- Italy

- /

- Personal Products

- /

- BIT:ICOS

Intercos (BIT:ICOS) investors are up 5.5% in the past week, but earnings have declined over the last year

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Intercos S.p.A. (BIT:ICOS) share price is 16% higher than it was a year ago, much better than the market decline of around 13% (not including dividends) in the same period. So that should have shareholders smiling. We'll need to follow Intercos for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Since it's been a strong week for Intercos shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Intercos

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Intercos actually saw its earnings per share drop 17%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 13% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

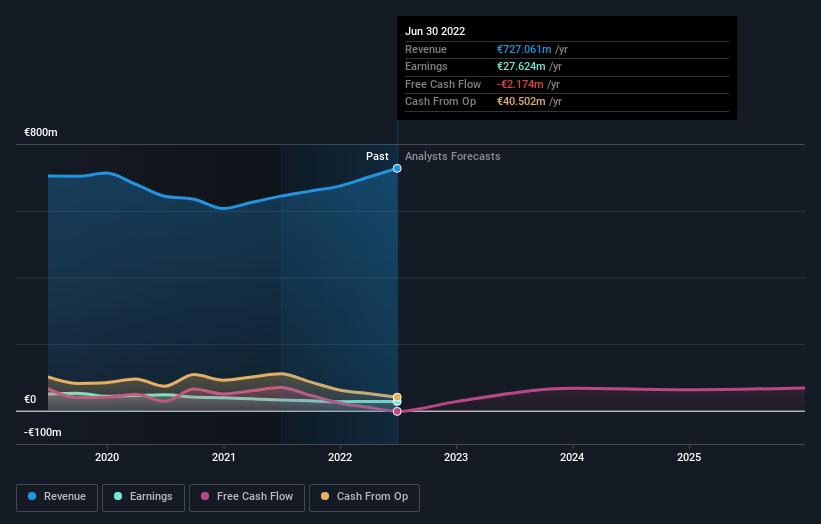

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Intercos' financial health with this free report on its balance sheet.

A Different Perspective

Intercos shareholders should be happy with the total gain of 16% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 18% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Intercos better, we need to consider many other factors. For example, we've discovered 1 warning sign for Intercos that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ICOS

Intercos

Intercos S.p.A., together with its subsidiaries, creates, produces, and markets cosmetics and skin care products worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success