- Italy

- /

- Telecom Services and Carriers

- /

- BIT:TSL

Tessellis (BIT:TSL investor three-year losses grow to 75% as the stock sheds €12m this past week

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Tessellis S.p.A. (BIT:TSL), who have seen the share price tank a massive 75% over a three year period. That would be a disturbing experience. More recently, the share price has dropped a further 22% in a month.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Tessellis

Tessellis isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Tessellis grew revenue at 7.7% per year. That's not a very high growth rate considering it doesn't make profits. But the share price crash at 21% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

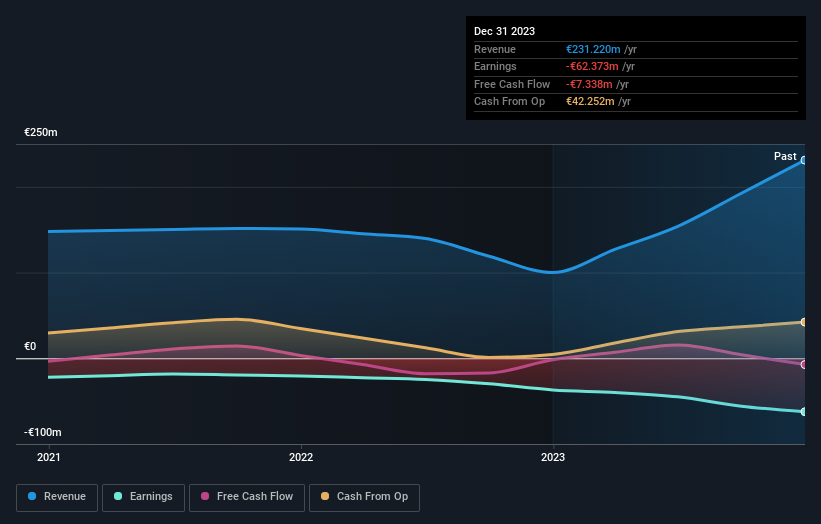

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Tessellis' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Tessellis has rewarded shareholders with a total shareholder return of 27% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Tessellis better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Tessellis , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tessellis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TSL

Tessellis

Provides telecommunication services through various fixed network technologies in Italy and the Netherlands.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives