Assessing Generali (BIT:G) Shares: Is the Current Valuation Justified After Recent Strong Gains?

Reviewed by Simply Wall St

Assicurazioni Generali (BIT:G) shares have recently caught the attention of investors, given the stock's steady upward trend over the past three months. However, questions remain around the sustainability of its current valuation and outlook.

See our latest analysis for Assicurazioni Generali.

Generali’s share price has gained notable ground since the start of the year, adding over 20% year-to-date, and that momentum is backed up by a robust 35% total shareholder return over the past twelve months. While the pace has cooled somewhat lately, the strong multi-year returns highlight investors’ confidence in the company’s long-term prospects, even as the latest price settles around €33.35.

If you’re looking for more ideas with similar momentum and reliable track records, now’s a great time to discover fast growing stocks with high insider ownership

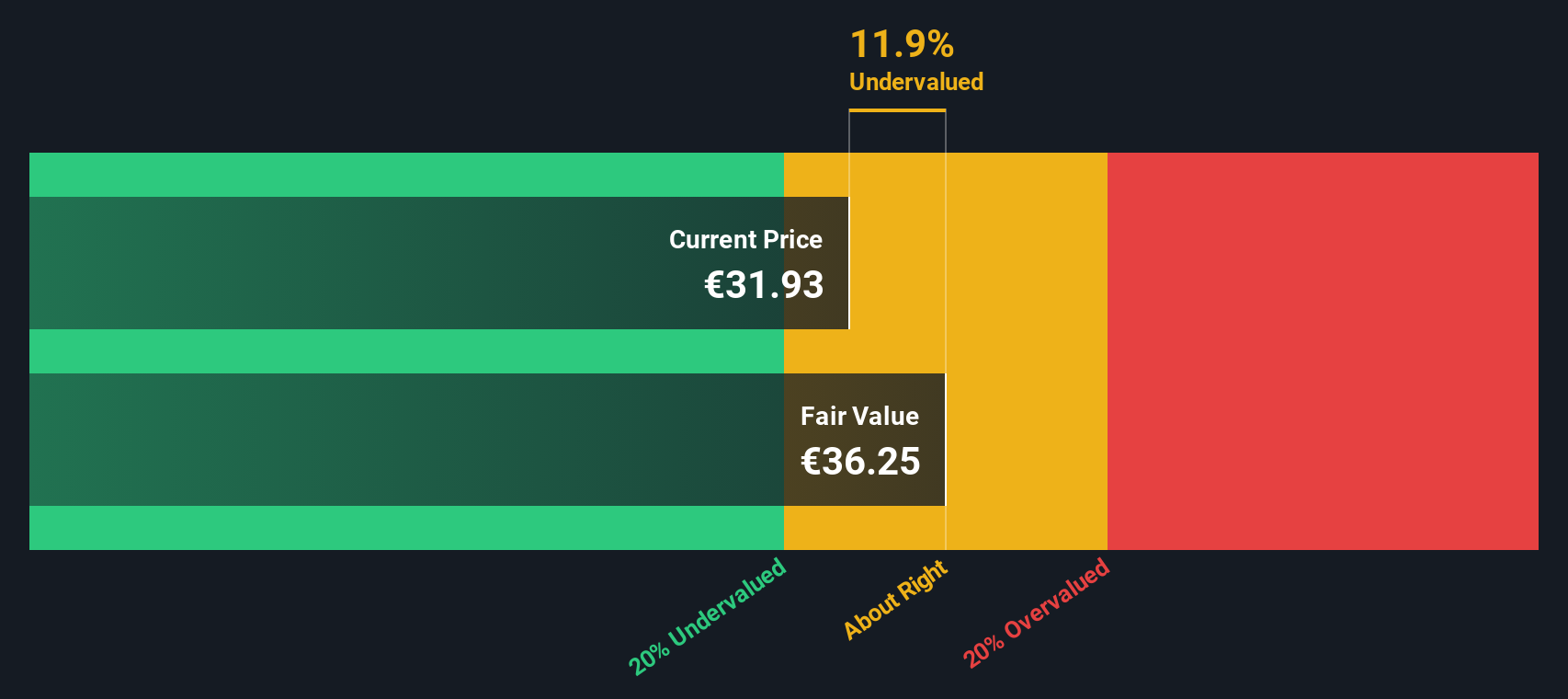

With shares up significantly and trading just above analyst price targets, the question now is whether Generali is still trading below its fair value or if the market has already priced in all expected future growth.

Most Popular Narrative: Fairly Valued

The most popular narrative sets a fair value nearly identical to Generali’s latest close, indicating that, in the eyes of analysts, the current price meaningfully reflects the company’s true worth. This equilibrium comes after a period of robust share price momentum and signals heightened scrutiny over whether future growth has already been captured.

Strategic investments in digitalization and artificial intelligence are enhancing distribution efficiency, pricing sophistication, and underwriting capabilities. These investments position Generali for future improvements in operational efficiency, lower expense ratios, and resilient net margins.

Want to know why analysts believe the market is spot on with Generali’s current price? The answer lies in a bold prediction about how future earnings will be driven by advanced tech and next-level operational transformation. There are quantitative assumptions in this story that might surprise you. See what sets this valuation apart.

Result: Fair Value of €33.16 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently low reinvestment yields and underperformance in key segments could challenge Generali’s earnings momentum if these issues are not effectively managed going forward.

Find out about the key risks to this Assicurazioni Generali narrative.

Another View: What Does the SWS DCF Model Say?

While analysts believe Generali is trading close to its fair value based on future earnings forecasts, our DCF model presents a different perspective. It suggests the company could actually be undervalued by around 8.8% today. Does this present an opportunity, or is the discount accounted for by lingering risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Assicurazioni Generali for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Assicurazioni Generali Narrative

If you see things differently or want to chart your own path through the data, you can piece together your own view in just a few minutes: Do it your way

A great starting point for your Assicurazioni Generali research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors seek out every edge. Don’t hold back when there are standout opportunities just a click away. Expand your strategy and see what you’ve been missing.

- Tap into potential market leaders by checking out these 831 undervalued stocks based on cash flows that could offer meaningful upside based on solid fundamentals.

- Catch the next tech trend and grow your knowledge by exploring these 26 AI penny stocks focused on artificial intelligence breakthroughs and innovation.

- Boost your search for stable income streams by scanning these 22 dividend stocks with yields > 3% with high yields and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:G

Assicurazioni Generali

Provides various insurance solutions under the Generali brand in the Americas, Italy, rest of Europe, Africa, the Middle East, Asia, and the Oceania.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives