- Italy

- /

- Infrastructure

- /

- BIT:ADB

Undiscovered Gems in Europe for April 2025

Reviewed by Simply Wall St

In the midst of heightened global trade tensions and economic uncertainty, European markets have experienced significant volatility, with the STOXX Europe 600 Index seeing its largest drop in five years. Despite these challenges, opportunities remain for discerning investors who can identify stocks with strong fundamentals and resilience to navigate turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Alantra Partners | NA | -3.99% | -23.83% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A. operates and oversees the development and maintenance of the Bologna airport, with a market capitalization of €291.90 million.

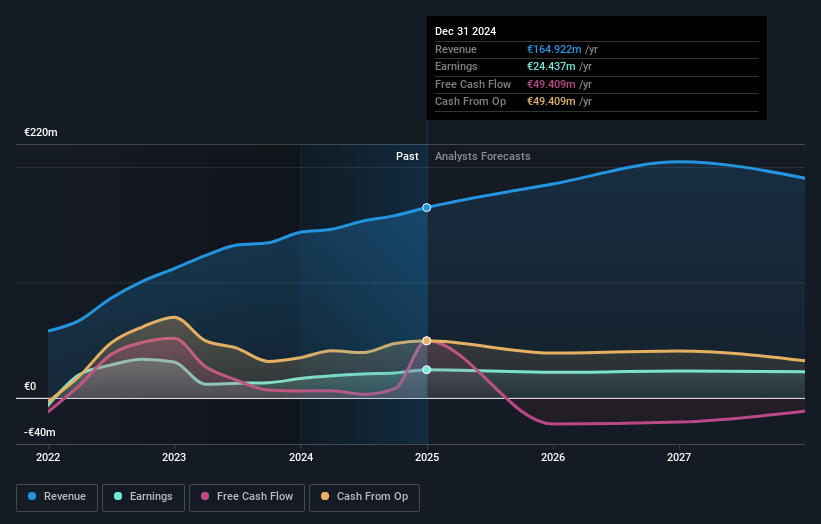

Operations: The primary revenue streams for Aeroporto Guglielmo Marconi di Bologna S.p.A. include aeronautical services generating €73.41 million and non-aeronautical services contributing €55.83 million.

Aeroporto Guglielmo Marconi di Bologna, a smaller player in the European market, has demonstrated robust financial health with earnings growth of 46.3% over the past year, outpacing the infrastructure sector's 0.6%. The company's debt-to-equity ratio increased from 9.7 to 15.8 over five years but remains manageable as cash exceeds total debt and interest payments are well-covered by EBIT at a multiple of 55.1x. Recent results show revenue climbing to €166 million from €145 million last year, while net income rose to €24 million from €17 million, reflecting solid profitability and an attractive P/E ratio of 11.9x against Italy’s market average of 13x.

Polaris Media (OB:POL)

Simply Wall St Value Rating: ★★★★★★

Overview: Polaris Media ASA operates as a media house and printing company in Norway and Sweden, with a market capitalization of NOK4.11 billion.

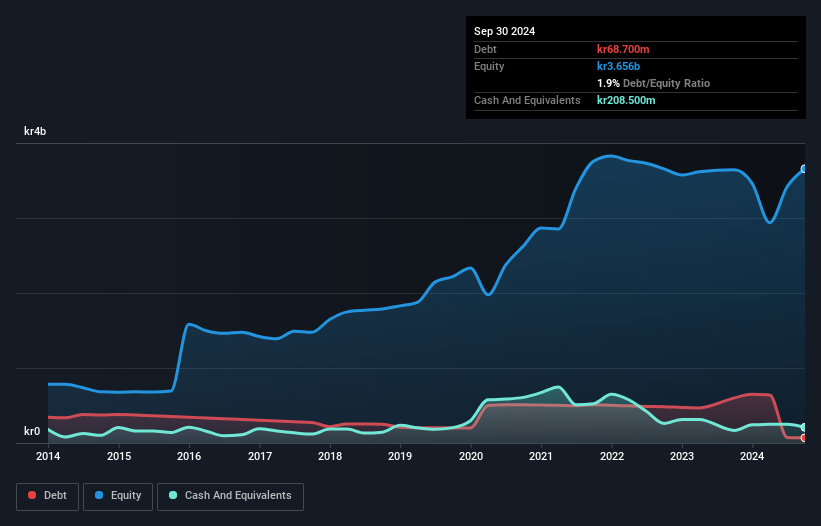

Operations: Polaris Media generates revenue primarily from its media house operations in Norway and Sweden, with significant contributions from print and distribution services. The Media House Norway segment leads the revenue streams at NOK1.95 billion, followed by Media House Sweden at NOK1.06 billion.

Polaris Media, a nimble player in the media sector, has shown promising financial strides. Over five years, its debt to equity ratio impressively dropped from 8.6% to 1.6%, reflecting prudent financial management. The company managed to turn profitable recently, with net income reaching NOK 678 million for the year compared to a NOK 47 million loss previously. Trading at a slight discount of 4.2% below estimated fair value suggests potential undervaluation. Despite full-year revenue slipping slightly from NOK 3,643.7 million to NOK 3,597.5 million, Polaris's high-quality earnings and positive free cash flow highlight operational resilience and growth prospects in the competitive media landscape.

- Click here and access our complete health analysis report to understand the dynamics of Polaris Media.

Assess Polaris Media's past performance with our detailed historical performance reports.

PlayWay (WSE:PLW)

Simply Wall St Value Rating: ★★★★★☆

Overview: PlayWay S.A. is a global producer and publisher of PC and mobile games, with a market capitalization of PLN1.85 billion.

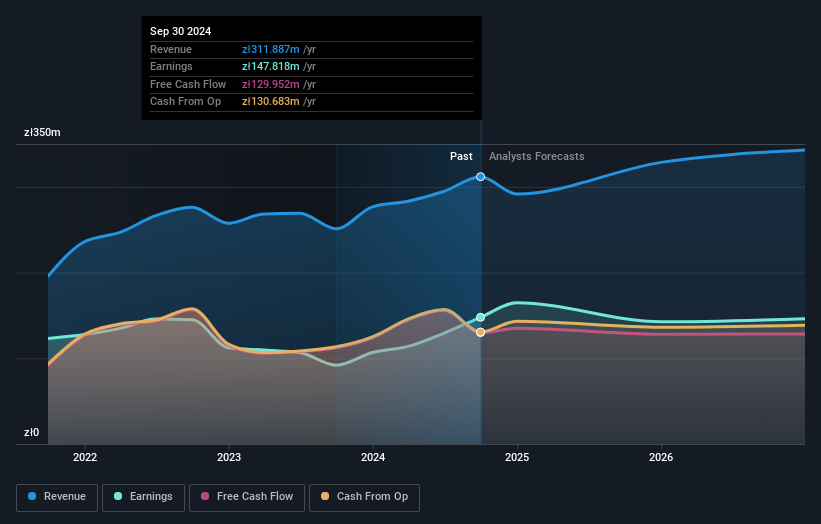

Operations: The company generates revenue primarily from its computer graphics segment, which amounts to PLN311.89 million. The net profit margin is a key financial metric for the firm, reflecting its profitability after accounting for all expenses.

PlayWay has shown impressive earnings growth of 60.8% over the past year, significantly outpacing the Entertainment industry's 7.1%. This profitability ensures that cash runway isn't a concern for this company. Trading at roughly 23.6% below estimated fair value, PlayWay offers good relative value compared to peers and industry standards. The company's debt-to-equity ratio increased slightly from 0% to 0.08% over five years, yet it maintains more cash than total debt, ensuring financial stability and interest coverage remains strong with profits exceeding interest payments comfortably. With earnings forecasted to grow by about 8% annually, PlayWay seems well-positioned for future expansion in its niche market segment.

- Click to explore a detailed breakdown of our findings in PlayWay's health report.

Evaluate PlayWay's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 340 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Aeroporto Guglielmo Marconi di Bologna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ADB

Aeroporto Guglielmo Marconi di Bologna

Develops, manages, and maintains an airport in Bologna.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives