- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6449

Discover 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and policy shifts, small-cap stocks have recently underperformed their larger counterparts, with the Russell 2000 Index trailing behind the S&P 500. In this environment, investors might find opportunities in undiscovered gems—stocks that exhibit strong fundamentals and growth potential despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Caltagirone (BIT:CALT)

Simply Wall St Value Rating: ★★★★★★

Overview: Caltagirone SpA operates through its subsidiaries in cement manufacturing, media, real estate, and publishing sectors, with a market capitalization of approximately €886.49 million.

Operations: The company's primary revenue stream is from Cement, Concrete, and Aggregates, generating €1.64 billion. Other significant contributions come from Other Assets at €244.51 million and Constructions at €186.77 million. The net profit margin shows notable fluctuations across reporting periods without a consistent trend observed over five consecutive periods.

Caltagirone, a small company in the Basic Materials sector, shows promising financial health with its debt to equity ratio dropping from 35.8% to 9.9% over five years. The company's earnings growth of 10.5% last year outpaced the industry average of -11.5%, indicating robust performance amidst broader challenges. Trading at a significant discount of 88.9% below estimated fair value, it appears undervalued relative to potential worth. With high-quality earnings and more cash than total debt, Caltagirone seems well-positioned financially, suggesting that it could be an attractive prospect for those seeking hidden opportunities in the market.

- Dive into the specifics of Caltagirone here with our thorough health report.

Gain insights into Caltagirone's past trends and performance with our Past report.

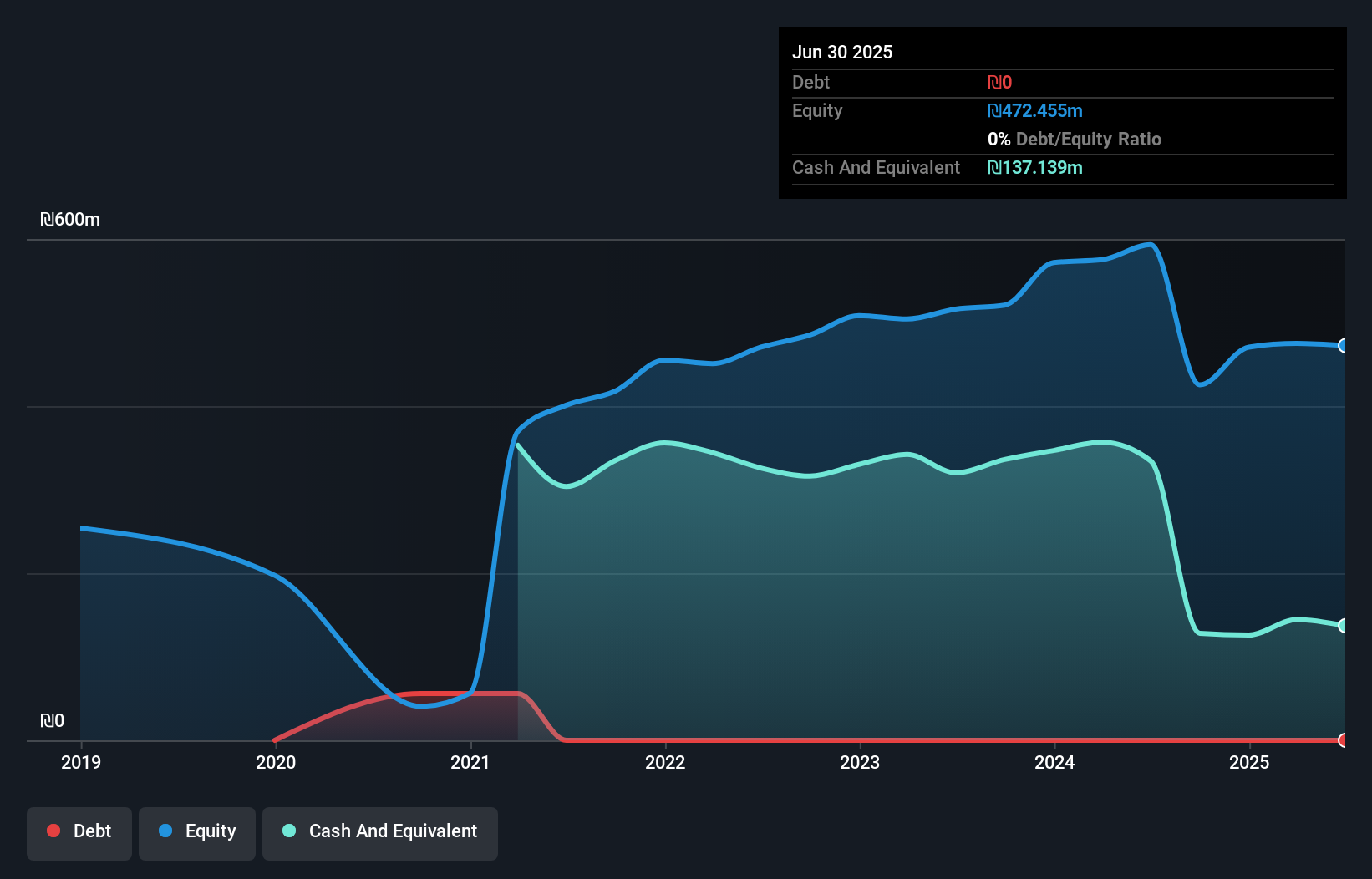

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. is engaged in the design, development, marketing, and sale of various clothing products within Israel and has a market capitalization of approximately ₪1.94 billion.

Operations: Delta Israel Brands generates revenue primarily from its Owned Brands segment, contributing approximately ₪1.08 billion, and its Franchise Brands segment, which adds about ₪108.47 million.

Delta Israel Brands, a nimble player in the specialty retail sector, has shown impressive financial health with no debt and high-quality earnings. Over the past year, its earnings surged by 36.8%, outpacing industry averages. Trading at 13% below estimated fair value suggests potential for investors seeking undervalued opportunities. Recent results highlight a robust sales increase to ILS 1.19 billion from ILS 945 million last year, while net income rose to ILS 158 million from ILS 116 million. With basic earnings per share climbing to ILS 6.35 from ILS 4.64, Delta's solid footing is evident as it navigates future growth prospects confidently.

- Delve into the full analysis health report here for a deeper understanding of Delta Israel Brands.

Examine Delta Israel Brands' past performance report to understand how it has performed in the past.

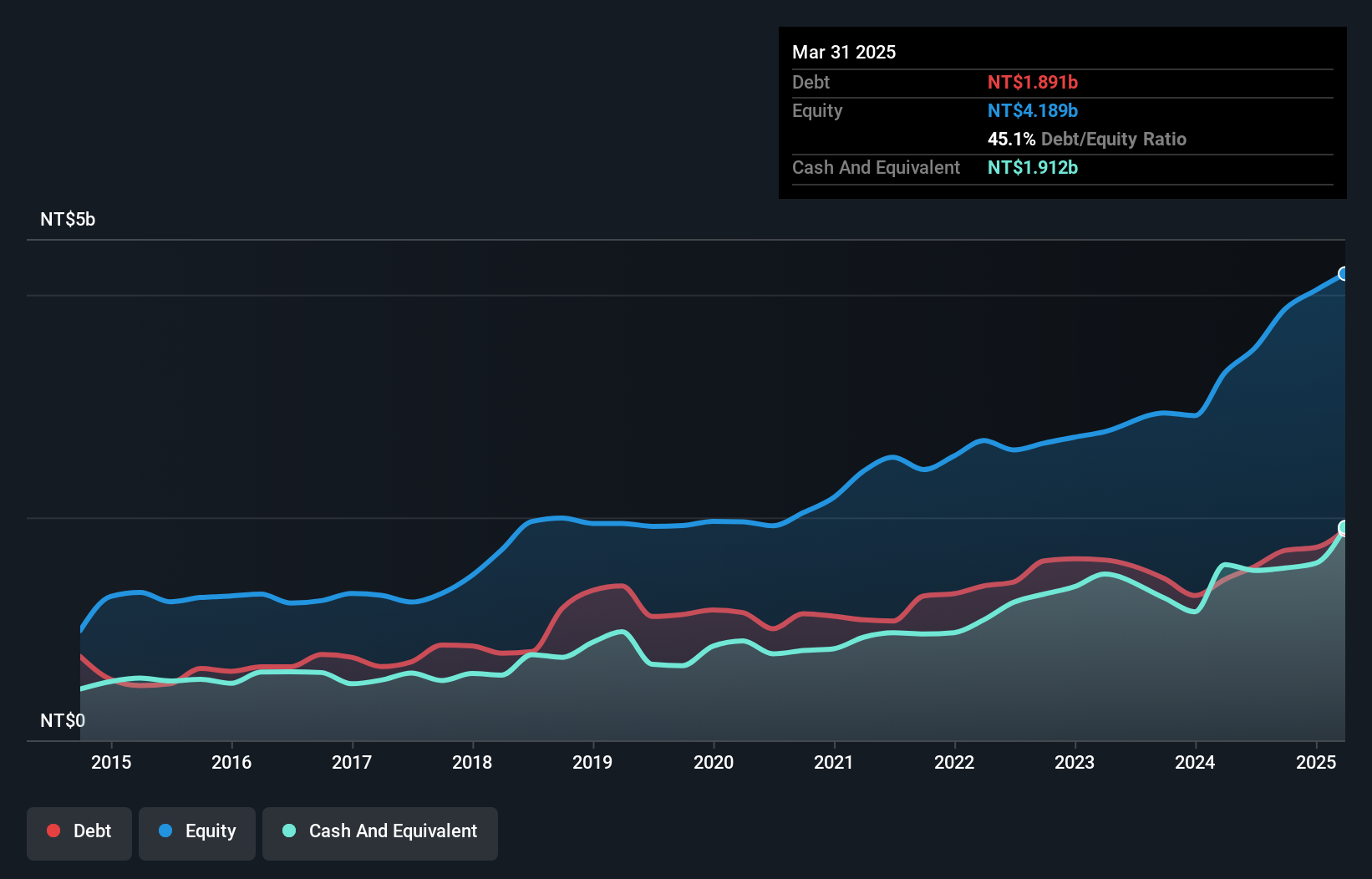

Apaq Technology (TWSE:6449)

Simply Wall St Value Rating: ★★★★★★

Overview: Apaq Technology Co., Ltd. is engaged in the research, development, manufacturing, and sale of electronic components in China and Taiwan with a market capitalization of NT$11.70 billion.

Operations: Apaq Technology generates revenue primarily from the sale of electronic components and parts, amounting to NT$3.28 billion. The company's market capitalization stands at NT$11.70 billion.

Apaq Technology stands out in the electronics sector with a notable earnings growth of 39.9% over the past year, significantly outpacing the industry average of 7.8%. The company boasts high-quality earnings and maintains a satisfactory net debt to equity ratio at 4.1%, reflecting strong financial health. Over five years, Apaq has effectively reduced its debt to equity from 58.6% to 44%, showing prudent management practices. Despite recent share price volatility, it remains profitable with positive free cash flow and no concerns regarding its ability to cover interest payments, suggesting robust operational efficiency and potential for sustained performance in the future.

- Unlock comprehensive insights into our analysis of Apaq Technology stock in this health report.

Understand Apaq Technology's track record by examining our Past report.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4708 more companies for you to explore.Click here to unveil our expertly curated list of 4711 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6449

Apaq Technology

Researches, develops, manufactures, and sells electronic components in China and Taiwan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives