- Italy

- /

- Real Estate

- /

- BIT:BRI

Health Check: How Prudently Does Brioschi Sviluppo Immobiliare (BIT:BRI) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Brioschi Sviluppo Immobiliare S.p.A. (BIT:BRI) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Brioschi Sviluppo Immobiliare

What Is Brioschi Sviluppo Immobiliare's Debt?

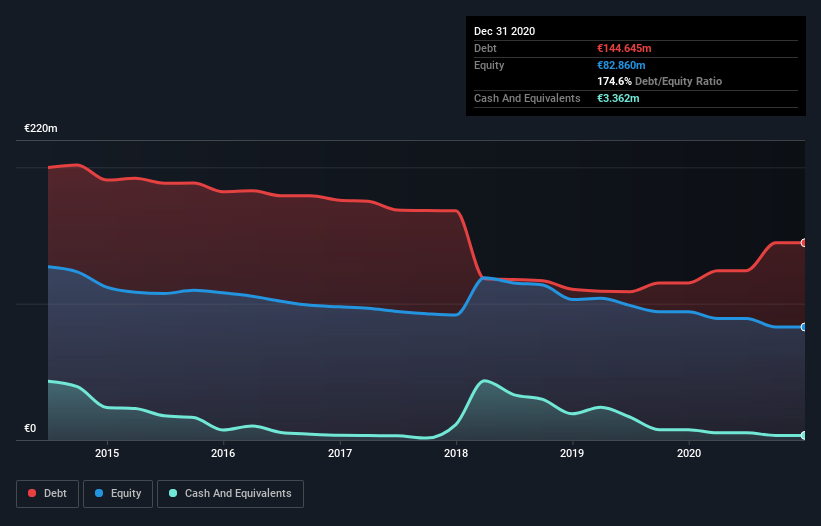

As you can see below, at the end of December 2020, Brioschi Sviluppo Immobiliare had €144.6m of debt, up from €115.1m a year ago. Click the image for more detail. However, it does have €3.36m in cash offsetting this, leading to net debt of about €141.3m.

How Healthy Is Brioschi Sviluppo Immobiliare's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Brioschi Sviluppo Immobiliare had liabilities of €71.5m due within 12 months and liabilities of €164.9m due beyond that. On the other hand, it had cash of €3.36m and €18.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €214.8m.

This deficit casts a shadow over the €67.0m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Brioschi Sviluppo Immobiliare would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is Brioschi Sviluppo Immobiliare's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Brioschi Sviluppo Immobiliare made a loss at the EBIT level, and saw its revenue drop to €14m, which is a fall of 22%. That makes us nervous, to say the least.

Caveat Emptor

Not only did Brioschi Sviluppo Immobiliare's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping €7.5m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it vaporized €33m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Brioschi Sviluppo Immobiliare (at least 2 which are significant) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Brioschi Sviluppo Immobiliare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brioschi Sviluppo Immobiliare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:BRI

Brioschi Sviluppo Immobiliare

Engages in the design and construction of real estate projects in Italy.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026