- Italy

- /

- Telecom Services and Carriers

- /

- BIT:CVG

There Is A Reason Convergenze S.p.A. Società Benefit's (BIT:CVG) Price Is Undemanding

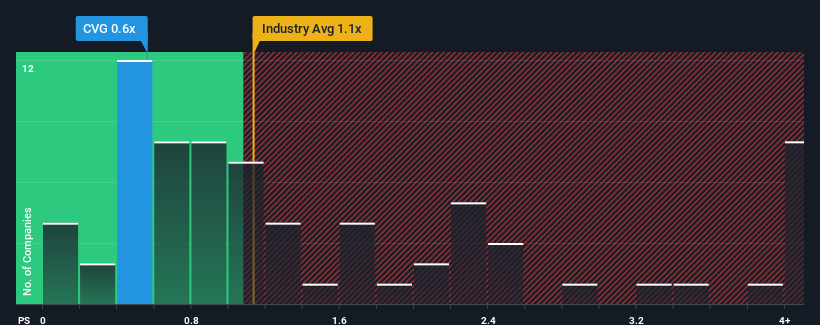

You may think that with a price-to-sales (or "P/S") ratio of 0.6x Convergenze S.p.A. Società Benefit (BIT:CVG) is a stock worth checking out, seeing as almost half of all the Telecom companies in Italy have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Convergenze. Società Benefit

How Has Convergenze. Società Benefit Performed Recently?

Convergenze. Società Benefit certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Convergenze. Società Benefit's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Convergenze. Società Benefit's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. The latest three year period has also seen an excellent 69% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.7% each year during the coming three years according to the dual analysts following the company. With the industry predicted to deliver 6.1% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Convergenze. Società Benefit's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Convergenze. Società Benefit's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Convergenze. Società Benefit's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Convergenze. Società Benefit's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Having said that, be aware Convergenze. Società Benefit is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Convergenze. Società Benefit, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CVG

Convergenze. Società Benefit

Provides Internet services, voice, energy, and natural gas services.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.