- Italy

- /

- Semiconductors

- /

- BIT:OSA

OSAI Automation System (BIT:OSA) shareholders are up 12% this past week, but still in the red over the last year

While it may not be enough for some shareholders, we think it is good to see the OSAI Automation System S.p.A. (BIT:OSA) share price up 13% in a single quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 27% in the last year, significantly under-performing the market.

The recent uptick of 12% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

Check out our latest analysis for OSAI Automation System

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

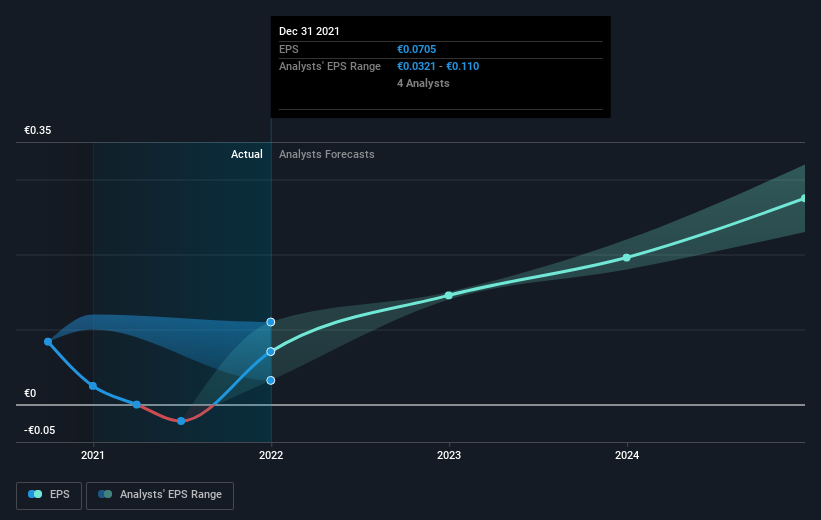

During the last year OSAI Automation System grew its earnings per share, moving from a loss to a profit.

The company was close to break-even last year, so earnings per share of €0.057 strike us as less than amazing. And judging by the share price, the market is not too happy about it, either. Given the improvement, though, contrarian investors might want to take a closer look.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on OSAI Automation System's earnings, revenue and cash flow.

A Different Perspective

OSAI Automation System shareholders are down 27% for the year, even worse than the market loss of 10%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand OSAI Automation System better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with OSAI Automation System (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OSA

OSAI Automation System

Engages in the automation, electronics and applied laser, semiconductor, and service businesses in Italy, Asia, Africa, the Americas, and rest of Europe.

Undervalued with high growth potential.

Market Insights

Community Narratives