- Italy

- /

- Medical Equipment

- /

- BIT:ELN

March 2025's European Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index ends a two-week losing streak with a modest gain, European markets are navigating a landscape marked by cautious central bank policies and trade-related uncertainties. Amid this backdrop, small-cap stocks present intriguing opportunities for investors seeking value, especially when insider activity suggests potential confidence in these companies' prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 22.8x | 5.8x | 11.06% | ★★★★★☆ |

| Macfarlane Group | 10.8x | 0.6x | 39.13% | ★★★★★☆ |

| Robert Walters | NA | 0.2x | 47.68% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 24.89% | ★★★★★☆ |

| Savills | 24.7x | 0.6x | 36.90% | ★★★★☆☆ |

| Gamma Communications | 20.5x | 2.1x | 41.48% | ★★★★☆☆ |

| Seeing Machines | NA | 1.8x | 23.75% | ★★★★☆☆ |

| Arendals Fossekompani | 20.4x | 1.6x | 48.25% | ★★★☆☆☆ |

| Franchise Brands | 36.6x | 1.9x | 29.74% | ★★★☆☆☆ |

| Exsitec Holding | 25.4x | 1.9x | 46.51% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Volex is a global manufacturer and supplier of integrated manufacturing services and power products, with a market cap of approximately £0.99 billion.

Operations: Volex generates revenue primarily through its sales, with a recent figure of $1.03 billion, while managing costs of goods sold (COGS) at $808.8 million. The company's gross profit margin has shown an upward trend, reaching 22.74% in the latest period. Operating expenses are significant, with general and administrative expenses being a major component at $129.4 million recently. Net income margin has been improving over time but remains modest at 4.21%.

PE: 14.8x

Volex, a notable player in the electrical and optical connectivity sector, recently reported a 21.8% revenue increase to US$789.4 million for the 39 weeks ending December 2024, driven by organic growth and acquisitions. Despite facing legal challenges from Credo Technology over patent infringement claims on March 13, insider confidence is evident with recent share purchases. The company's high debt levels pose risks; however, projected earnings growth of 15% annually suggests potential for future value realization.

- Take a closer look at Volex's potential here in our valuation report.

Gain insights into Volex's past trends and performance with our Past report.

EL.En (BIT:ELN)

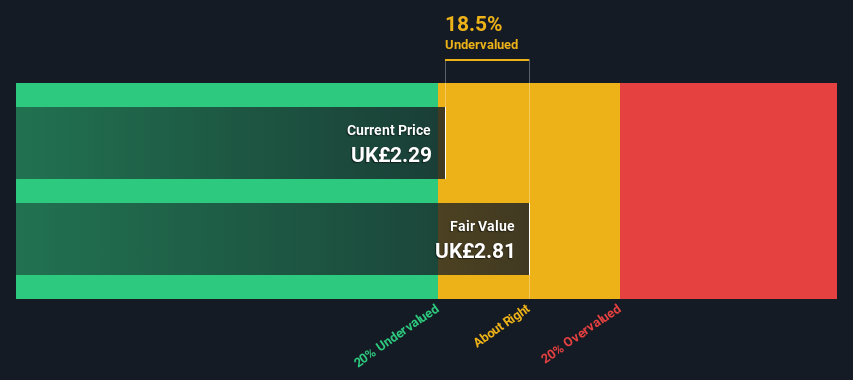

Simply Wall St Value Rating: ★★★☆☆☆

Overview: EL.En is a company that specializes in the design, production, and distribution of laser systems for medical and industrial applications with a market capitalization of approximately €1.38 billion.

Operations: EL.En's revenue streams are primarily driven by its sales, with a notable gross profit margin that fluctuated between 36.83% and 37.95% in recent periods. The company incurs significant costs of goods sold (COGS), which reached €412.91 million by September 2024, impacting its overall profitability. Operating expenses have also been substantial, with general and administrative expenses consistently forming a major part of these costs, amounting to €165.16 million in March 2024.

PE: 20.8x

EL.En. S.p.A., a European small-cap company, shows potential for growth with its recent performance and strategic moves. In 2024, the firm reported sales of €148.11 million and net income of €33.99 million, reflecting an upward trend from the previous year. Insider confidence is evident as Alberto Pecci purchased 15,000 shares valued at approximately €145,198 in early 2025. The company has initiated share repurchases since January 2025 and announced a dividend increase to €0.22 per share payable in May 2025, indicating shareholder value focus despite reliance on higher-risk external funding sources.

- Dive into the specifics of EL.En here with our thorough valuation report.

Explore historical data to track EL.En's performance over time in our Past section.

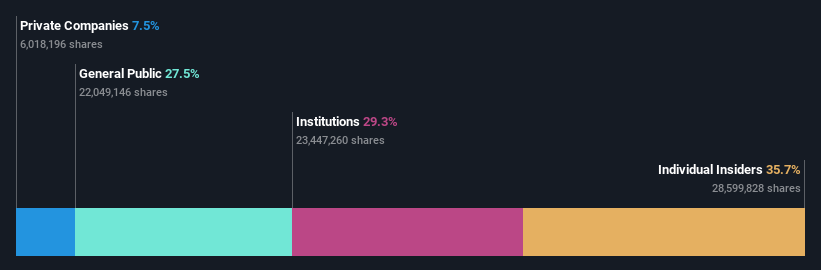

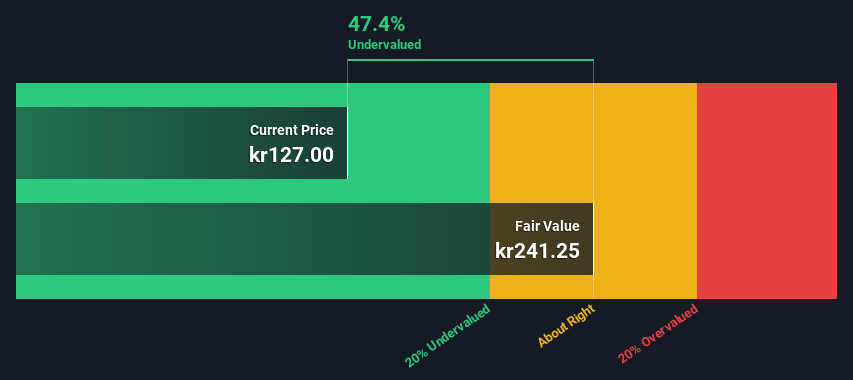

Arendals Fossekompani (OB:AFK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Arendals Fossekompani is a diversified industrial investment company involved in renewable energy, technology, and infrastructure sectors, with a market capitalization of approximately NOK 8.64 billion.

Operations: Arendals Fossekompani derives its revenue primarily from segments such as ENRX, NSSL Global, and Tekna. The company's gross profit margin has shown variability, reaching 65.83% in recent periods. Operating expenses are a significant component of the cost structure, with general and administrative expenses consistently being a large portion of these costs.

PE: 20.4x

Arendals Fossekompani stands out in the European investment landscape due to its recent insider confidence, highlighted by their Executive Vice President purchasing 9,000 shares for approximately NOK 1.48 million. This move reflects a significant 19% increase in their holdings, signaling potential optimism about future prospects. Despite relying entirely on external borrowing, the company reported impressive financial growth for the year ending December 2024, with net income soaring to NOK 2.6 billion from NOK 40 million previously. Additionally, they affirmed a cash dividend of NOK 1 per share in February 2025, underlining shareholder value focus amidst volatile funding dynamics.

- Click here and access our complete valuation analysis report to understand the dynamics of Arendals Fossekompani.

Assess Arendals Fossekompani's past performance with our detailed historical performance reports.

Make It Happen

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 65 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research, development, production, sale, and distribution of laser solutions in Italy, rest of Europe, and internationally.

Flawless balance sheet with high growth potential and pays a dividend.