- Japan

- /

- Auto Components

- /

- TSE:7259

Three Compelling Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and geopolitical uncertainties, investors are seeking stability amid volatility. In this environment, dividend stocks can offer a compelling opportunity for those looking to balance income with potential growth, as they often provide regular payouts that can help cushion against market swings.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

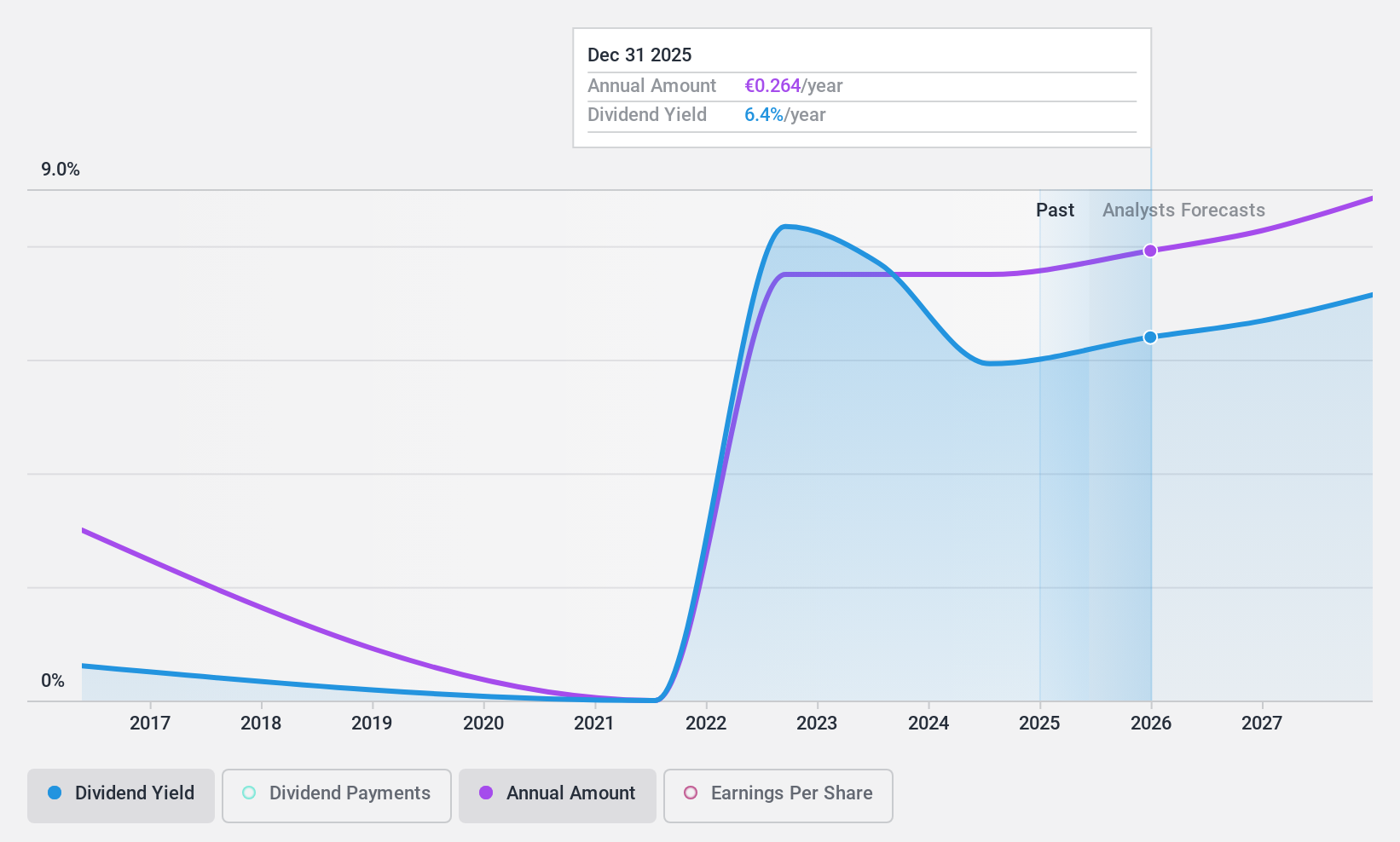

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFE-Mediaforeurope N.V. operates in the television industry in Italy and Spain, with a market cap of €2.02 billion.

Operations: MFE-Mediaforeurope N.V. generates revenue through its television operations in both Italy and Spain.

Dividend Yield: 5.8%

MFE-Mediaforeurope offers a compelling dividend yield of 5.84%, ranking in the top 25% among Italian dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 61.8% and 41.9%, respectively, despite a historically unstable track record over the past decade. Recent earnings growth supports sustainability, with sales reaching €2 billion for the first nine months of 2024 and net income rising to €96.2 million from €71 million year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of MFE-Mediaforeurope.

- The analysis detailed in our MFE-Mediaforeurope valuation report hints at an deflated share price compared to its estimated value.

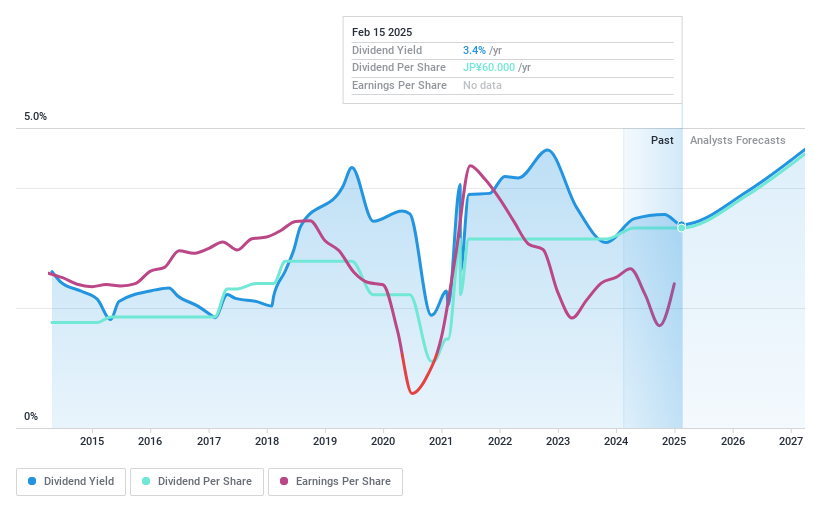

Aisin (TSE:7259)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aisin Corporation manufactures and sells automotive parts, as well as energy and lifestyle-related products, with a market cap of ¥1.34 trillion.

Operations: Aisin Corporation's revenue segments are comprised of ¥3.09 trillion from Japan, ¥1.06 trillion from North America, ¥590.47 million from China, ¥514.99 million from ASEAN India, and ¥310.67 million from Europe.

Dividend Yield: 3.4%

Aisin's dividend payments are well-covered by earnings and cash flows, with payout ratios of 72.3% and 56.8%, respectively, though the dividend history has shown volatility over the past decade. Despite this instability, dividends have grown in the last ten years. The recent completion of a significant share buyback program worth ¥83.91 billion could enhance shareholder value but doesn't directly impact dividend stability or yield competitiveness in Japan's market.

- Get an in-depth perspective on Aisin's performance by reading our dividend report here.

- Our valuation report here indicates Aisin may be overvalued.

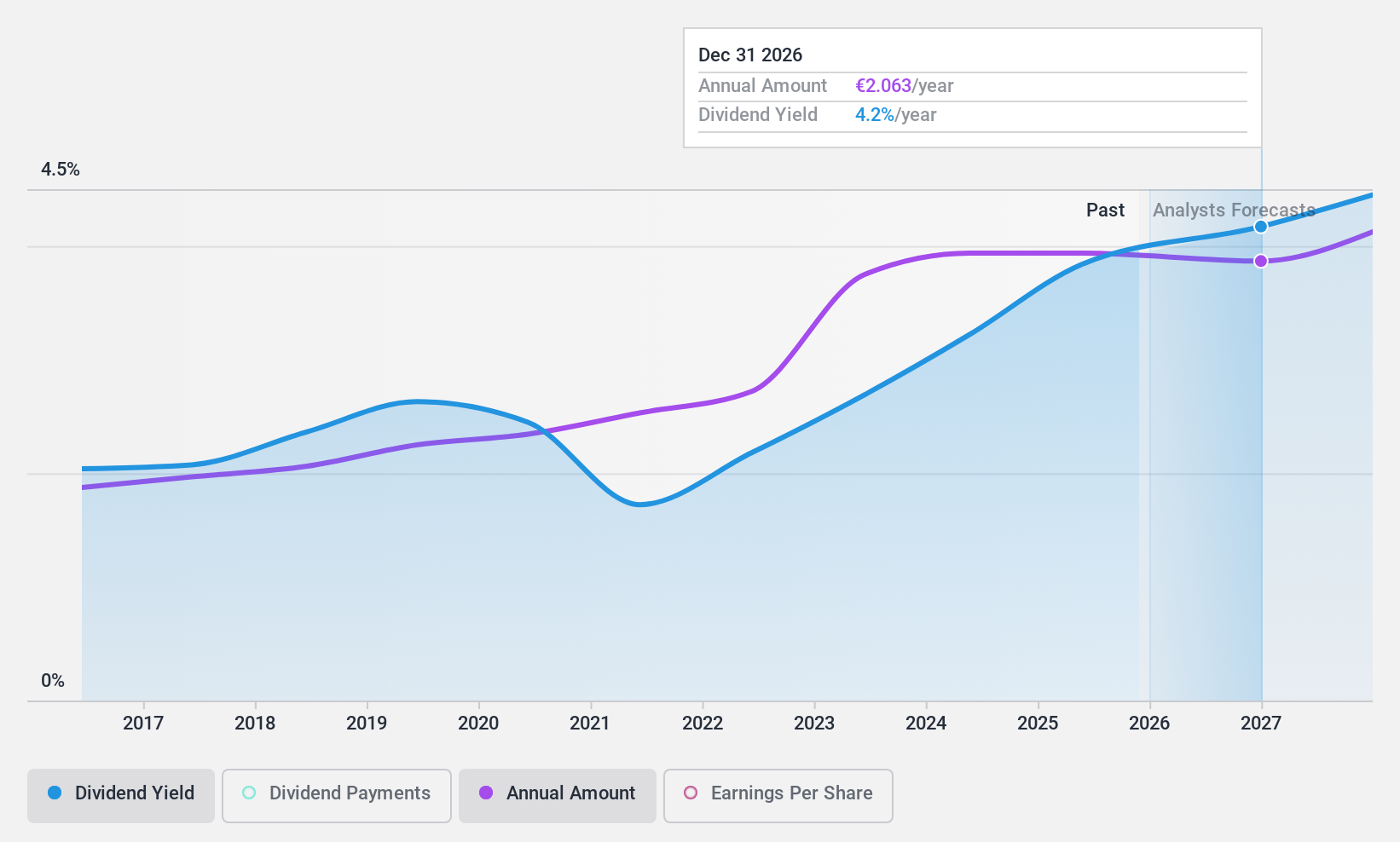

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is a global distributor of industrial and specialty chemicals and ingredients, operating across Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €8.78 billion.

Operations: Brenntag SE's revenue segments include Brenntag Essentials in Latin America (€665.50 million), North America (€4.28 billion), Asia Pacific (€745.20 million), and Europe, Middle East & Africa (€3.35 billion).

Dividend Yield: 3.5%

Brenntag's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 56.1% and 45.1%, respectively, ensuring sustainability. The company has maintained stable dividends over the past decade, though its yield of 3.46% is below the top tier in Germany. Despite recent declines in net income, Brenntag's strategic expansion in APAC through partnerships like Aquaporin could bolster future growth prospects without compromising dividend reliability.

- Navigate through the intricacies of Brenntag with our comprehensive dividend report here.

- Our expertly prepared valuation report Brenntag implies its share price may be lower than expected.

Turning Ideas Into Actions

- Access the full spectrum of 1952 Top Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7259

Aisin

Manufactures and sells automotive parts, and energy and lifestyle related products.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives