- Sweden

- /

- Diversified Financial

- /

- OM:ORES

Exploring Pharmanutra And Two Other European Small Caps with Strong Potential

Reviewed by Simply Wall St

As the European markets experience a modest uptick, with the STOXX Europe 600 Index rising by 1.32% amid easing trade tensions and potential economic stimuli, small-cap stocks are garnering increased attention from investors seeking opportunities in a dynamic environment. In this context, identifying promising small-cap companies like Pharmanutra involves assessing their growth potential and resilience in an economy where business sentiment remains cautious yet optimistic about future prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and other international markets with a market capitalization of €449.91 million.

Operations: Pharmanutra generates revenue primarily from the Italian market, contributing €70.24 million, followed by international sales amounting to €39.34 million and Akern at €5.92 million.

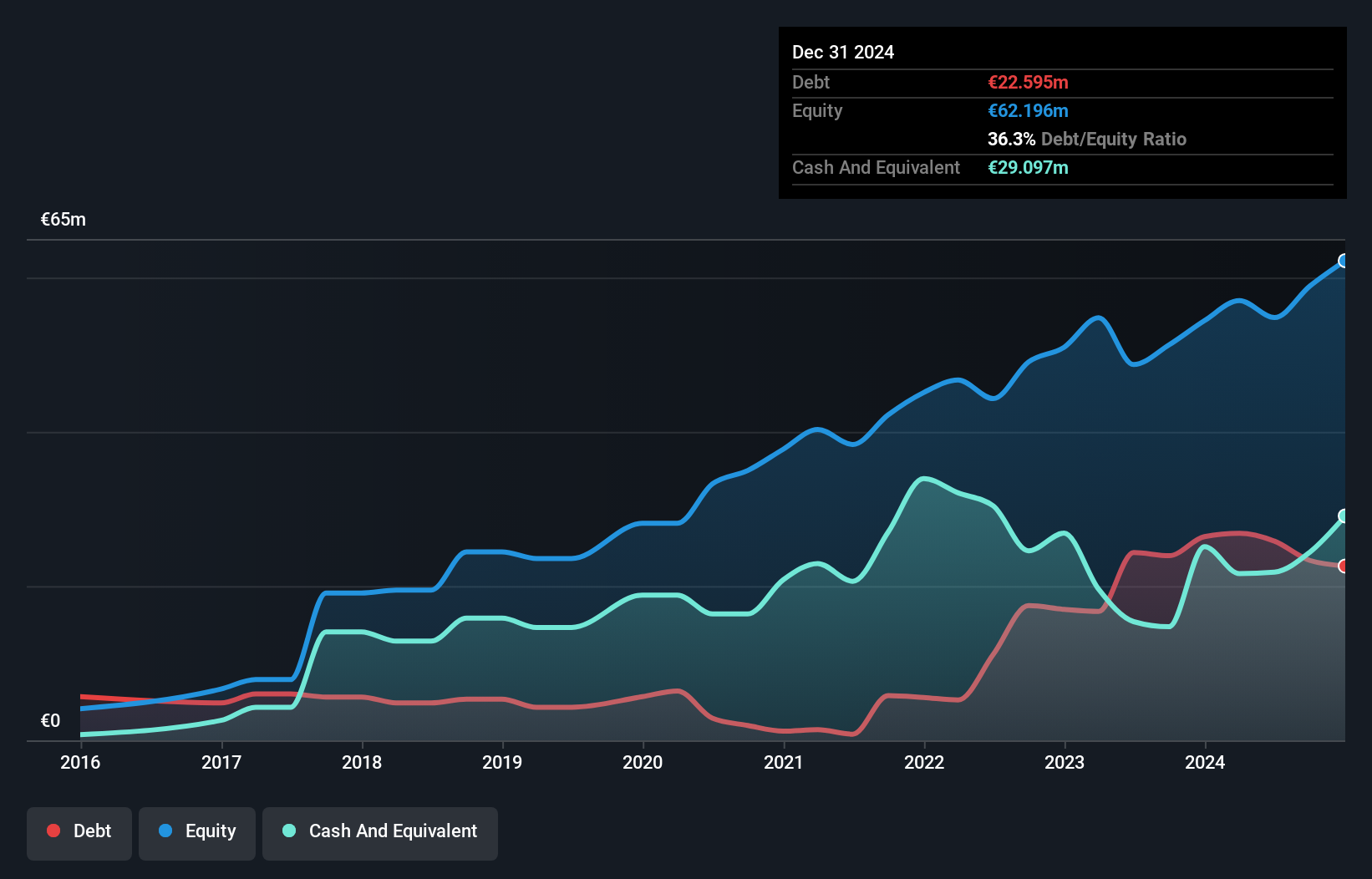

Pharmanutra, a small player in the European market, has shown impressive earnings growth of 29.4% over the past year, outpacing its industry peers. Despite a rise in its debt to equity ratio from 20.1% to 36.3% over five years, it maintains more cash than total debt, suggesting sound financial health. The firm's interest payments are comfortably covered by EBIT with a coverage ratio of 72x, indicating robust operational performance. With high-quality earnings and free cash flow positivity, Pharmanutra seems poised for continued growth at an expected rate of 15.72% annually in the personal products sector.

- Navigate through the intricacies of Pharmanutra with our comprehensive health report here.

Explore historical data to track Pharmanutra's performance over time in our Past section.

Premier Energy (BVB:PE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Premier Energy PLC is an integrated energy and power infrastructure company operating in Romania, Moldova, Hungary, and Serbia, with a market capitalization of RON2.53 billion.

Operations: Premier Energy PLC derives its revenue primarily from natural gas (€407.40 million), Moldova electricity (€434.26 million), and Romania renewable energy (€215.38 million).

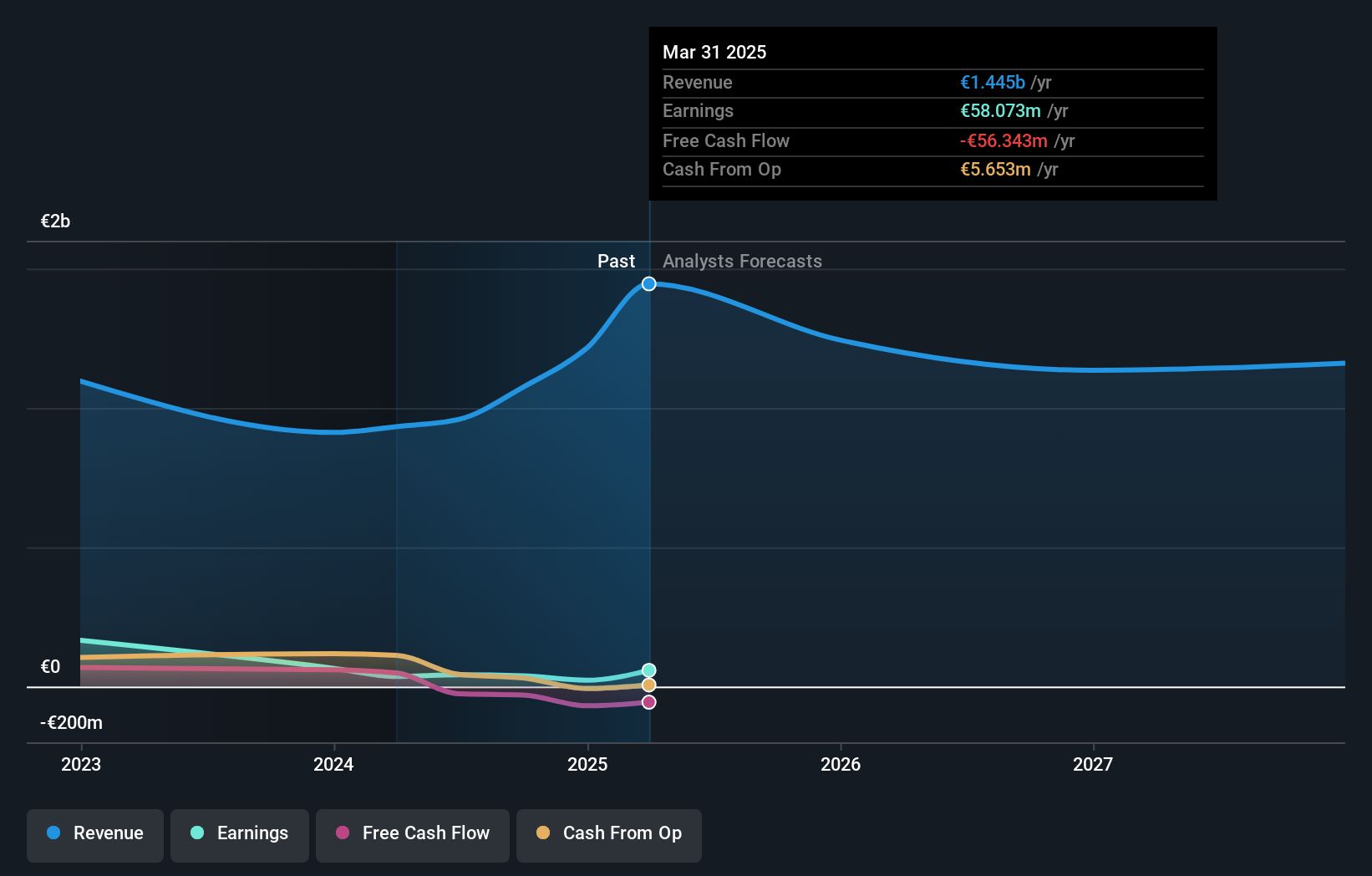

Premier Energy stands out with a notable earnings growth of 61% over the past year, far surpassing the Integrated Utilities industry's 14.2%. Despite this impressive performance, its earnings have faced a decline of 21.1% annually over the last five years. The company's net debt to equity ratio is at a satisfactory level of 30.9%, and interest payments are well covered by EBIT at 4.5 times coverage, indicating solid financial management. However, free cash flow remains negative, and recent results show significant one-off gains impacting financials with €20.3M influencing outcomes for March 2025-end period.

- Unlock comprehensive insights into our analysis of Premier Energy stock in this health report.

Review our historical performance report to gain insights into Premier Energy's's past performance.

Investment AB Öresund (OM:ORES)

Simply Wall St Value Rating: ★★★★★★

Overview: Investment AB Öresund (publ) is a Swedish investment company focused on asset management, with a market capitalization of SEK5.26 billion.

Operations: Öresund generates revenue primarily from its asset management activities, reporting SEK368.19 million in this segment.

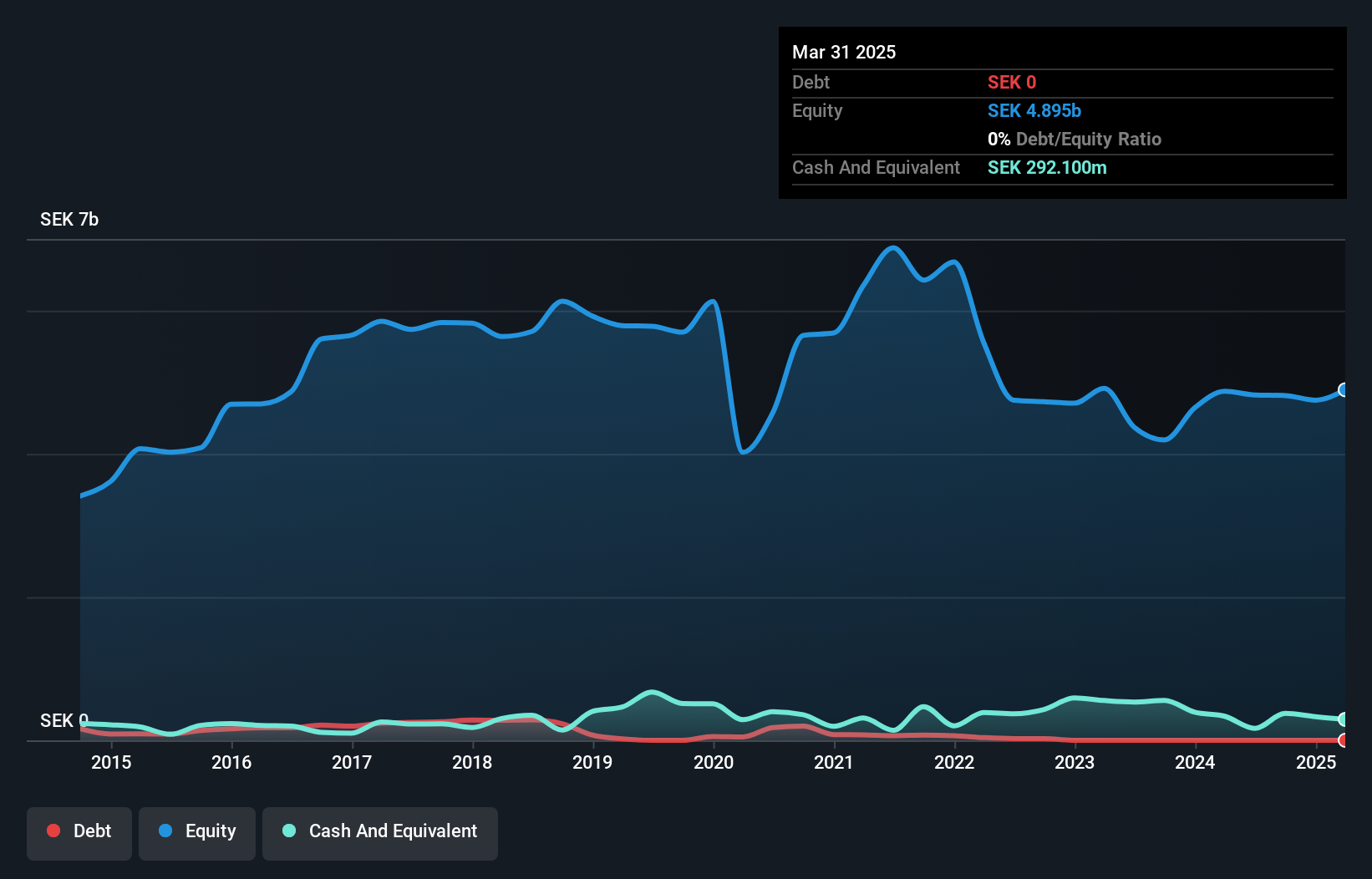

With a P/E ratio of 15.5x, Investment AB Öresund stands out against the Swedish market's 23.2x, suggesting potential undervaluation. The company boasts high-quality earnings and has impressively eliminated its debt over five years from a debt-to-equity ratio of 1.2%. Recent earnings growth at 26.6% outpaced the Diversified Financial industry, which saw a -40% shift, showcasing resilience and adaptability in challenging times. Despite first-quarter revenue dipping to SEK 150.7 million from SEK 224.5 million last year, its net income remained robust at SEK 144.6 million, underlining strong financial management amidst fluctuating market conditions.

- Get an in-depth perspective on Investment AB Öresund's performance by reading our health report here.

Evaluate Investment AB Öresund's historical performance by accessing our past performance report.

Next Steps

- Discover the full array of 326 European Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ORES

Investment AB Öresund

Operates as an investment company that engages in the asset management activities in Sweden.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives