As European markets continue to show resilience, with the STOXX Europe 600 Index marking its longest streak of weekly gains since August 2012, investors are keenly observing how tech stocks will perform amid mixed economic signals such as steady inflation in Germany and a shrinking economy in France. In this environment, identifying high-growth tech stocks requires careful consideration of companies that not only demonstrate strong innovation and adaptability but also have the potential to thrive despite broader market uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 22.65% | 39.77% | ★★★★★★ |

| Yubico | 21.27% | 26.82% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Bonesupport Holding | 30.50% | 48.59% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

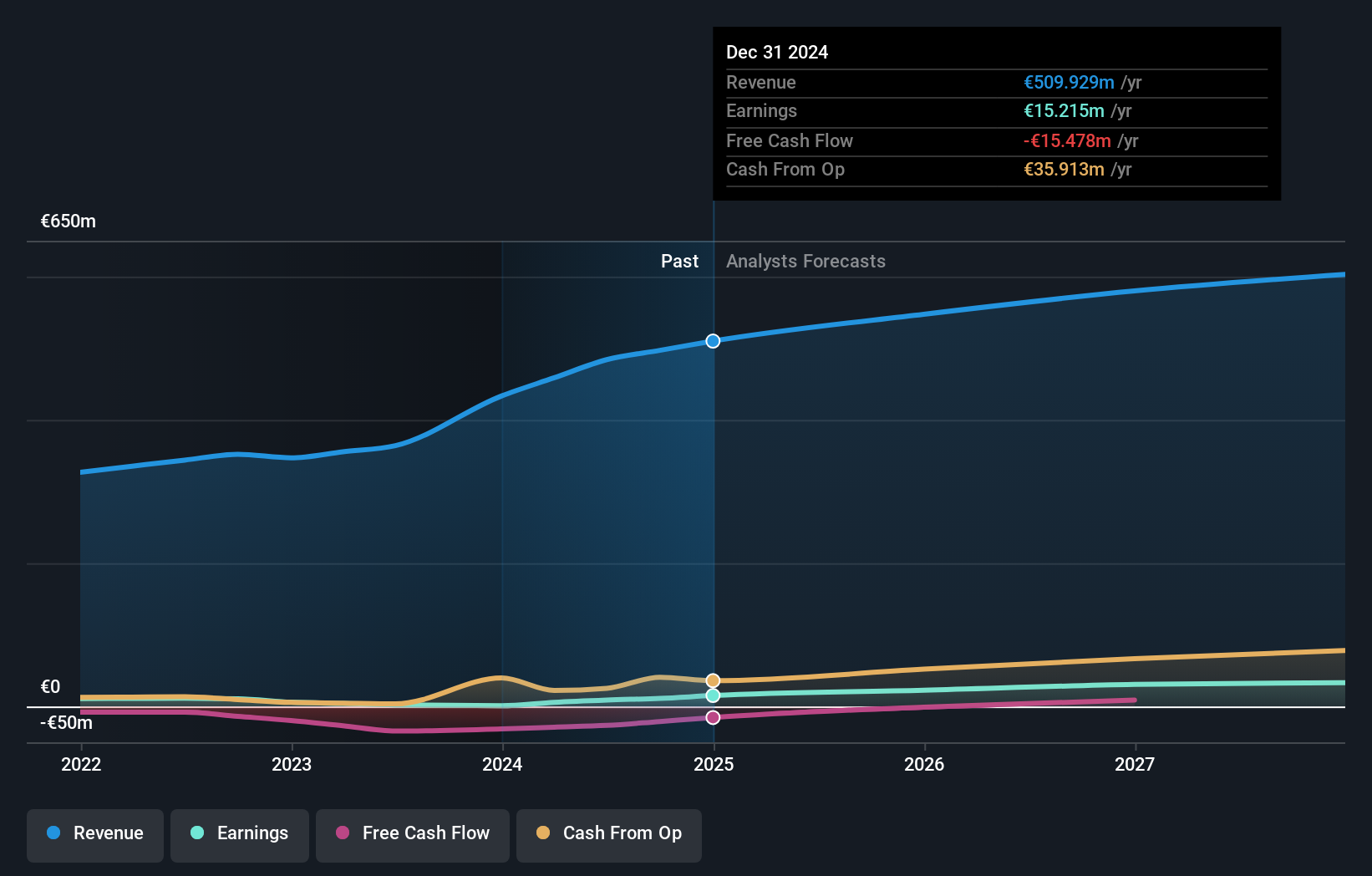

GPI (BIT:GPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GPI S.p.A. offers social-healthcare and information technology hi-tech services both in Italy and internationally, with a market capitalization of approximately €258.72 million.

Operations: GPI S.p.A. generates revenue primarily through its Software and Care segments, contributing €283.27 million and €161.11 million, respectively.

GPI S.p.A.'s recent presentation at the Mid & Small 2024 Milan Conference highlighted its robust earnings growth, which surged by an impressive 280.3% over the past year, starkly outperforming the Healthcare Services industry's decline of 9.9%. Despite a modest annual revenue growth forecast of 6.3%, GPI's earnings are expected to continue their upward trajectory with a projected annual increase of 43%. This performance is particularly notable in the Italian market, where GPI's revenue and earnings growth rates surpass the national averages of 4.1% and 8%, respectively. The company’s commitment to innovation is evident from its R&D investments, ensuring it remains competitive in a challenging sector.

- Dive into the specifics of GPI here with our thorough health report.

Explore historical data to track GPI's performance over time in our Past section.

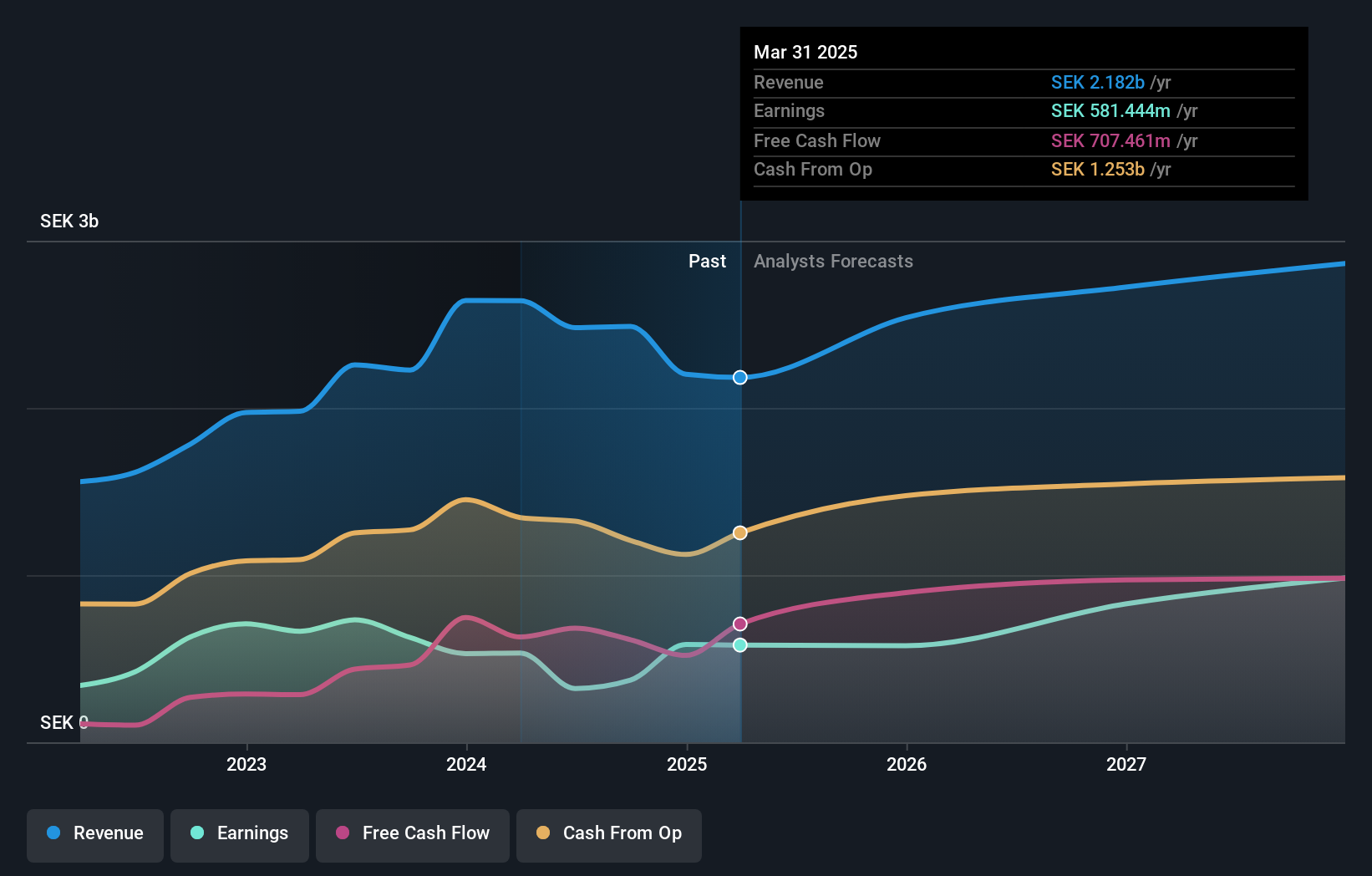

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various regions including North and Latin America, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of approximately SEK21.99 billion.

Operations: Paradox Interactive focuses on developing and publishing strategy and management games for PC and consoles, generating revenue primarily from computer graphics amounting to SEK2.20 billion.

Paradox Interactive, a European tech firm, recently showcased its financial agility with a notable increase in net income to SEK 310.82 million for Q4 2024, up from SEK 98.27 million the previous year. This growth is supported by an earnings forecast predicting a robust annual increase of 22% over the next three years, outpacing the Swedish market's average of 9.5%. The company's commitment to innovation is underlined by its R&D investments which remain integral to its strategy, ensuring it stays relevant in the competitive gaming sector despite a slower revenue growth rate of 11.3% compared to industry giants. With recent dividends and special dividends announced, Paradox is reinforcing shareholder value while maintaining strong financial health.

- Navigate through the intricacies of Paradox Interactive with our comprehensive health report here.

Understand Paradox Interactive's track record by examining our Past report.

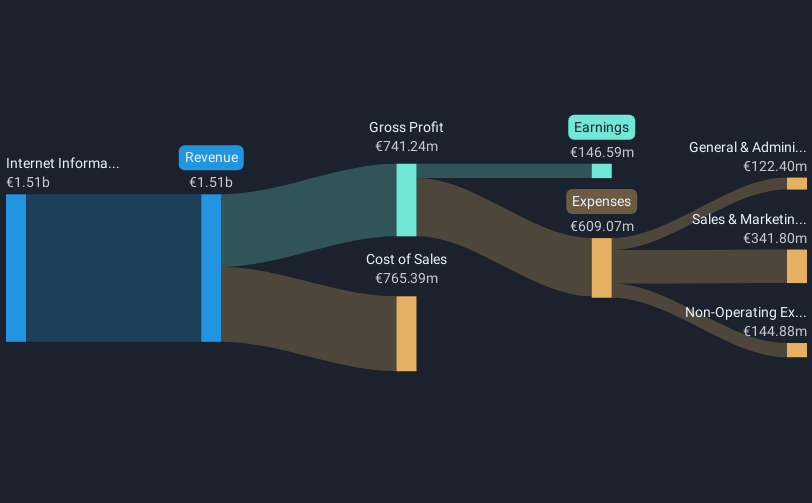

IONOS Group (XTRA:IOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IONOS Group SE, with a market cap of €3.33 billion, provides web presence and productivity services as well as cloud solutions across several countries including Germany, the United States, the United Kingdom, Spain, France, Poland, and Austria.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to approximately €1.51 billion.

Amidst the bustling European tech landscape, IONOS Group SE stands out, particularly after its recent inclusion in Germany's TECDAX Index. This recognition comes at a pivotal time as the company navigates through a significant follow-on equity offering of €210 million, co-led by notable financial institutions like J.P. Morgan and Deutsche Bank. Financially, IONOS is set to outpace its local market with an expected annual profit growth of 17.6% and revenue growth forecasts at 7.7%. These figures not only surpass the German market averages of 16.9% and 5.7%, respectively but also highlight IONOS’s robust positioning within the tech sector despite a challenging past year where earnings slightly retracted by 0.05%.

- Unlock comprehensive insights into our analysis of IONOS Group stock in this health report.

Gain insights into IONOS Group's past trends and performance with our Past report.

Taking Advantage

- Access the full spectrum of 249 European High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IOS

IONOS Group

Through its subsidiaries, provides web presence and productivity, and cloud solutions for companies in Germany, the United States, the United Kingdom, Spain, France, Poland, and Austria.

Good value with proven track record.

Market Insights

Community Narratives