Assessing Reply (BIT:REY) Valuation After This Week’s Share Price Uptick

Reviewed by Kshitija Bhandaru

See our latest analysis for Reply.

Reply’s share price has seen a modest rise lately, but momentum is still struggling to gain traction this year. Despite occasional bright spots, its 1-year total shareholder return is slightly negative, while the long-term picture shows more robust gains. This suggests that investors are weighing short-term volatility against the company’s strong multi-year track record and growth prospects.

If you’re weighing what’s moving in tech and digital services, it is a good moment to expand your search and discover fast growing stocks with high insider ownership

With shares still trading well below analyst price targets and long-term returns healthy, the key question remains: Is Reply undervalued right now, or is the market already factoring in its future growth potential?

Price-to-Earnings of 19.6x: Is it justified?

Reply’s shares currently trade at a Price-to-Earnings (P/E) ratio of 19.6x, which is lower than the IT industry average of 21.5x and well below the peer group average of 30.5x. This valuation suggests that Reply may be attractively priced compared to similar companies.

The P/E ratio indicates what investors are willing to pay for each euro of earnings generated by the company. It serves as a quick way to compare valuation across companies within the same industry, helping investors determine if a stock is priced fairly in relation to its profitability.

Reply’s lower-than-average P/E, particularly in comparison to peers, suggests the market may not be fully recognizing its earnings power. According to regression-based analysis, the fair Price-to-Earnings ratio for Reply could be even higher, at 25.7x, which could indicate further potential if market sentiment changes.

In a broader context, Reply is valued below industry norms but is more aligned with the sector and still below analyst estimates, possibly allowing for re-rating if future growth or profitability surpasses expectations. The current multiple could approach the fair ratio if profitability trends remain favorable.

Explore the SWS fair ratio for Reply

Result: Price-to-Earnings of 19.6x (UNDERVALUED)

However, ongoing short-term volatility and lagging year-to-date returns could challenge the outlook if earnings or growth momentum weaken in the coming quarters.

Find out about the key risks to this Reply narrative.

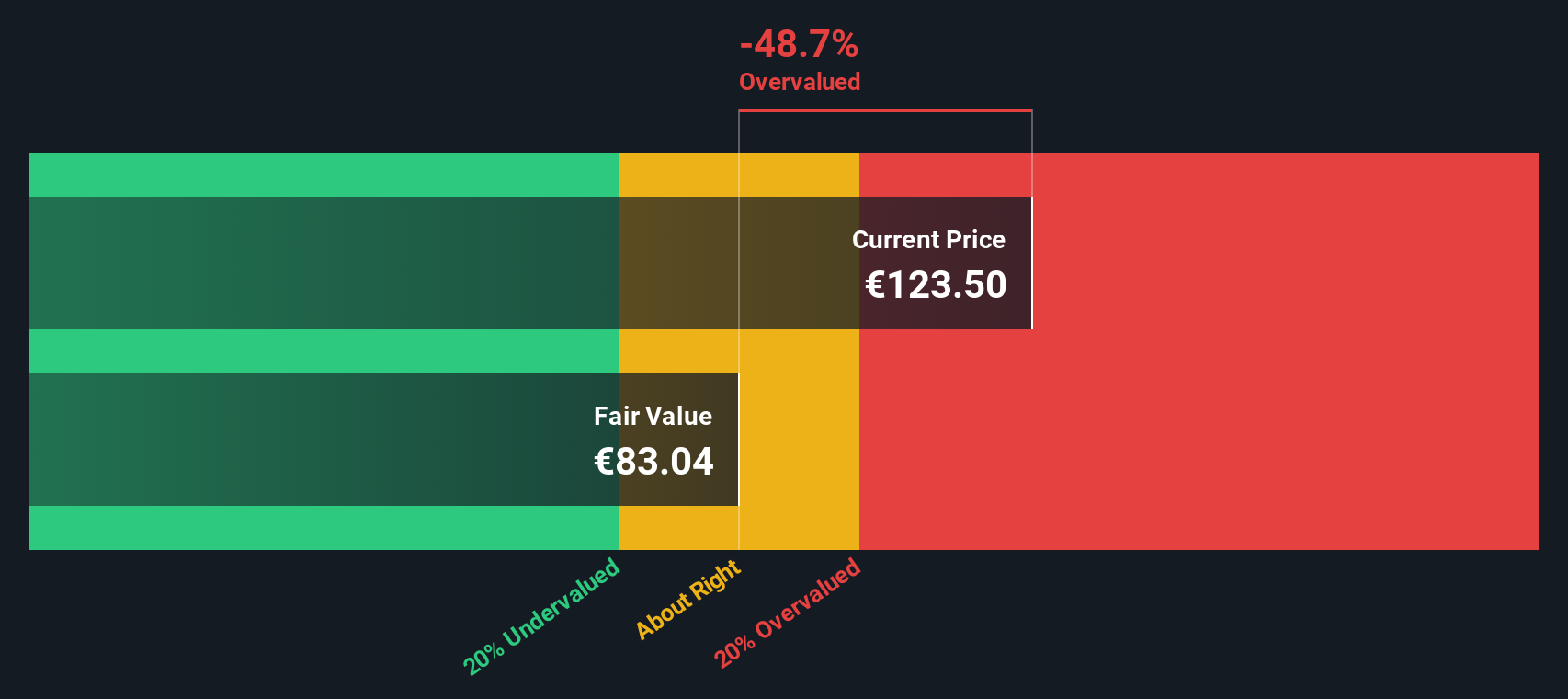

Another View: Discounted Cash Flow Suggests a Different Story

While the price-to-earnings ratio paints Reply as undervalued relative to peers, the Simply Wall St DCF model provides a contrasting perspective. According to our DCF analysis, Reply’s current price of €124 sits above our estimated fair value of €82.86. This suggests the stock may actually be overvalued on a cash flow basis.

Look into how the SWS DCF model arrives at its fair value.

Does this mean valuation optimism is misplaced, or is the market rightly pricing future growth? The answer may depend on which lens you trust more.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reply Narrative

If you want your own perspective or enjoy looking through the numbers yourself, it only takes a few minutes to build your personal view. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reply.

Looking for more investment ideas?

Give yourself an edge by tapping into timely stock ideas that fit your strategy. Don’t wait for the next big winner to pass you by.

- Amplify your returns with attractive yields when you track these 19 dividend stocks with yields > 3% offering solid payouts and reliable income.

- Capitalize on AI’s explosive growth by scanning these 24 AI penny stocks positioned for breakthroughs in machine learning, automation, and next-generation software.

- Go straight to unique, resilient opportunities by reviewing these 26 quantum computing stocks set to benefit from cutting-edge advancements in quantum technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives