- Italy

- /

- Tech Hardware

- /

- BIT:CELL

Reflecting on Cellularline's (BIT:CELL) Share Price Returns Over The Last Year

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Cellularline S.p.A. (BIT:CELL) shareholders over the last year, as the share price declined 38%. That falls noticeably short of the market decline of around 9.4%. Cellularline hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

See our latest analysis for Cellularline

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

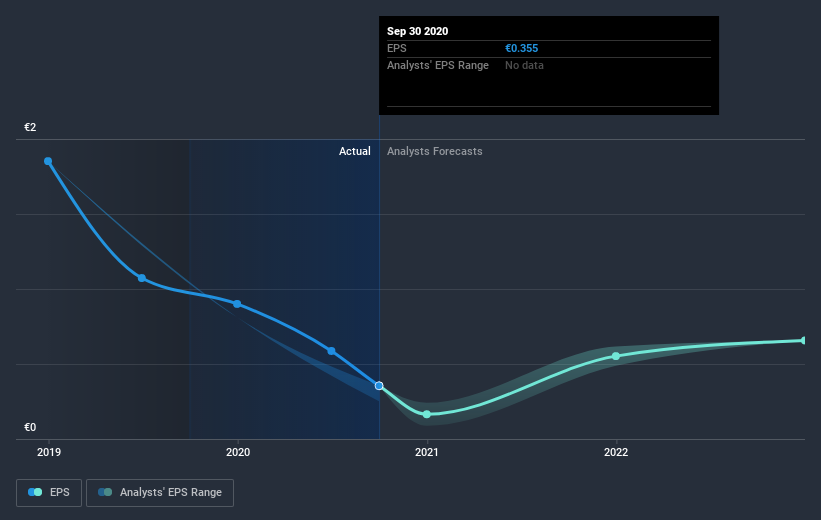

Unfortunately Cellularline reported an EPS drop of 64% for the last year. This fall in the EPS is significantly worse than the 38% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Cellularline has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Cellularline stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Cellularline the TSR over the last year was -33%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We doubt Cellularline shareholders are happy with the loss of 33% over twelve months (even including dividends). That falls short of the market, which lost 9.4%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Cellularline better, we need to consider many other factors. Even so, be aware that Cellularline is showing 3 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you’re looking to trade Cellularline, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BIT:CELL

Cellularline

Manufactures and sells accessories for smartphones and tablets in Italy, Spain, Portugal, Germany, Eastern Europe, Switzerland, Benelux, Northern Europe, France, Great Britain, the Middle East, North America, and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026