- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Undiscovered Gems With Potential In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of heightened inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing their value counterparts. Despite small-cap stocks lagging behind the larger indices like the S&P 500, this environment presents a unique opportunity to explore lesser-known companies that may offer potential for growth. In times of economic uncertainty and market volatility, identifying undiscovered gems often involves seeking out companies with strong fundamentals and innovative strategies that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★☆

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy, Europe, and internationally with a market capitalization of approximately €848.41 million.

Operations: EL.En. S.p.A. generates revenue primarily from its Medical and Industrial segments, contributing €398.49 million and €267.42 million, respectively.

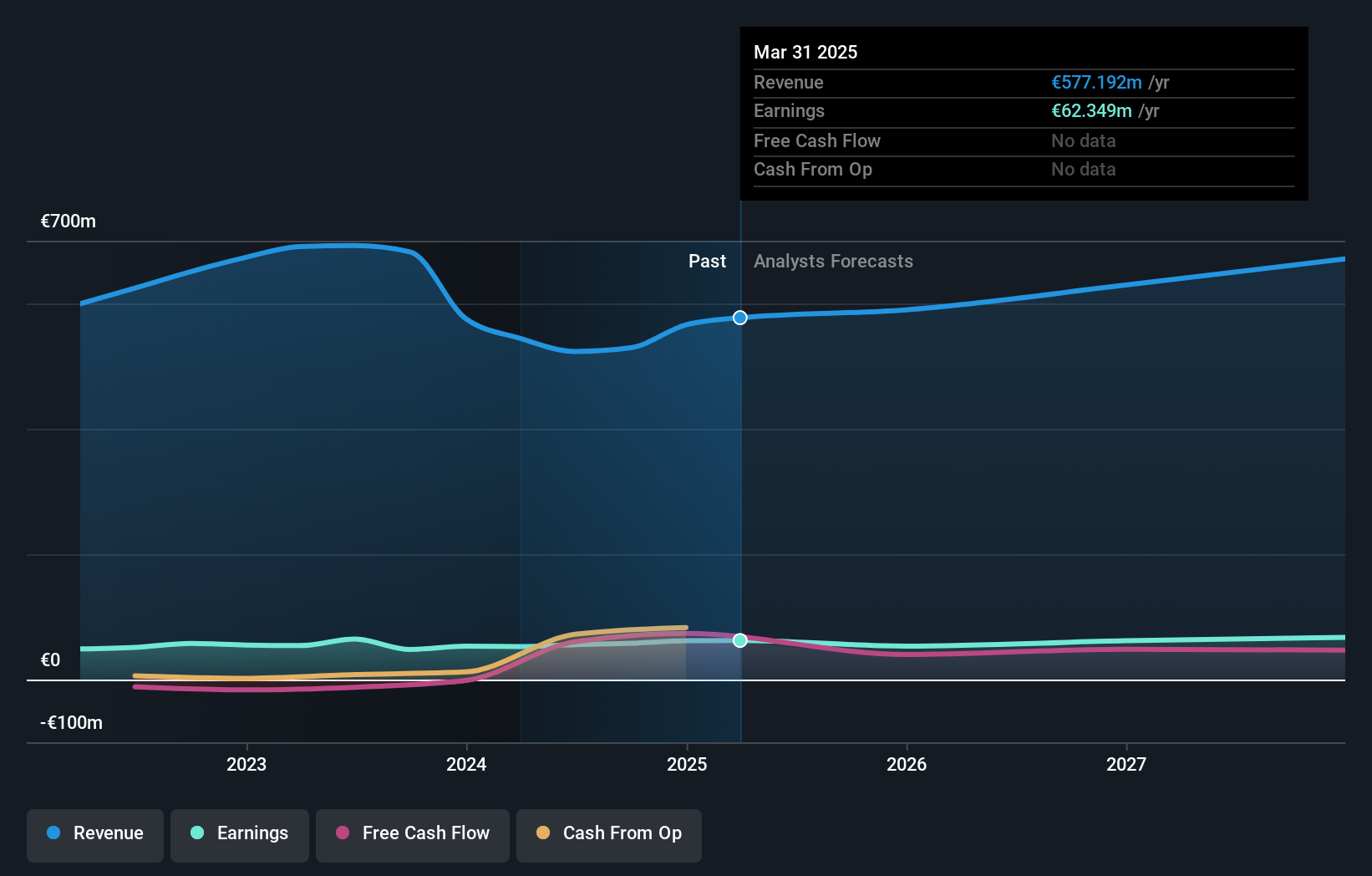

EL.En, a nimble player in the medical equipment space, is making strategic shifts by divesting its laser cutting units to focus on high-margin medical devices. This move seems poised to boost profitability and revenue growth, with forecasts indicating an 8.34% annual earnings increase and net margins rising from 7.7% to 8.4%. The company's price-to-earnings ratio of 16.9x suggests good value compared to the industry average of 32.6x, while robust EBIT coverage of interest payments at 120.9x underscores financial stability. Recent share repurchases could signal management's confidence in future prospects despite challenges in key markets like the U.S and China.

Sogefi (BIT:SGF)

Simply Wall St Value Rating: ★★★★★★

Overview: Sogefi S.p.A. is a company that specializes in the design, development, and production of filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry across Europe, South America, North America, and Asia with a market capitalization of approximately €255.89 million.

Operations: Sogefi generates revenue primarily from its suspensions and air and cooling segments, with €546.31 million and €479.15 million, respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability within the automotive industry.

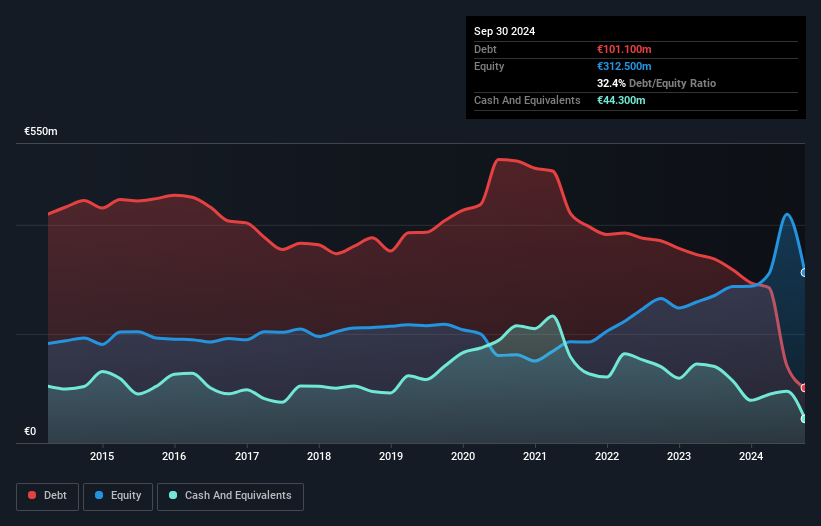

Sogefi, a player in the auto components sector, has shown remarkable earnings growth of 2366.3% over the past year, outpacing the industry's -16.5%. The company's interest payments are well covered by EBIT at 7.1x, demonstrating financial robustness. With a satisfactory net debt to equity ratio of 18.2%, Sogefi's debt management appears prudent. Over five years, it has reduced its debt to equity from 187.2% to 32.4%, indicating improved financial health. Although trading at a discount of about 20% below its estimated fair value suggests potential undervaluation, earnings are forecasted to decline significantly in coming years by an average of 50%.

Transcend Information (TWSE:2451)

Simply Wall St Value Rating: ★★★★★★

Overview: Transcend Information, Inc. is involved in the manufacturing, processing, and selling of computer software and hardware, peripheral equipment, and other computer components across Taiwan and internationally with a market cap of NT$38.17 billion.

Operations: Transcend generates revenue primarily from computer peripherals, amounting to NT$10.27 billion. The company's market capitalization stands at NT$38.17 billion.

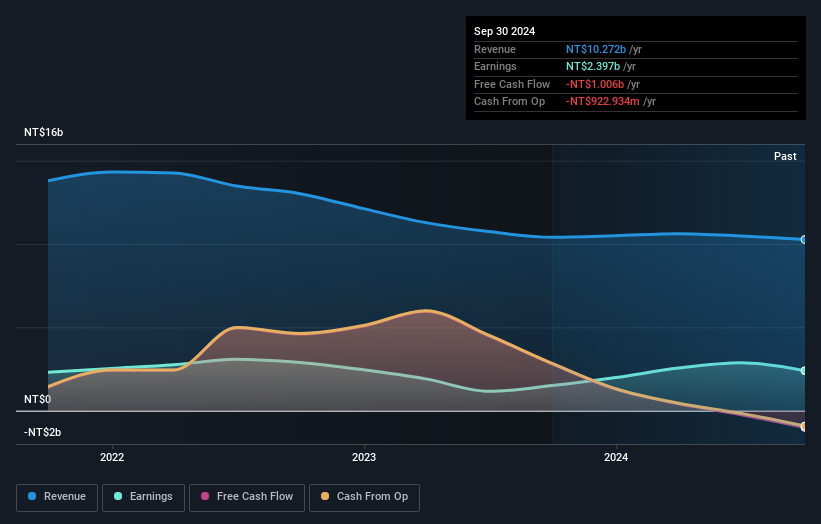

Transcend Information, a tech player with promising growth potential, boasts an impressive earnings surge of 59.3% over the past year, outpacing the broader Tech industry’s 12.9%. This performance is underscored by its attractive price-to-earnings ratio of 15.9x, which is competitive against the TW market's 21.3x benchmark. The company operates debt-free, eliminating concerns over interest coverage and financial leverage. Despite not being free cash flow positive recently, Transcend's high level of non-cash earnings suggests robust underlying business operations that could support future profitability and stability in a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of Transcend Information.

Understand Transcend Information's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 4716 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research, development, production, sale, and distribution of laser solutions in Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives