- Italy

- /

- Industrials

- /

- BIT:ITM

3 European Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently climbed 1.40%, buoyed by optimism around potential lower U.S. borrowing costs, European markets have shown resilience amidst global economic fluctuations. In this environment, dividend stocks can offer a compelling investment opportunity, providing investors with steady income streams while potentially benefiting from market gains.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.86% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.21% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.91% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.97% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.54% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.73% | ★★★★★☆ |

Click here to see the full list of 218 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

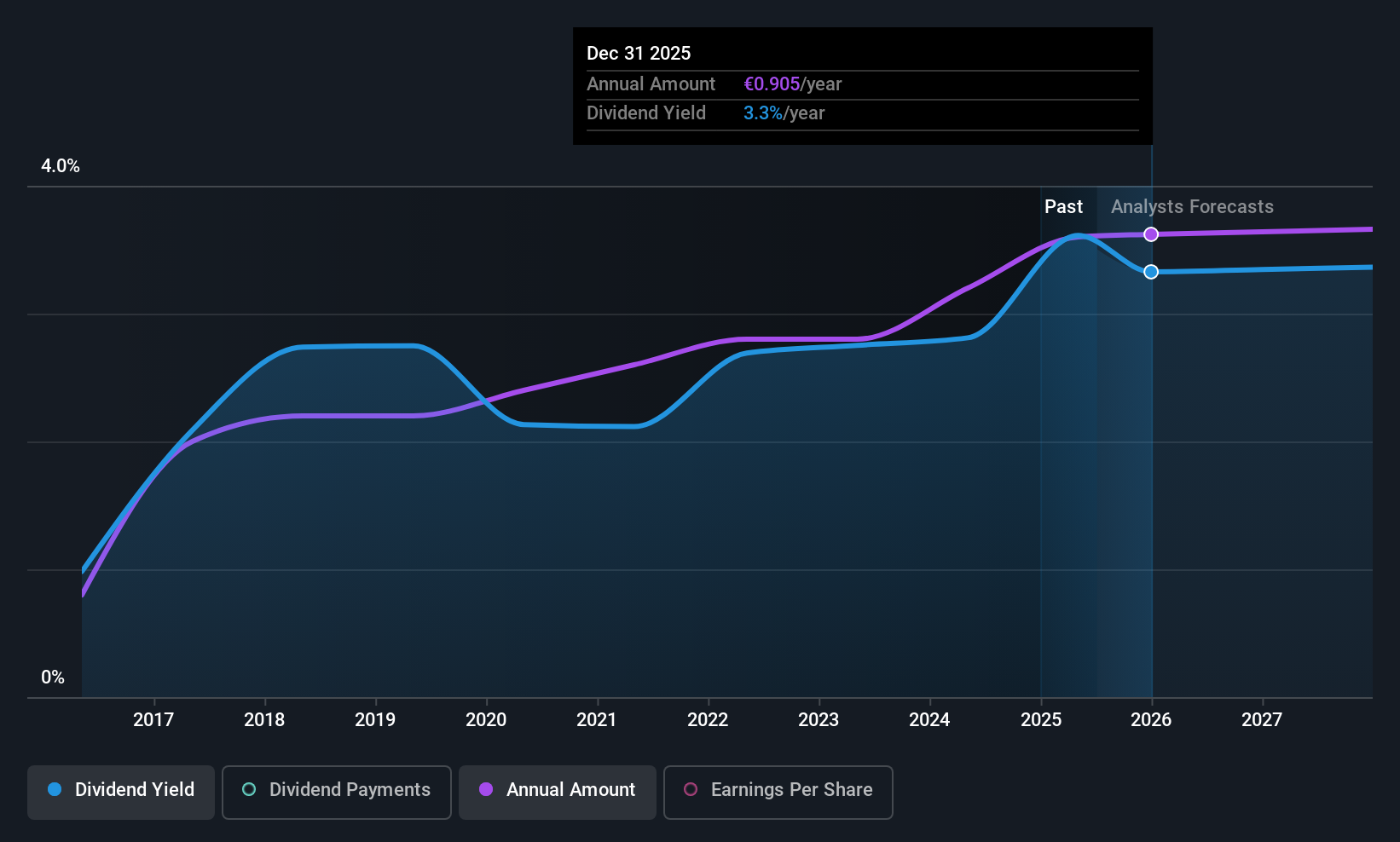

Italmobiliare (BIT:ITM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Italmobiliare S.p.A. is an investment holding company that manages a diverse portfolio of equity and investments across financial and industrial sectors both in Italy and internationally, with a market cap of €1.20 billion.

Operations: Italmobiliare S.p.A. generates revenue through its diverse investments in the financial and industrial sectors across both domestic and international markets.

Dividend Yield: 3.2%

Italmobiliare's dividend payments have demonstrated stability and growth over the past decade, yet recent financial performance raises concerns. The company reported a net loss for the first half of 2025, impacting its ability to cover dividends with earnings or cash flows. Despite a low payout ratio of 40.6%, dividends aren't well covered by free cash flows. Additionally, Italmobiliare's dividend yield is lower than top-tier Italian payers, and ongoing share repurchase programs aim to bolster financial flexibility.

- Unlock comprehensive insights into our analysis of Italmobiliare stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Italmobiliare is priced higher than what may be justified by its financials.

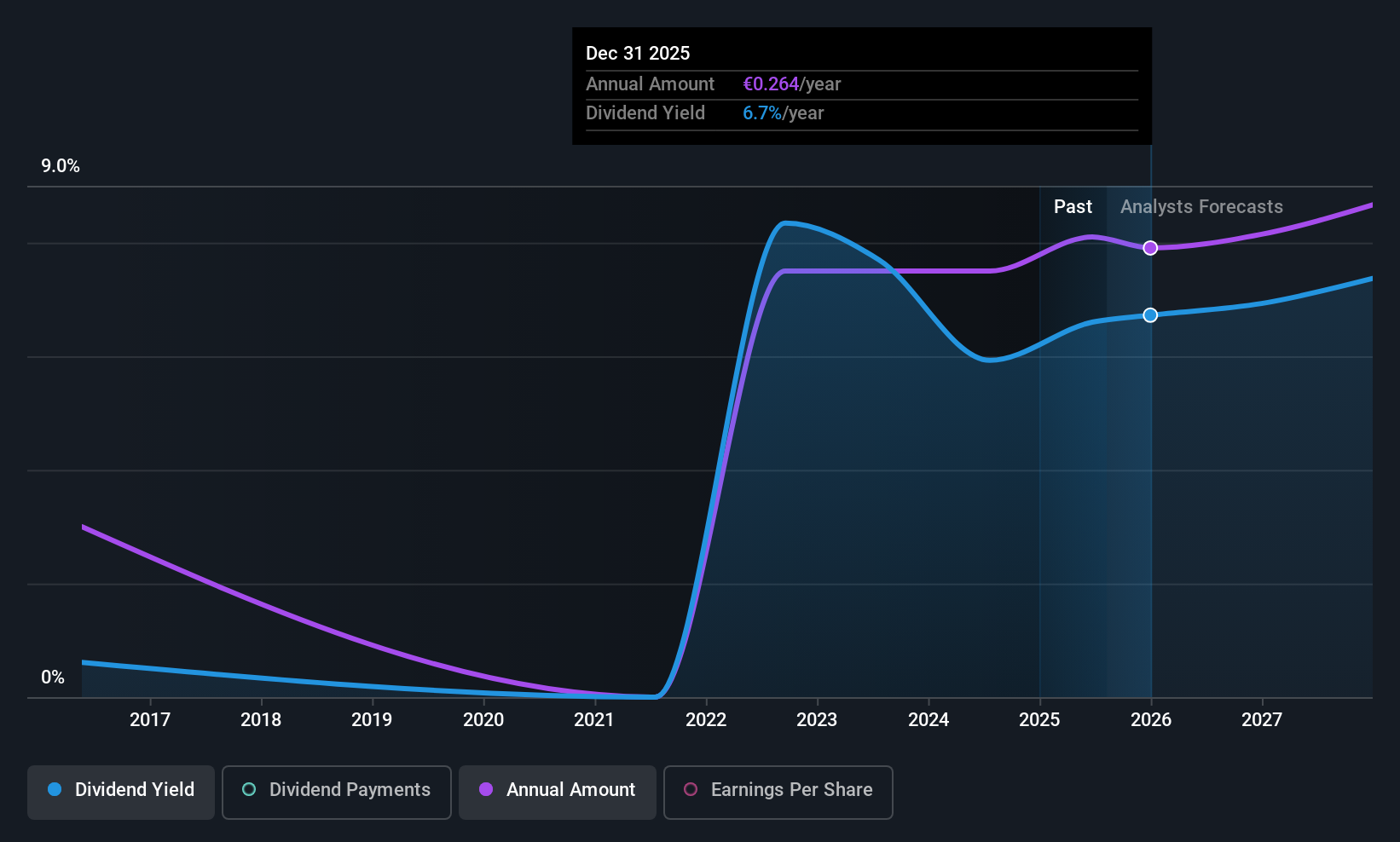

MFE-Mediaforeurope (BIT:MFEB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MFE-Mediaforeurope N.V. operates in the television industry across Italy and Spain, with a market cap of €2.05 billion.

Operations: MFE-Mediaforeurope N.V. generates its revenue from television operations in Italy and Spain.

Dividend Yield: 6.1%

MFE-Mediaforeurope's dividend yield of 6.05% ranks in the top 25% of Italian payers, but its dividends have been volatile over the past decade. Despite a low cash payout ratio of 38.5%, dividends are not covered by earnings due to a high payout ratio of 109.9%. Recent dividend increases to €0.27 per share highlight efforts to maintain investor appeal, though sustainability concerns persist given coverage issues and historical unreliability in payments.

- Dive into the specifics of MFE-Mediaforeurope here with our thorough dividend report.

- The valuation report we've compiled suggests that MFE-Mediaforeurope's current price could be quite moderate.

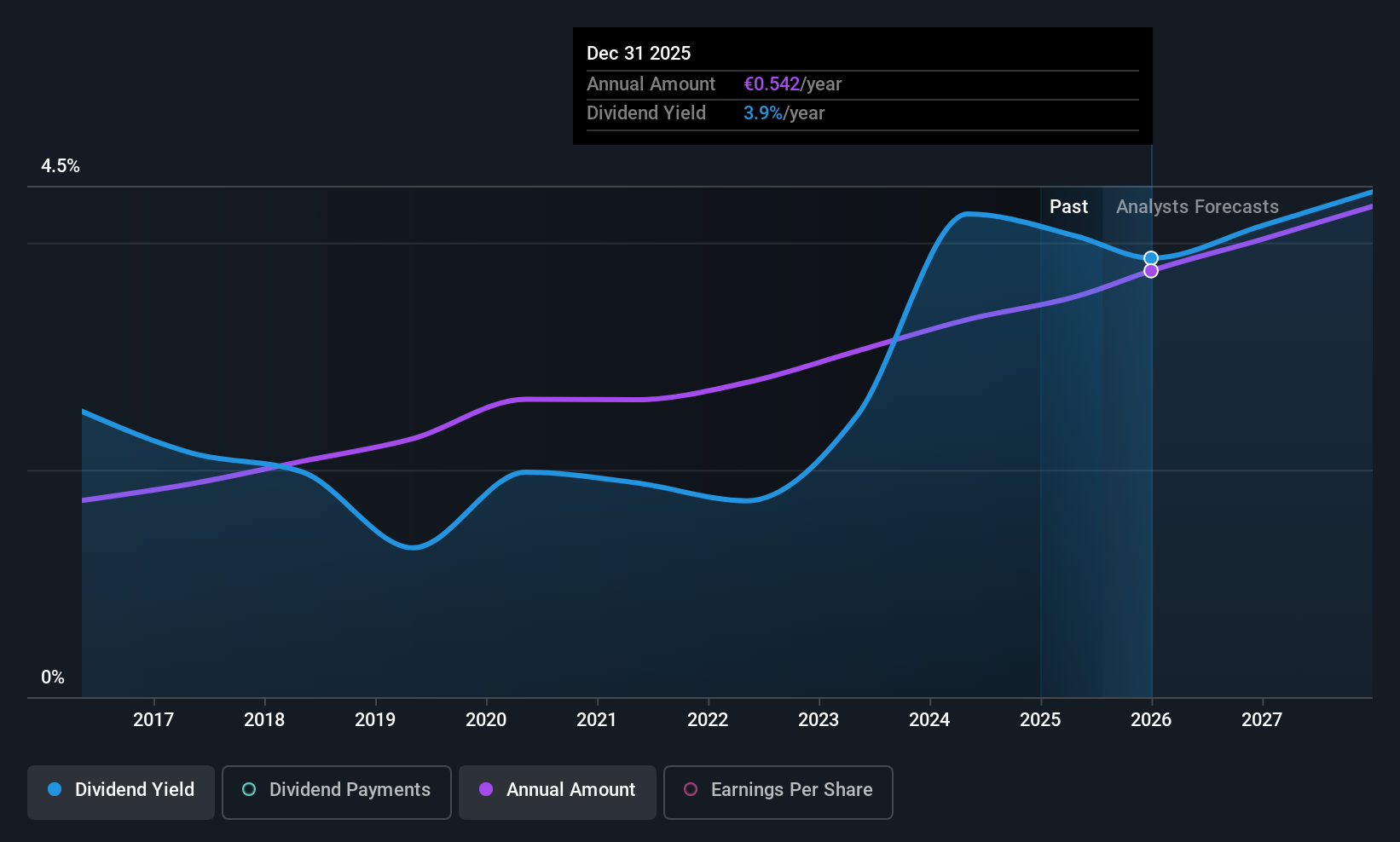

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, with a market cap of €1.20 billion, develops visualization solutions and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Operations: Barco NV's revenue segments include €248.38 million from Enterprise, €279.87 million from Healthcare, and €438.23 million from Entertainment.

Dividend Yield: 3.6%

Barco pays a stable dividend with a yield of 3.58%, supported by earnings and cash flows, evidenced by payout ratios of 57.4% and 39.6% respectively. Despite not being among the highest in Belgium, its dividends have grown over the past decade without volatility. Recent financials show improved performance, with net income rising to €23.34 million for H1 2025 from €9.04 million previously, bolstered by strategic partnerships like those expanding HDR technology across Europe and India.

- Click here to discover the nuances of Barco with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Barco's share price might be too optimistic.

Summing It All Up

- Take a closer look at our Top European Dividend Stocks list of 218 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ITM

Italmobiliare

An investment holding company, owns and manages a portfolio of equity and other investments in the financial and industrial sectors in Italy and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)