- Japan

- /

- Auto Components

- /

- TSE:3526

Ashimori Industry Co., Ltd. (TSE:3526) Shares Fly 28% But Investors Aren't Buying For Growth

The Ashimori Industry Co., Ltd. (TSE:3526) share price has done very well over the last month, posting an excellent gain of 28%. Looking back a bit further, it's encouraging to see the stock is up 82% in the last year.

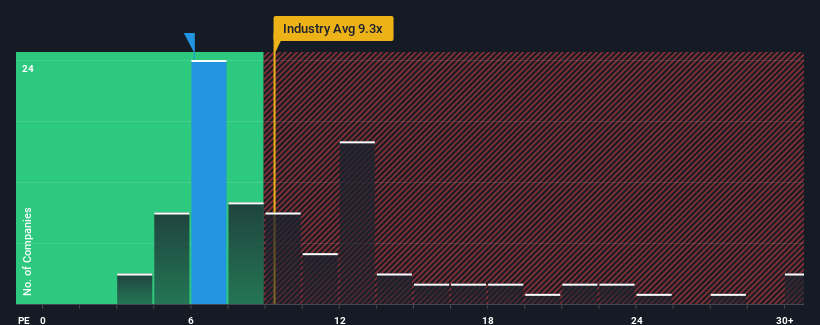

In spite of the firm bounce in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Ashimori Industry as a highly attractive investment with its 6.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Ashimori Industry has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Ashimori Industry

How Is Ashimori Industry's Growth Trending?

In order to justify its P/E ratio, Ashimori Industry would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 117% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Ashimori Industry's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in Ashimori Industry are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ashimori Industry revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Ashimori Industry that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3526

Ashimori Industry

Manufactures and sells automotive safety systems in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.