As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent volatility, investors are keenly observing economic indicators and adjusting their strategies accordingly. For those interested in exploring opportunities beyond traditional large-cap investments, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies with growth potential. This article will explore several penny stocks that exhibit financial strength and could offer long-term value amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cellularline S.p.A. manufactures and sells smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €53.26 million.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to €164.29 million.

Market Cap: €53.26M

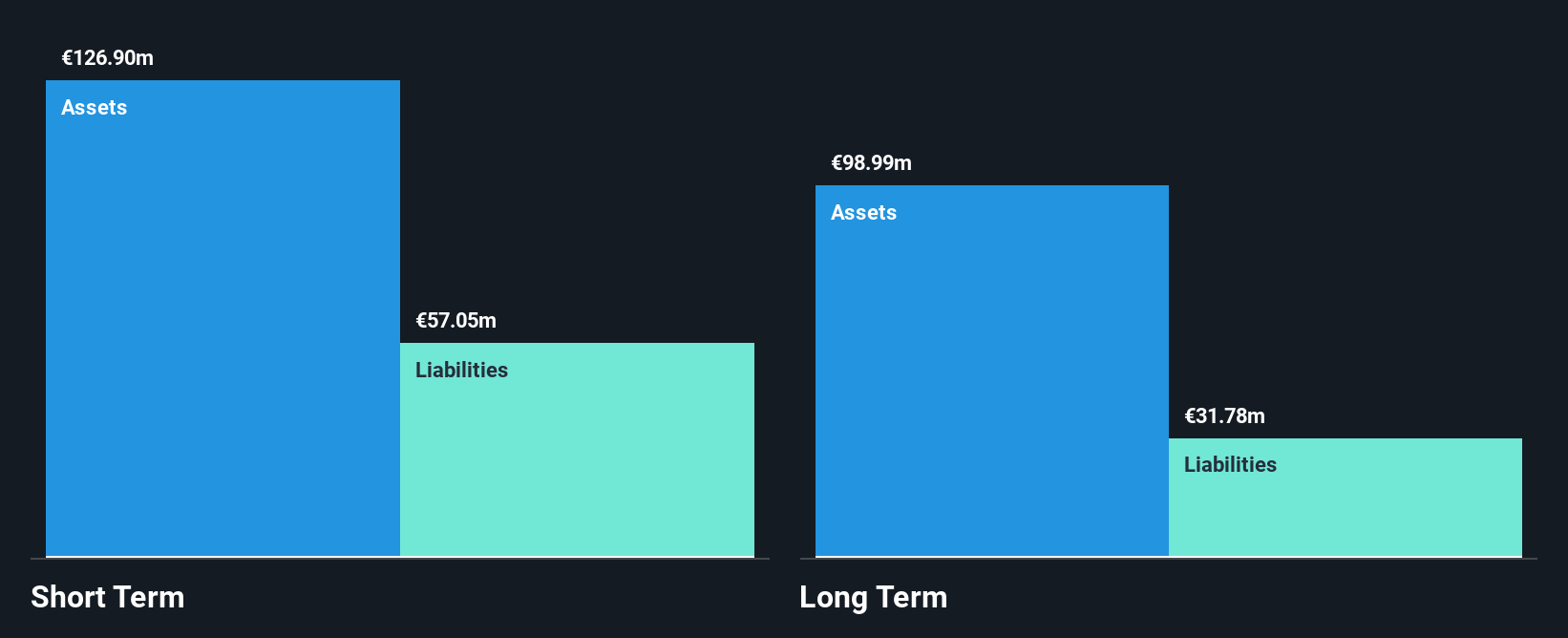

Cellularline S.p.A. has shown signs of stabilization with a market cap of €53.26 million and recent earnings indicating profitability, reporting a net income of €1.09 million for the nine months ending September 2024, compared to a loss previously. The company’s debt is well-managed with satisfactory net debt to equity and operating cash flow coverage, although interest coverage remains below optimal levels. Despite high-quality earnings and good value relative to peers, challenges include an inexperienced board and management team alongside low return on equity. Cellularline's short-term assets sufficiently cover both its short-term and long-term liabilities.

- Take a closer look at Cellularline's potential here in our financial health report.

- Evaluate Cellularline's prospects by accessing our earnings growth report.

Sa Sa International Holdings (SEHK:178)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sa Sa International Holdings Limited is an investment holding company involved in the retail and wholesale of cosmetic products across Hong Kong, Macau, Mainland China, Southeast Asia, and internationally with a market cap of HK$2.14 billion.

Operations: The company's revenue is primarily derived from its operations in Hong Kong & Macau (HK$3.09 billion), followed by Mainland China (HK$648.19 million) and Southeast Asia (HK$391.73 million).

Market Cap: HK$2.14B

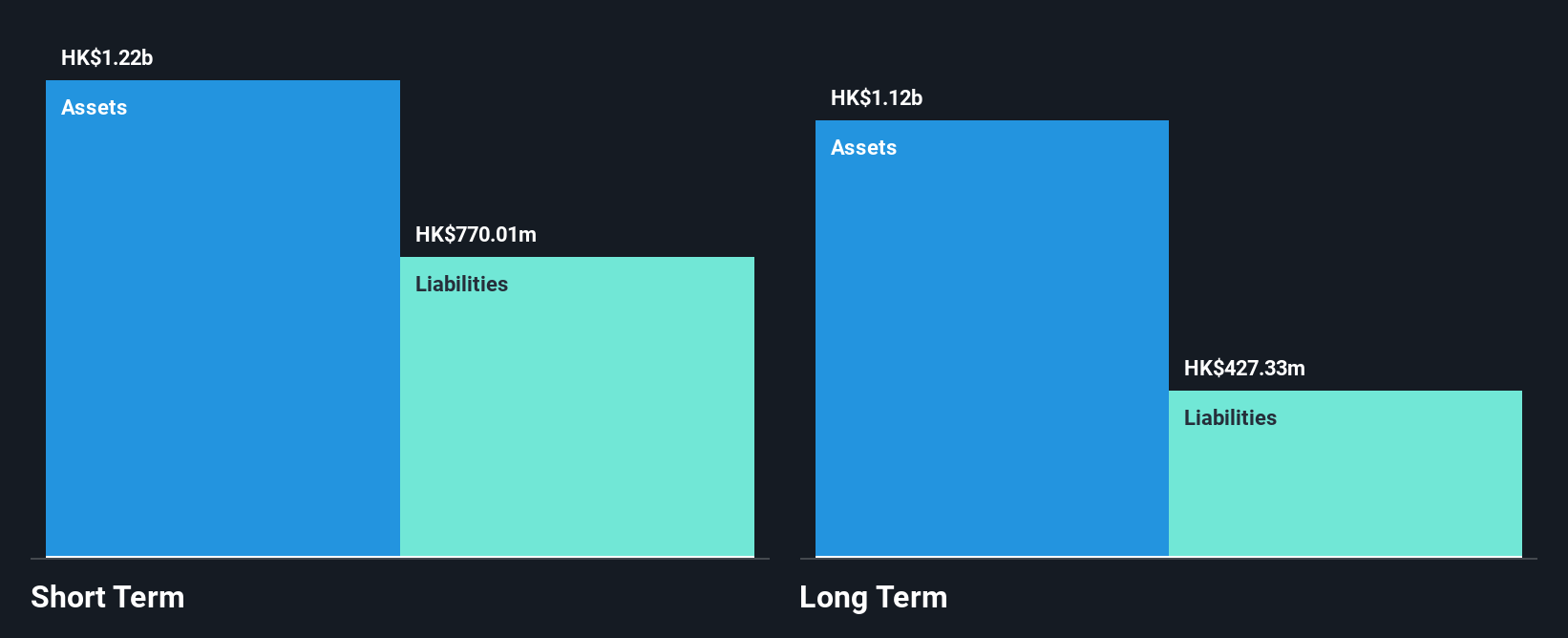

Sa Sa International Holdings faces challenges with declining profitability, as evidenced by a drop in net income to HK$32.41 million for the half-year ending September 2024 from HK$102.42 million the previous year, alongside reduced profit margins. The company's core market turnover in Hong Kong and Macau has declined due to shifting consumer behavior and currency impacts. Despite these hurdles, Sa Sa remains debt-free with strong short-term asset coverage over liabilities and seasoned management. Recent executive changes include a new CFO appointment, which could influence future financial strategies amid ongoing revenue pressures across its key markets.

- Click to explore a detailed breakdown of our findings in Sa Sa International Holdings' financial health report.

- Learn about Sa Sa International Holdings' future growth trajectory here.

Honma Golf (SEHK:6858)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Honma Golf Limited is an investment holding company that designs, develops, manufactures, and sells golf club equipment across various international markets including Japan, Korea, and North America with a market cap of HK$2.01 billion.

Operations: The company generates revenue of ¥22.84 billion from the manufacture and sales of golf-related products and rendering of services.

Market Cap: HK$2.01B

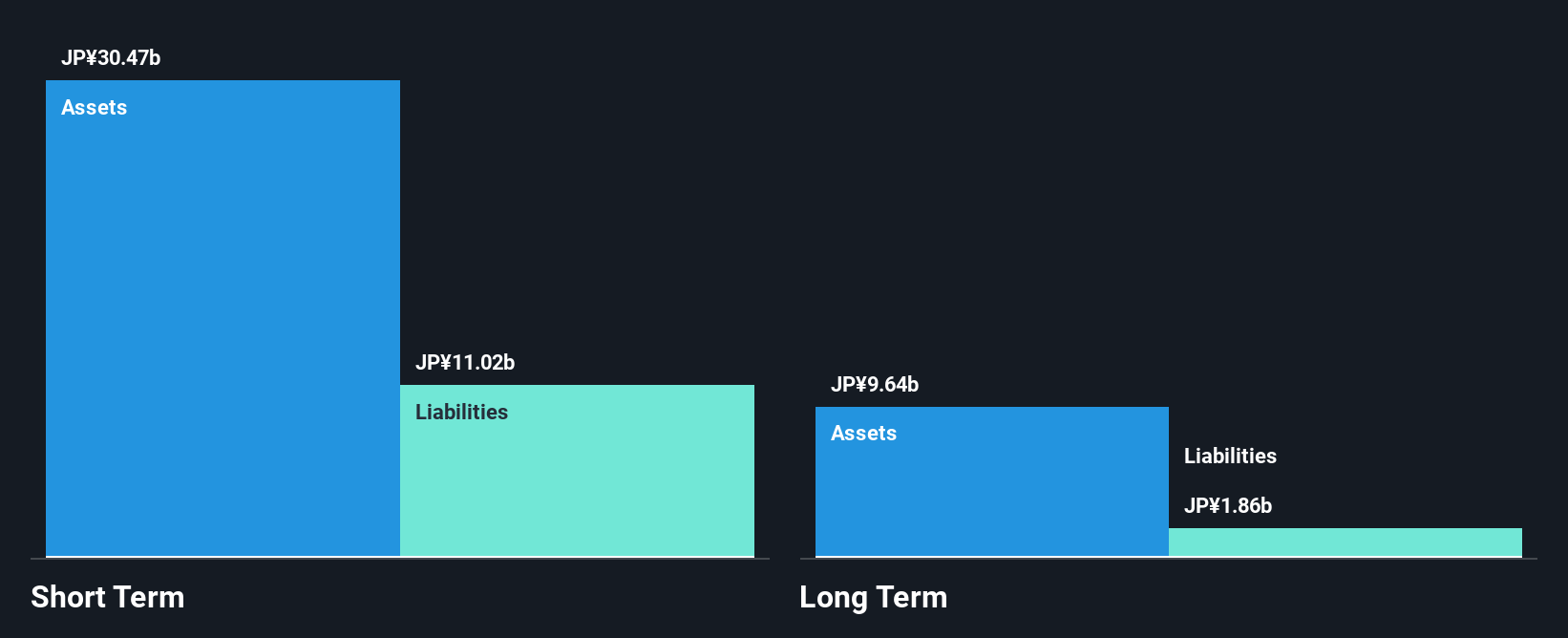

Honma Golf Limited's financial health shows a mixed picture with its operating cash flow effectively covering debt and short-term assets exceeding liabilities. However, the company faced significant challenges in the recent half-year, reporting a net loss of ¥845.63 million compared to a previous net income of ¥3.33 billion, largely due to decreased sales and one-off losses. Despite these setbacks, Honma benefits from seasoned management and board members with extensive industry experience. Recent leadership additions include strategic advisors which may influence future business directions amidst declining profit margins and an absence of interim dividends for 2024.

- Click here to discover the nuances of Honma Golf with our detailed analytical financial health report.

- Gain insights into Honma Golf's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Explore the 5,810 names from our Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honma Golf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6858

Honma Golf

An investment holding company, designs, develops, manufactures, and sells a range of golf club equipment in Japan, Korea, Hong Kong, Macau, rest of China, North America, Europe, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives