- Italy

- /

- Personal Products

- /

- BIT:PHN

3 Insider-Owned Growth Stocks With 39% Earnings Expansion

Reviewed by Simply Wall St

In the face of recent market volatility and economic slowdown concerns, investors are increasingly seeking stability and growth potential in their portfolios. One key indicator of a promising stock is high insider ownership, which often signals confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

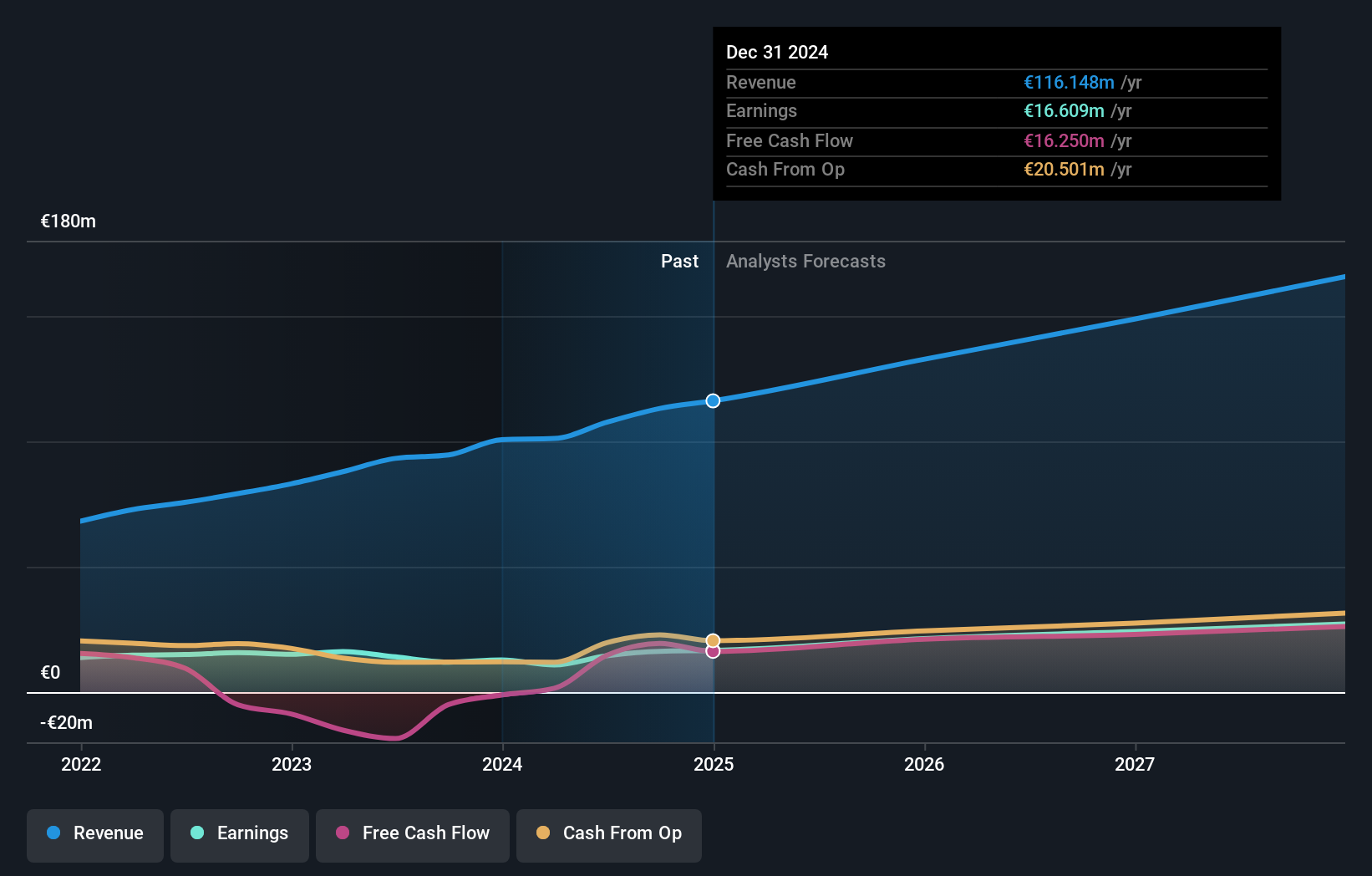

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharmanutra S.p.A., with a market cap of €573.05 million, is a pharmaceutical and nutraceutical company that researches, designs, develops, and markets nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally.

Operations: Pharmanutra generates revenue from three main segments: Direct Line (€63.08 million), Indirect Line (€32.30 million), and Medical Instruments (€4.94 million).

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.2% p.a.

Pharmanutra S.p.A. has demonstrated solid growth with half-year revenue reaching EUR 57 million, up from EUR 50.25 million last year, and net income improving to EUR 8.9 million from EUR 7.23 million. Insider ownership remains strong with substantial buying activity in the past three months. Despite a forecasted slower revenue growth of 13.8% annually, earnings are expected to grow significantly at 26.24% per year, outpacing the broader Italian market's growth rate of 6.9%.

- Get an in-depth perspective on Pharmanutra's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Pharmanutra's shares may be trading at a premium.

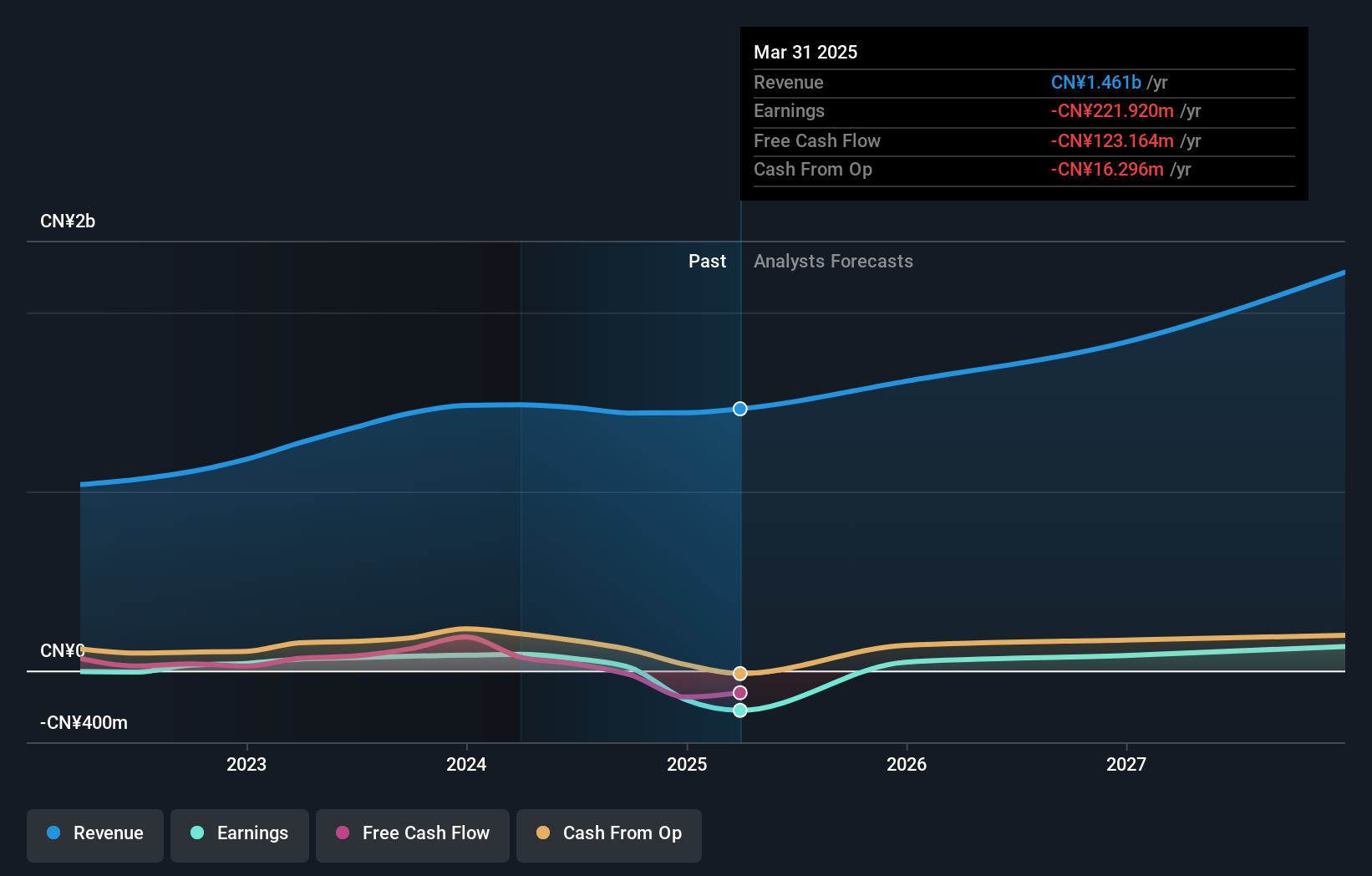

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products in China and internationally, with a market cap of CN¥7.69 billion.

Operations: Wondershare generates revenue from developing application software products both domestically and internationally.

Insider Ownership: 15.3%

Earnings Growth Forecast: 34.1% p.a.

Wondershare Technology Group has shown promising growth potential with forecasted annual earnings growth of 34.09%, outpacing the broader Chinese market's 23.2%. Recent product launches like PDFelement 11 and Repairit V6.0 highlight their commitment to innovation, particularly in AI and video repair technology. Insider ownership is significant, though recent earnings show a dip with net income at CNY 24.49 million compared to CNY 43.73 million last year, reflecting some volatility in performance despite strong long-term prospects.

- Click here to discover the nuances of Wondershare Technology Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Wondershare Technology Group's share price might be too optimistic.

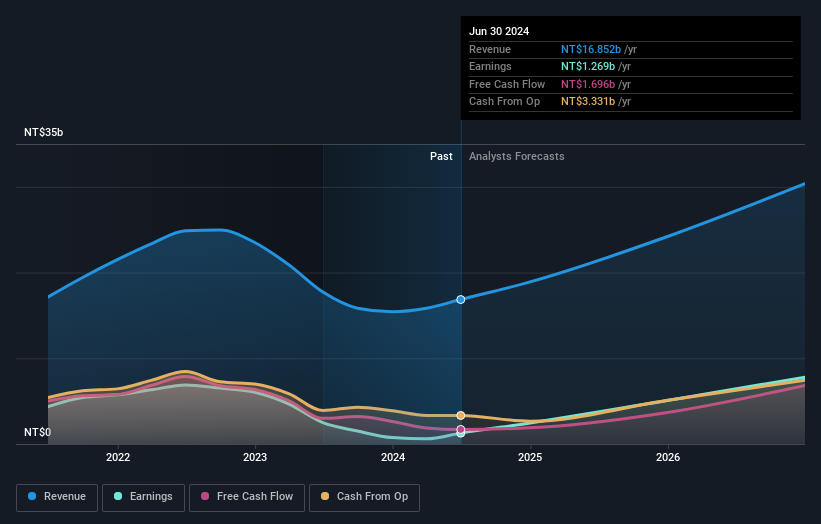

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Silergy Corp. designs, manufactures, and sells various integrated circuit products and related technical services in China and internationally, with a market cap of NT$158.56 billion.

Operations: The company generates NT$16.85 billion in revenue from its semiconductors segment.

Insider Ownership: 14.4%

Earnings Growth Forecast: 39.9% p.a.

Silergy Corp. has demonstrated strong growth potential with forecasted annual earnings growth of 39.86%, significantly outpacing the Taiwanese market's 18.2%. Recent earnings results show substantial improvement, with Q2 net income reaching TWD 560.6 million compared to a net loss last year, reflecting a robust recovery and operational efficiency. Despite its high volatility and lower profit margins compared to last year, Silergy trades at a significant discount to its estimated fair value, indicating potential for future appreciation.

- Click here and access our complete growth analysis report to understand the dynamics of Silergy.

- Our valuation report here indicates Silergy may be overvalued.

Seize The Opportunity

- Investigate our full lineup of 1509 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PHN

Pharmanutra

A pharmaceutical and nutraceutical company, researches, designs, develops, and markets nutritional supplements and medical devices in Italy, Europe, the Middle East, South America, Far East, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives