- Italy

- /

- Electric Utilities

- /

- BIT:ENEL

Is There Still Room for Enel Shares to Grow After Twelve Months of Gains in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Enel shares? You are not alone. As the company’s stock continues to deliver eye-catching movements, investors are trying to figure out whether there is more room for growth or if the recent gains signal a market reassessment. Over just the past week, Enel’s share price has crept up 1.3%, building on the steady upward momentum seen for much of the year. In fact, looking at the numbers, Enel is up 4.2% in the last month, 16.3% year to date, and a remarkable 24.7% over the past twelve months. If you zoom out even further, the stock has gained 143.9% in three years and is now 43.8% above where it was five years ago.

What is fueling these numbers? Beyond general investor optimism, recent market sentiment in Europe for utilities has shifted, as analysts weigh the ongoing global energy transition and look for stability amidst uncertain macroeconomic conditions. There has been growing attention on companies involved in renewable energy development, which has encouraged a steadier hand from investors when it comes to companies like Enel. The recent price moves suggest that risk perceptions may be adjusting, opening the door for both value seekers and growth chasers.

But the big question remains: is Enel undervalued even after this run? Based on several well-established valuation methods, Enel earns a valuation score of 2 out of 6 for being undervalued, meaning it only passes two checks. In the next sections, we will break down how these valuation scores are calculated, and why some approaches tell a different story than others. Before we wrap up, I will share a more nuanced way to judge Enel’s value that goes beyond the usual numbers.

Enel scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Enel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation technique that estimates a company’s true worth by projecting its future cash flows and then discounting them back to today’s value. This approach offers a view of what the company is really worth based on its ability to generate free cash in the future, rather than simply relying on market sentiment or present earnings.

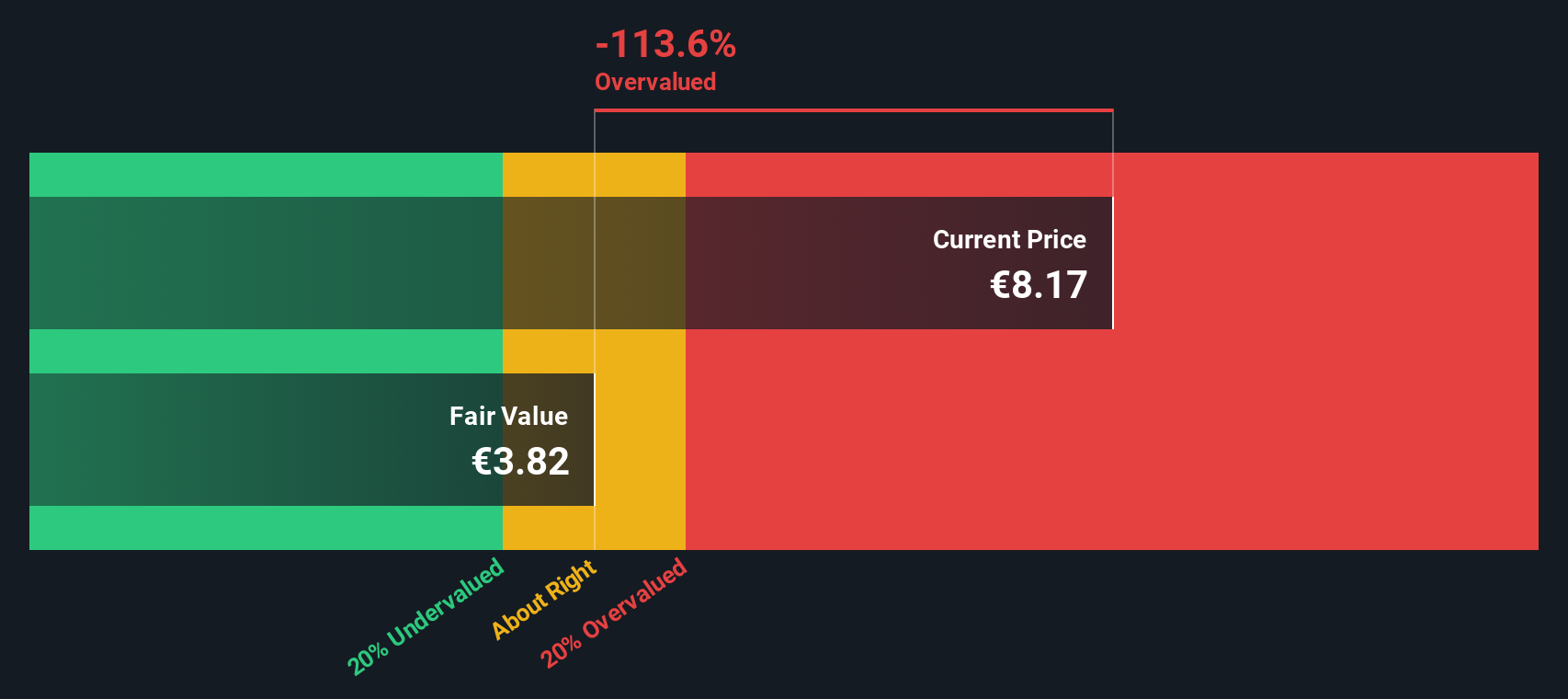

For Enel, the latest reported free cash flow (FCF) stands at €2.6 Billion. According to analyst estimates, Enel’s FCF is expected to remain relatively stable over the next five years, with a projection of €2.53 Billion in 2029. Beyond that, projections are extrapolated. By 2035, the model estimates an FCF of roughly €2.72 Billion. These numbers suggest modest long-term FCF growth based on both analyst consensus and extended modeling.

The core output from this DCF approach values Enel shares at €3.82 each. When compared to the current share price, this result implies the stock is trading at a 113.6 percent premium to its intrinsic value. In practical terms, the DCF signals that Enel is substantially overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enel may be overvalued by 113.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Enel Price vs Earnings

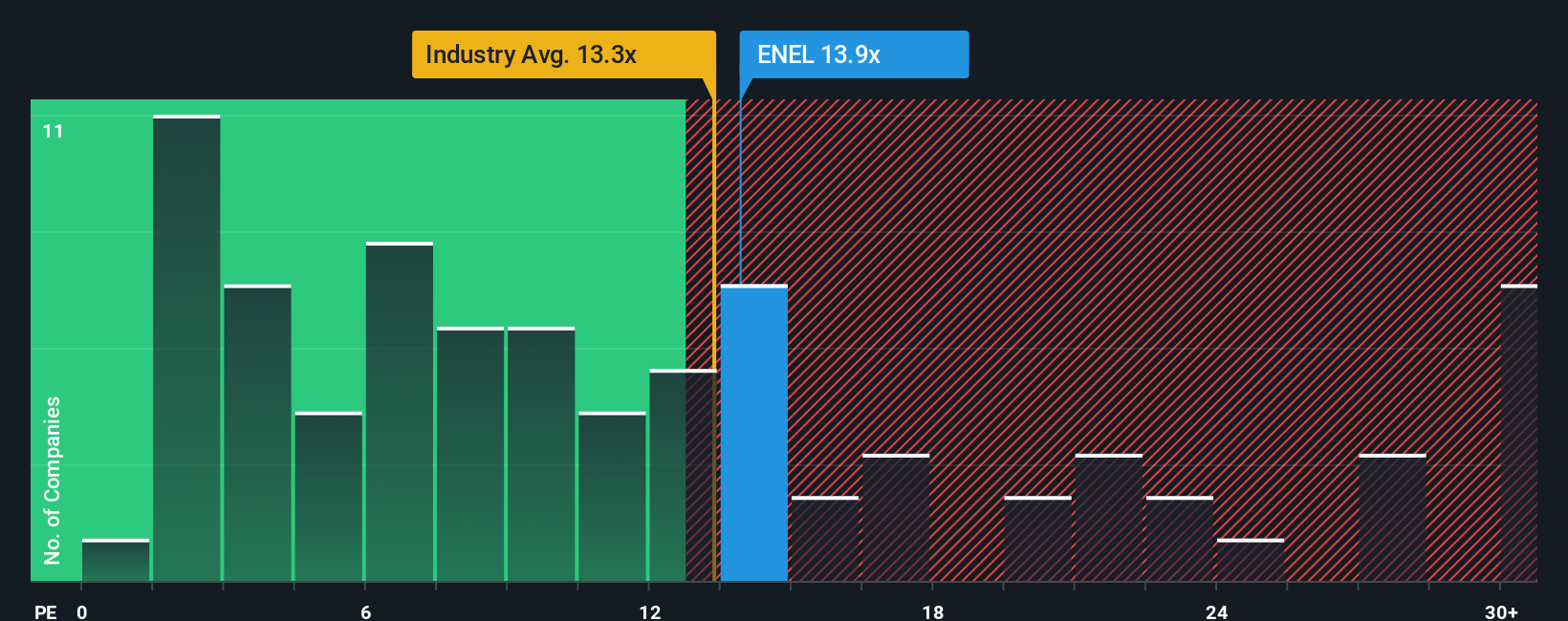

The Price-to-Earnings (PE) ratio is a staple tool for analyzing profitable companies like Enel, mainly because it ties the stock price directly to the company’s earnings power. For established firms with consistent earnings, the PE ratio offers a clear picture of what investors are paying for each euro of profit generated.

It is important to note that growth prospects and perceived risks both shape what counts as a “normal” or “fair” PE ratio. Companies expecting faster earnings growth usually justify higher PE multiples, while higher risk levels typically hold them down. For this reason, it is useful to look at more than one benchmark.

Currently, Enel trades on a PE ratio of 13.74x. For context, this is slightly below both the Electric Utilities industry average of 14.76x and some key peers sitting at 18.90x. Simply Wall St’s “Fair Ratio” for Enel is calculated at 16.47x. The Fair Ratio improves on generic industry or peer comparisons by factoring in Enel’s own earnings growth outlook, profit margins, market cap, risk profile, and industry positioning. In this way, it provides a more tailored and realistic benchmark for what Enel’s PE ratio should be.

With Enel’s current PE multiple sitting around 2.73x below its Fair Ratio, the numbers suggest that the stock is undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enel Narrative

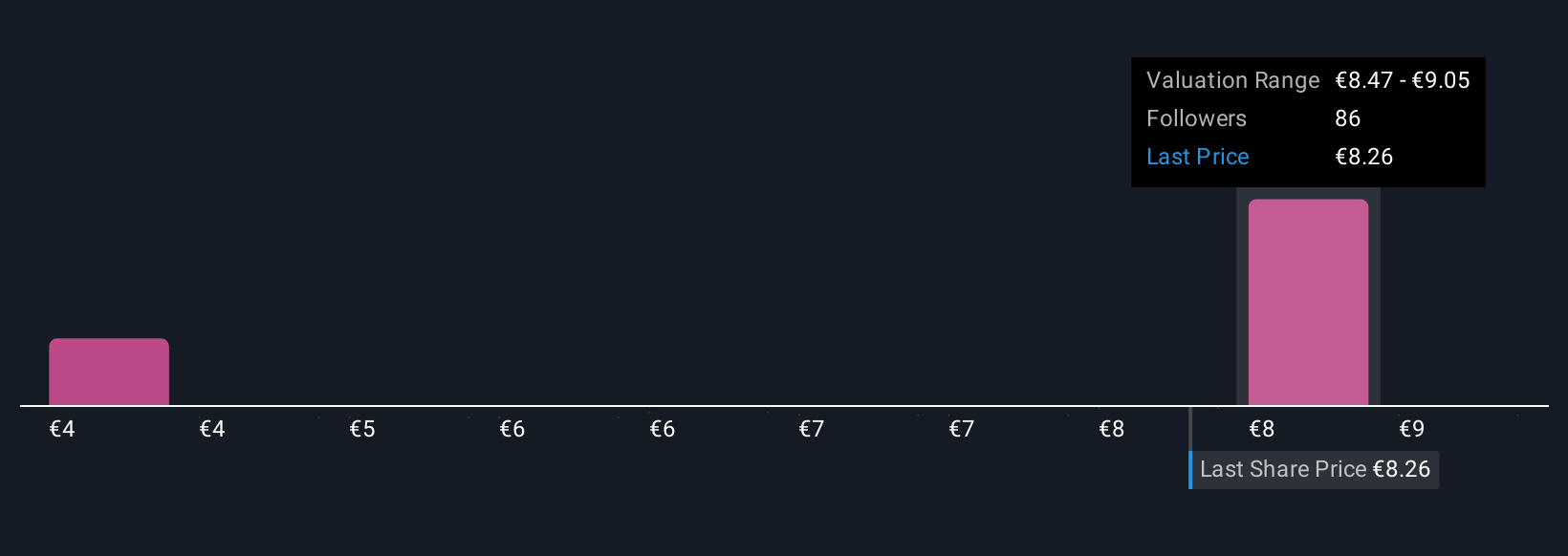

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your way of giving Enel’s numbers a story. It lets you express your personal view of the company’s future by combining your own assumptions about revenue, profit margins, and fair value with the reasons you believe in them.

On Simply Wall St’s platform, millions of investors use Narratives to connect their perspective on a company to specific financial forecasts, and ultimately to a fair value that updates as the facts change. Narratives are found on each company’s Community page and make your investment process more dynamic by comparing your fair value against the current price, helping you decide when to buy or sell with real-world context.

Unlike static analyst ratings or spreadsheets, Narratives are always evolving. For example, if a new earnings result or regulatory development comes out, your Narrative (and thus your fair value) can update automatically. As an illustration, some investors currently estimate Enel’s fair value as high as €10.0 based on aggressive expansion in renewables and digitalization, while others, focused on operational risks, see fair value closer to €7.6.

By building your own Narrative, you put your beliefs and expectations at the center of your investment decisions, giving you a transparent and responsive way to judge Enel or any company beyond surface-level ratios.

Do you think there's more to the story for Enel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENEL

Enel

Operates as an integrated operator in electricity and gas industries worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)