Why Shedir Pharma Group's (BIT:SHE) Earnings Are Better Than They Seem

Shedir Pharma Group S.p.A.'s (BIT:SHE) solid earnings announcement recently didn't do much to the stock price. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

See our latest analysis for Shedir Pharma Group

Zooming In On Shedir Pharma Group's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

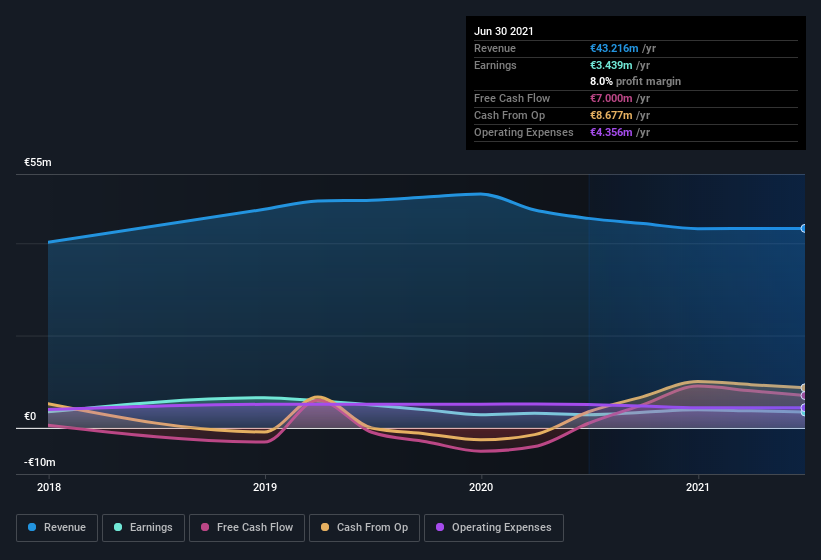

For the year to June 2021, Shedir Pharma Group had an accrual ratio of -0.17. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of €7.0m, well over the €3.44m it reported in profit. Shedir Pharma Group's free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Shedir Pharma Group's Profit Performance

Happily for shareholders, Shedir Pharma Group produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Shedir Pharma Group's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Shedir Pharma Group has 3 warning signs (1 makes us a bit uncomfortable!) that deserve your attention before going any further with your analysis.

Today we've zoomed in on a single data point to better understand the nature of Shedir Pharma Group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:SHE

Shedir Pharma Group

Through its subsidiaries, engages in the research, formulation, development, and marketing of nutraceuticals, dermocosmetics, medical devices, and pharmaceutical products in Italy.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives