The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, ENAV S.p.A. (BIT:ENAV) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for ENAV

How Much Debt Does ENAV Carry?

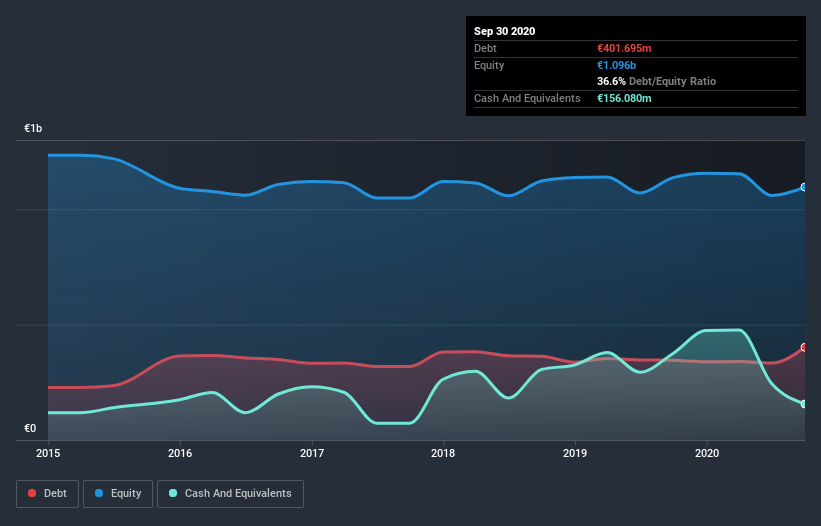

You can click the graphic below for the historical numbers, but it shows that as of September 2020 ENAV had €401.7m of debt, an increase on €345.2m, over one year. On the flip side, it has €156.1m in cash leading to net debt of about €245.6m.

A Look At ENAV's Liabilities

We can see from the most recent balance sheet that ENAV had liabilities of €271.7m falling due within a year, and liabilities of €570.7m due beyond that. Offsetting this, it had €156.1m in cash and €272.2m in receivables that were due within 12 months. So its liabilities total €414.1m more than the combination of its cash and short-term receivables.

Of course, ENAV has a market capitalization of €2.18b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ENAV has a low net debt to EBITDA ratio of only 1.3. And its EBIT covers its interest expense a whopping 21.1 times over. So we're pretty relaxed about its super-conservative use of debt. The modesty of its debt load may become crucial for ENAV if management cannot prevent a repeat of the 36% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine ENAV's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, ENAV's free cash flow amounted to 23% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

ENAV's EBIT growth rate and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. It's also worth noting that ENAV is in the Infrastructure industry, which is often considered to be quite defensive. Looking at all the angles mentioned above, it does seem to us that ENAV is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for ENAV you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade ENAV, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ENAV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:ENAV

ENAV

Provides air traffic control and management, and other air navigation services in Italy, the rest of Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives