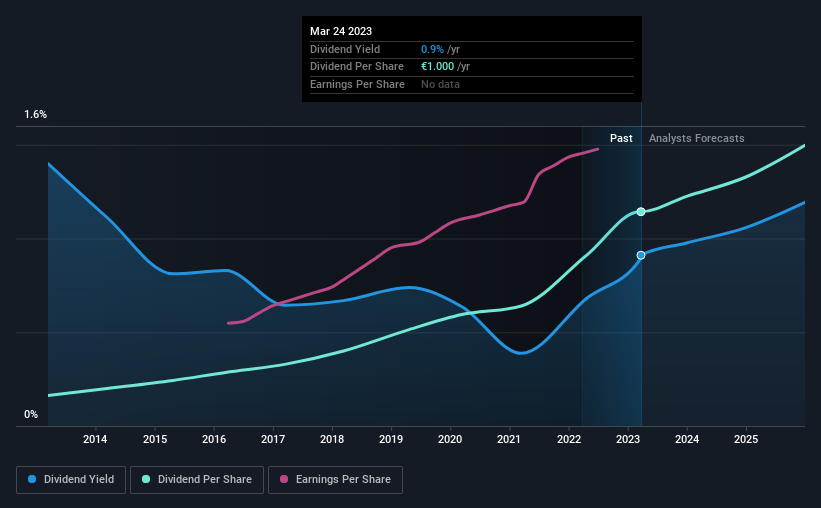

Reply S.p.A. (BIT:REY) will increase its dividend from last year's comparable payment on the 24th of May to €1.00. This takes the annual payment to 0.9% of the current stock price, which is about average for the industry.

View our latest analysis for Reply

Reply's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. However, prior to this announcement, Reply's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 5.5% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 22%, which is in the range that makes us comfortable with the sustainability of the dividend.

Reply Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2013, the dividend has gone from €0.143 total annually to €1.00. This works out to be a compound annual growth rate (CAGR) of approximately 22% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. We are encouraged to see that Reply has grown earnings per share at 20% per year over the past five years. Reply definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Reply Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 6 Reply analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

The Transition From Automaker To AI Behemoth Is Underway, But Priced In

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion