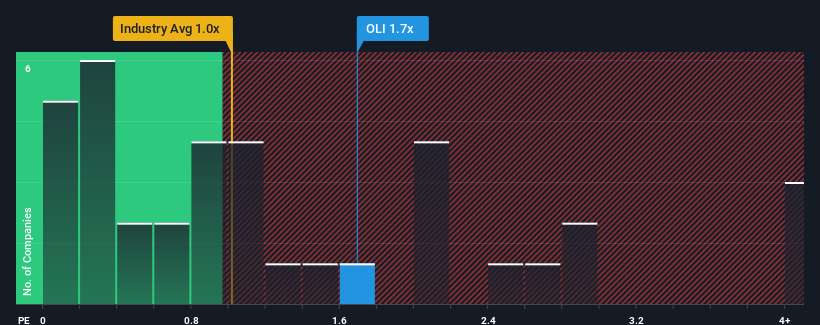

When close to half the companies in the Tech industry in Italy have price-to-sales ratios (or "P/S") below 1.1x, you may consider Olidata S.p.A. (BIT:OLI) as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Olidata

How Olidata Has Been Performing

Olidata certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Olidata, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

Olidata's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 2.2% shows it's a great look while it lasts.

In light of this, it's understandable that Olidata's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Olidata's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As detailed previously, the strength of Olidata's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

Plus, you should also learn about these 5 warning signs we've spotted with Olidata (including 2 which are potentially serious).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OLI

Olidata

Operates as a systems integration and technology consulting company.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives