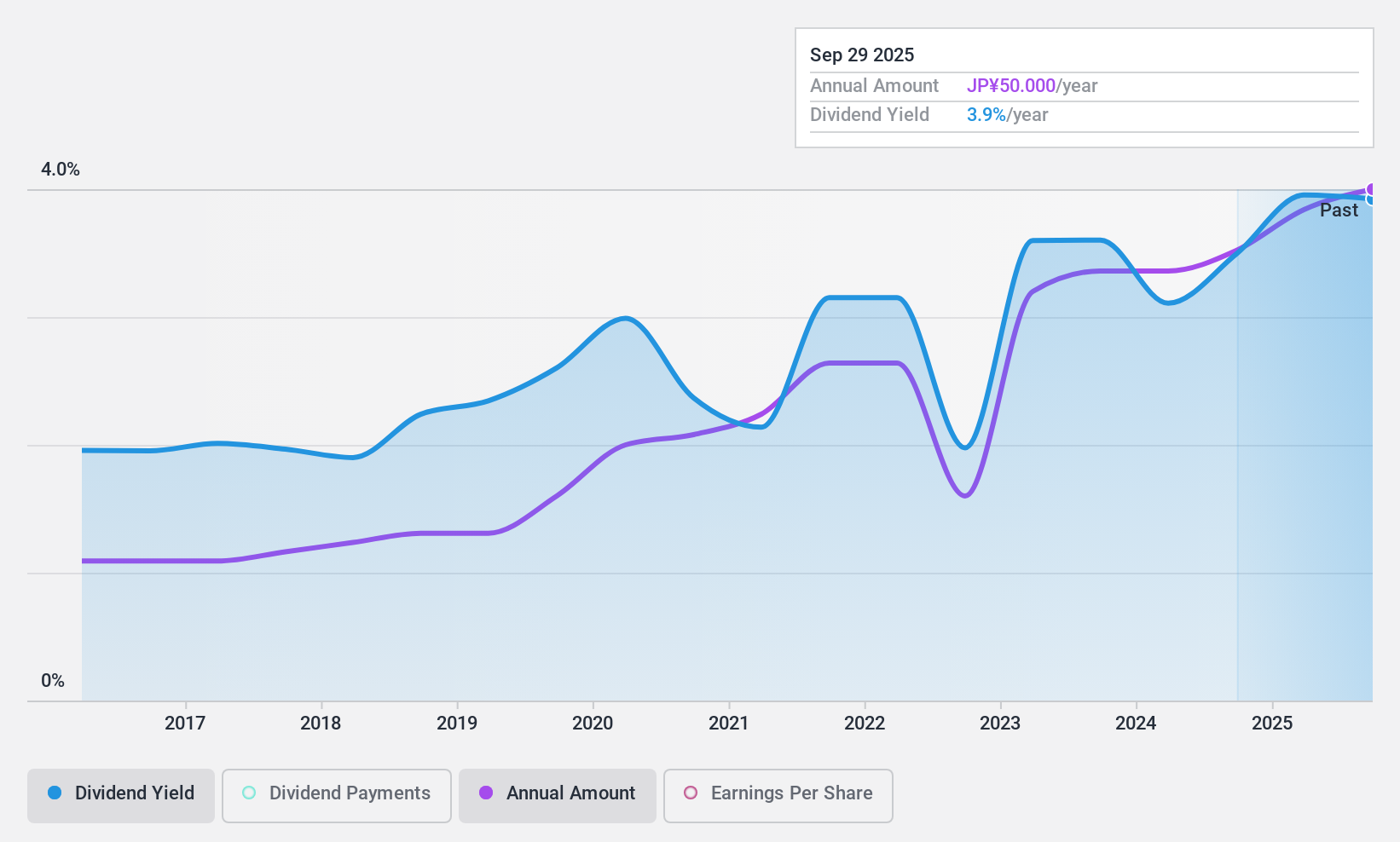

Hashimoto Sogyo HoldingsLtd (TSE:7570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hashimoto Sogyo Holdings Co., Ltd. is involved in the processing, manufacturing, and sale of plumbing and housing equipment in Japan with a market cap of ¥25.90 billion.

Operations: Hashimoto Sogyo Holdings Co., Ltd. generates revenue from several segments, including Piping Materials at ¥46.11 billion, Air Conditioners & Pumps at ¥37.92 billion, Sanitary Ceramic and Fittings at ¥46.70 billion, and Housing Facilities and Equipment at ¥28.69 billion.

Dividend Yield: 3.7%

Hashimoto Sogyo Holdings Ltd. offers a dividend yield of 3.69%, slightly below the top 25% of JP market payers. Despite stable and growing dividends over the past decade, the dividend isn't covered by free cash flows, though earnings do cover it with a payout ratio of 34.1%. The company's price-to-earnings ratio is favorable at 9.8x compared to the JP market average, but debt coverage by operating cash flow remains inadequate.

- Get an in-depth perspective on Hashimoto Sogyo HoldingsLtd's performance by reading our dividend report here.

- According our valuation report, there's an indication that Hashimoto Sogyo HoldingsLtd's share price might be on the expensive side.

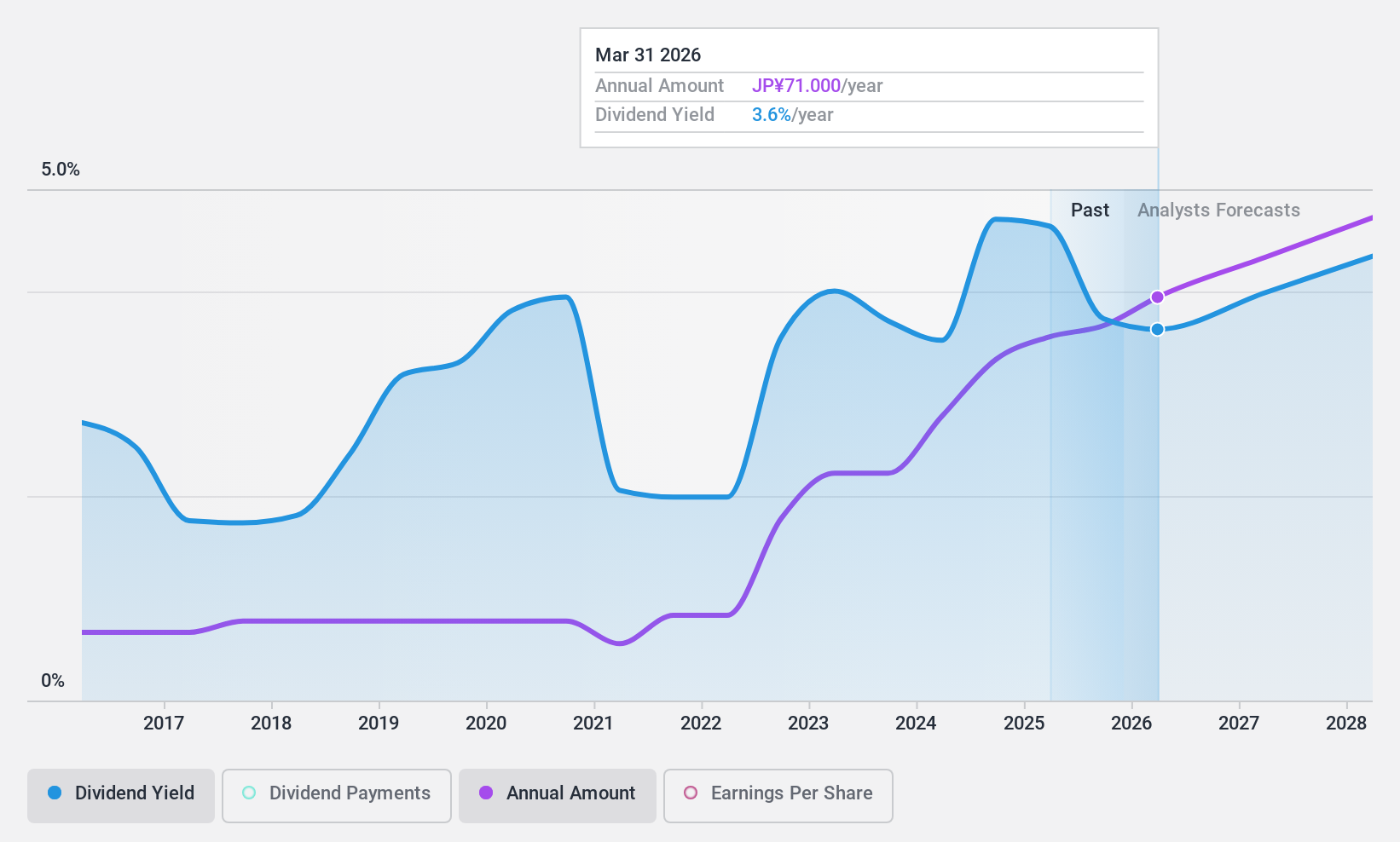

Kyushu Leasing Service (TSE:8596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyushu Leasing Service Co., Ltd. is a financial services company operating in Japan with a market cap of ¥23.45 billion.

Operations: Kyushu Leasing Service Co., Ltd. generates revenue primarily through its Lease/installment segment at ¥21.26 billion, followed by Immovable Properties at ¥13.73 billion, Finance at ¥1.96 billion, Environmental Solution at ¥1.09 billion, and Fee Business at ¥447 million.

Dividend Yield: 3.5%

Kyushu Leasing Service's dividend yield of 3.46% is below the top 25% in Japan, yet its low payout ratio of 22.3% suggests earnings coverage is strong. Dividends have been stable and growing over the past decade, although they aren't covered by free cash flows, raising sustainability concerns. Despite these issues, the stock trades at a significant discount to its estimated fair value, but debt coverage by operating cash flow remains problematic.

- Click here and access our complete dividend analysis report to understand the dynamics of Kyushu Leasing Service.

- According our valuation report, there's an indication that Kyushu Leasing Service's share price might be on the cheaper side.

Key Takeaways

- Click here to access our complete index of 1951 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyushu Leasing Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8596

Kyushu Leasing Service

Operates as a financial services company in Japan.

Established dividend payer and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026