- Italy

- /

- Electric Utilities

- /

- BIT:ENEL

Enel (BIT:ENEL) Valuation: Assessing Upside After a Steady Share Price Rise

Reviewed by Kshitija Bhandaru

See our latest analysis for Enel.

Enel’s steady climb this month is part of a longer-term trend, as the stock has delivered a solid 1-year total shareholder return of 26%. This shows momentum is building as investors grow more comfortable with its earnings and growth outlook.

If you’re looking to broaden your search beyond utilities, now’s a great opportunity to discover fast growing stocks with high insider ownership.

But with Enel shares near their recent highs and trading just below analysts’ price targets, investors may wonder if there is still room for upside or if the market has already factored in the company’s future growth.

Most Popular Narrative: 3.3% Undervalued

Enel’s most followed narrative suggests its fair value sits just above the current price, hinting at some remaining upside. The fair value is set at €8.49, compared to the latest close of €8.21, with analysts factoring in both growth prospects and sector risks.

*Enel's significant investment in digitalization (e.g., smart grids, automation, BESS capacity now at 11.5GW) and grid modernization is yielding improved operational efficiency. This is evidenced by €1 billion in cash cost savings already realized toward its 2027 target, supporting margin expansion and sustained net income improvement.*

Curious what earnings projections and profit margin targets push this valuation higher? The next move might surprise you. See how analysts are building a case for growth and discover the financial levers that could redefine Enel’s future payout and price potential.

Result: Fair Value of €8.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility or regulatory changes in key European markets could present challenges to Enel's growth optimism and put pressure on its profit outlook.

Find out about the key risks to this Enel narrative.

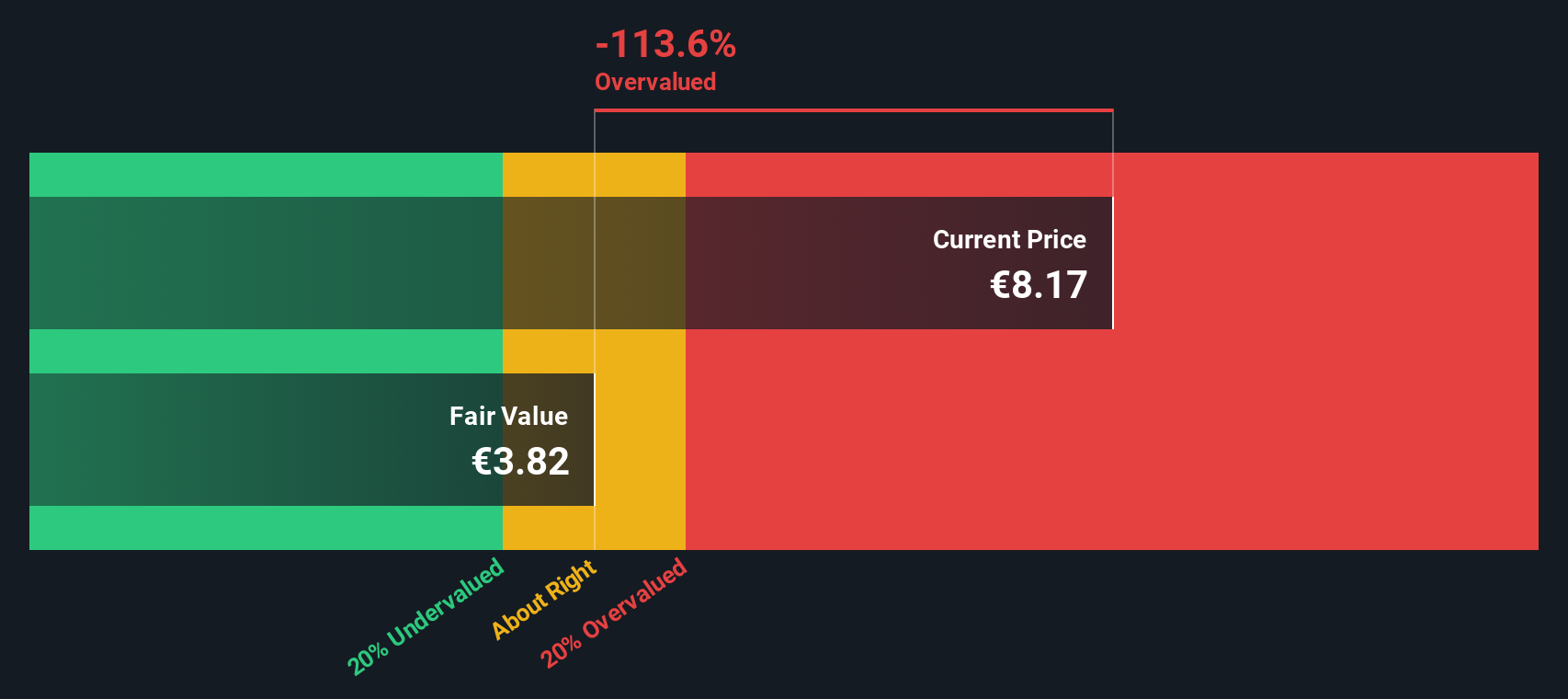

Another View: Discounted Cash Flow Model

Taking a different approach, our DCF model offers a more cautious outlook than the multiples-based valuation. The SWS DCF model estimates Enel’s fair value to be much lower than its current price, suggesting the shares may be overvalued if you weigh cash flow projections more heavily. This raises the question: do cash flows tell a different story than analyst optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enel Narrative

If you want to take a hands-on approach or see things differently, you can craft your own narrative using the available data in just a few minutes. Do it your way.

A great starting point for your Enel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio with unique opportunities you might have overlooked. The right investment at the right time could give you the edge over the crowd.

- Tap into massive yield potential by finding these 19 dividend stocks with yields > 3% that are keeping income investors ahead of the curve.

- Unlock tech innovation by tracking these 26 quantum computing stocks and their breakthroughs in quantum hardware, secure communication, and future-defining algorithms.

- Capitalize on market mispricing with these 896 undervalued stocks based on cash flows that have solid fundamentals yet remain under investors’ radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENEL

Enel

Operates as an integrated operator in electricity and gas industries worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives