- Italy

- /

- Semiconductors

- /

- BIT:OSA

A Piece Of The Puzzle Missing From OSAI Automation System S.p.A.'s (BIT:OSA) 25% Share Price Climb

Those holding OSAI Automation System S.p.A. (BIT:OSA) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

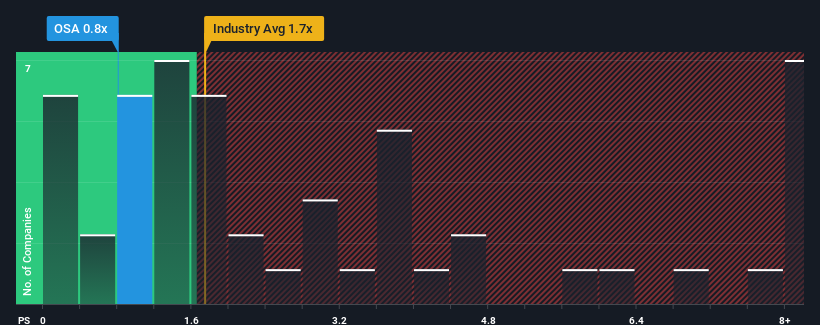

In spite of the firm bounce in price, OSAI Automation System's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Semiconductor industry in Italy, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for OSAI Automation System

How OSAI Automation System Has Been Performing

With revenue growth that's inferior to most other companies of late, OSAI Automation System has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think OSAI Automation System's future stacks up against the industry? In that case, our free report is a great place to start.How Is OSAI Automation System's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like OSAI Automation System's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.5% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the four analysts watching the company. With the industry only predicted to deliver 11% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that OSAI Automation System's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

OSAI Automation System's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at OSAI Automation System's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You need to take note of risks, for example - OSAI Automation System has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of OSAI Automation System's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OSA

OSAI Automation System

Engages in the automation, electronics and applied laser, semiconductor, and service businesses in Italy, Asia, Africa, the Americas, and rest of Europe.

Slightly overvalued with very low risk.

Market Insights

Community Narratives