- Italy

- /

- Electric Utilities

- /

- BIT:EVISO

Investors Still Aren't Entirely Convinced By eVISO S.p.A.'s (BIT:EVISO) Revenues Despite 25% Price Jump

Despite an already strong run, eVISO S.p.A. (BIT:EVISO) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 199% following the latest surge, making investors sit up and take notice.

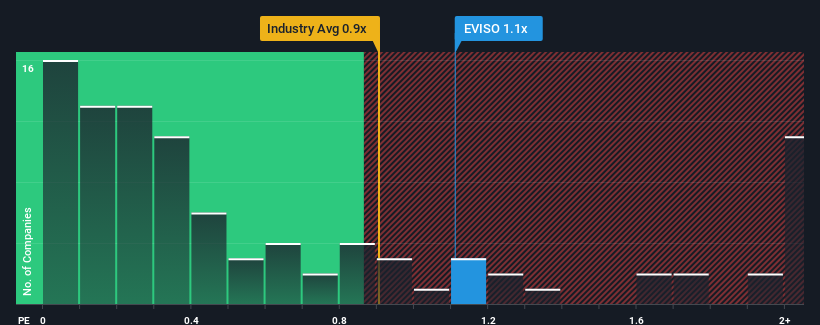

Although its price has surged higher, you could still be forgiven for feeling indifferent about eVISO's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Electric Utilities industry in Italy is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for eVISO

How Has eVISO Performed Recently?

With only a limited decrease in revenue compared to most other companies of late, eVISO has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on eVISO.How Is eVISO's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like eVISO's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 194% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the three analysts watching the company. With the industry only predicted to deliver 2.8% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that eVISO's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

eVISO's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that eVISO currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Having said that, be aware eVISO is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on eVISO, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:EVISO

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives