- Japan

- /

- Auto Components

- /

- TSE:5105

Toyo Tire (TSE:5105): Valuation Spotlight After CEO Confidence and Share Buyback Plans

Reviewed by Simply Wall St

Toyo Tire (TSE:5105) shares are getting attention after the CEO projected the company will surpass profit forecasts this year, citing ongoing strong US demand and a planned share buyback program.

See our latest analysis for Toyo Tire.

After a bumpy start to the year, Toyo Tire’s momentum has shifted into high gear, with the latest leadership confidence and share buyback plans fueling a powerful rally. The one-year total shareholder return now stands at an impressive 107%, and strong demand signals that long-term confidence in the business is building.

If Toyo’s surge sparked your curiosity, now is a great moment to broaden your search and discover See the full list for free.

The big question now is whether Toyo Tire shares are still trading at an attractive valuation, or if the recent surge has already factored in all the projected growth and optimism, leaving little room for further upside.

Price-to-Earnings of 9.9x: Is it justified?

Toyo Tire shares are trading at a price-to-earnings (P/E) ratio of 9.9x, which suggests that investors are currently valuing the company at a notable discount compared to the market and its peers.

The P/E ratio reflects how much investors are willing to pay for each yen of earnings. It is a common valuation measure for auto component makers. For Toyo Tire, this modest multiple could signal the market is cautious about its growth prospects, or it could present an opportunity if the company outpaces expectations.

Toyo Tire’s P/E not only stands below the Japanese Auto Components industry average of 11.3x, but also comes in significantly under the peer group average of 12.9x. In addition, the SWS fair P/E ratio estimate for Toyo Tire is 12.2x, underscoring potential for upward re-rating if market sentiment shifts or fundamentals strengthen.

Explore the SWS fair ratio for Toyo Tire

Result: Price-to-Earnings of 9.9x (UNDERVALUED)

However, potential risks such as slower revenue growth or broader industry headwinds could quickly alter investor sentiment, even with the current optimism around Toyo Tire.

Find out about the key risks to this Toyo Tire narrative.

Another View: What Does the SWS DCF Model Say?

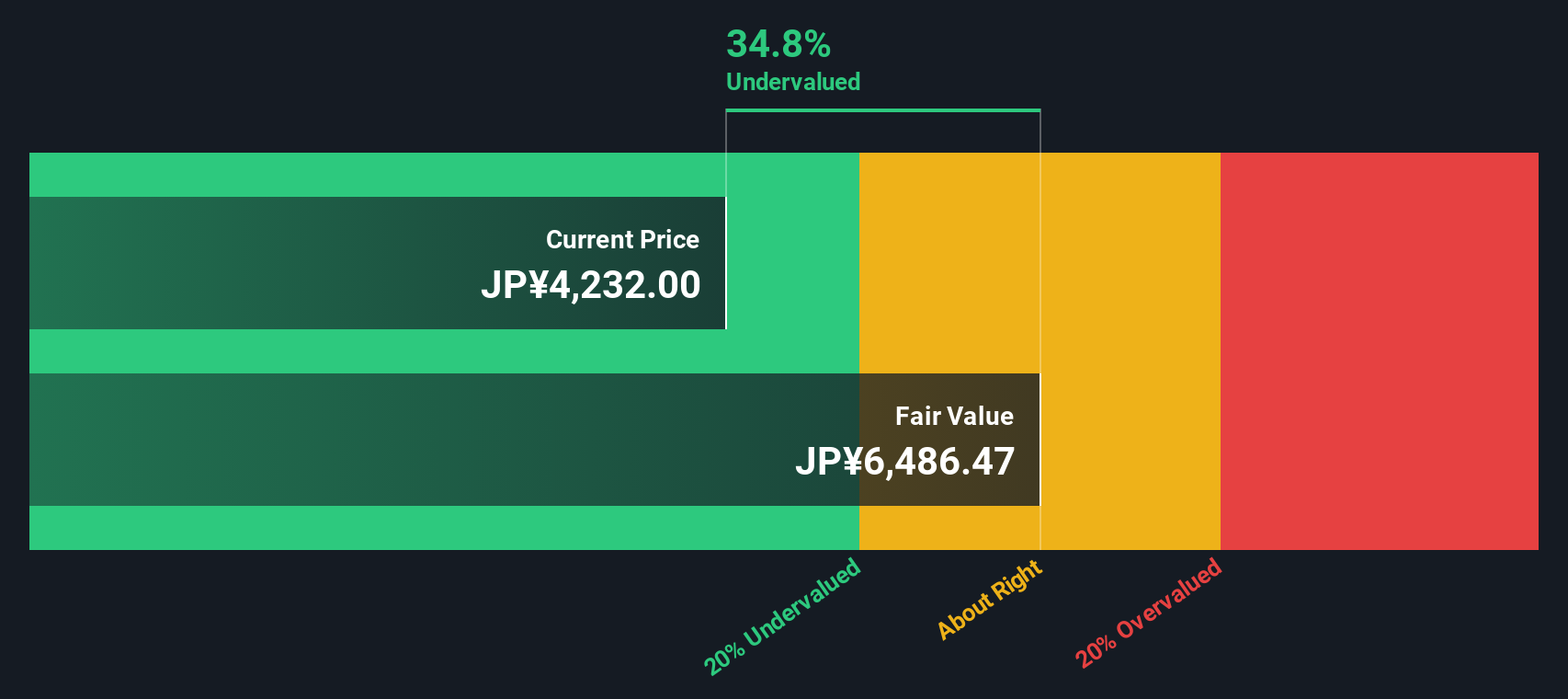

While the low price-to-earnings ratio suggests Toyo Tire could be undervalued compared to peers, our DCF model presents an even more optimistic view. It estimates the shares are trading roughly 35% below fair value, indicating significant upside. Does this suggest the market is underestimating Toyo’s future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyo Tire for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyo Tire Narrative

If you have your own perspective or want to dig deeper into the numbers, you’re invited to craft your own view of Toyo Tire in just a few minutes with Do it your way.

A great starting point for your Toyo Tire research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let your next opportunity slip by. Put your watchlist to work and instantly uncover stocks with powerful advantages, untapped potential, or stable income streams right now.

- Supercharge your portfolio by tracking these 871 undervalued stocks based on cash flows that the market hasn’t fully priced in yet. This can give you a head start over other investors.

- Fuel your search for futuristic tech with these 26 AI penny stocks that are transforming industries and redefining what’s possible in artificial intelligence.

- Elevate your income strategy with these 17 dividend stocks with yields > 3% that deliver reliable yields above 3% and can help you build wealth steadily over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5105

Toyo Tire

Manufactures and sells tires in Japan, North America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives