- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Discovering None's Hidden Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and broad-based declines in U.S. stocks, smaller-cap indexes experienced some of the most significant losses, highlighting ongoing concerns about market stability and economic forecasts. Despite these challenges, the resilience shown by certain economic indicators, such as robust consumer spending and job growth, suggests that opportunities may still exist for discerning investors willing to explore beyond the mainstream markets. In this context of fluctuating sentiment and shifting monetary policies, identifying undiscovered gems with strong potential involves seeking companies that demonstrate solid fundamentals, adaptability to changing conditions, and promising growth prospects within their respective niches.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★☆

Overview: EL.En. S.p.A. is involved in the research, development, planning, manufacture, and sale of laser systems across Italy, Europe, and internationally with a market cap of €932 million.

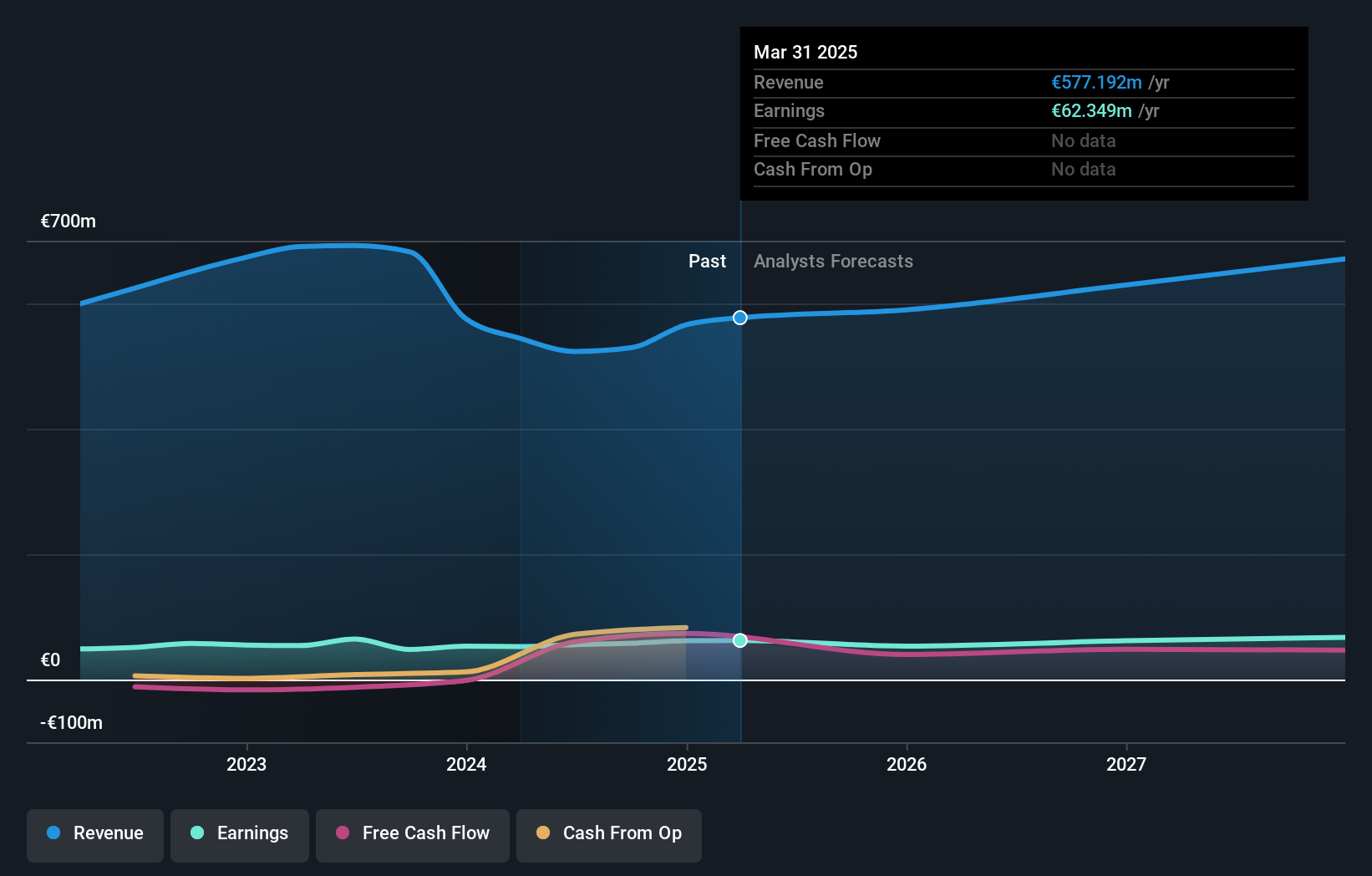

Operations: EL.En. S.p.A. generates revenue primarily from its medical laser systems segment, contributing €398.49 million, and its industrial laser systems segment, which brings in €267.42 million. The company's net profit margin reflects the efficiency of its operations and profitability after all expenses are accounted for.

EL.En., a nimble player in the medical equipment sector, has shown consistent earnings growth of 16.8% annually over the past five years, though recent figures reveal a slower 6.5% rise, lagging behind industry peers at 26%. The company reported third-quarter sales of €153.26 million and net income of €15.31 million, reflecting improvement from last year despite overall revenue slipping to €480.19 million for nine months ended September 2024. With more cash than total debt and interest payments covered by EBIT at an impressive 120x, EL.En.'s financial health appears robust amidst its strategic divestment plans with Yangtze Optical Fibre and Cable Joint Stock Ltd.

- Navigate through the intricacies of EL.En with our comprehensive health report here.

Explore historical data to track EL.En's performance over time in our Past section.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.14 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion) and Renewable Generation Infrastructure (€1.09 billion). The company's net profit margin is a key financial indicator to consider when evaluating its overall profitability.

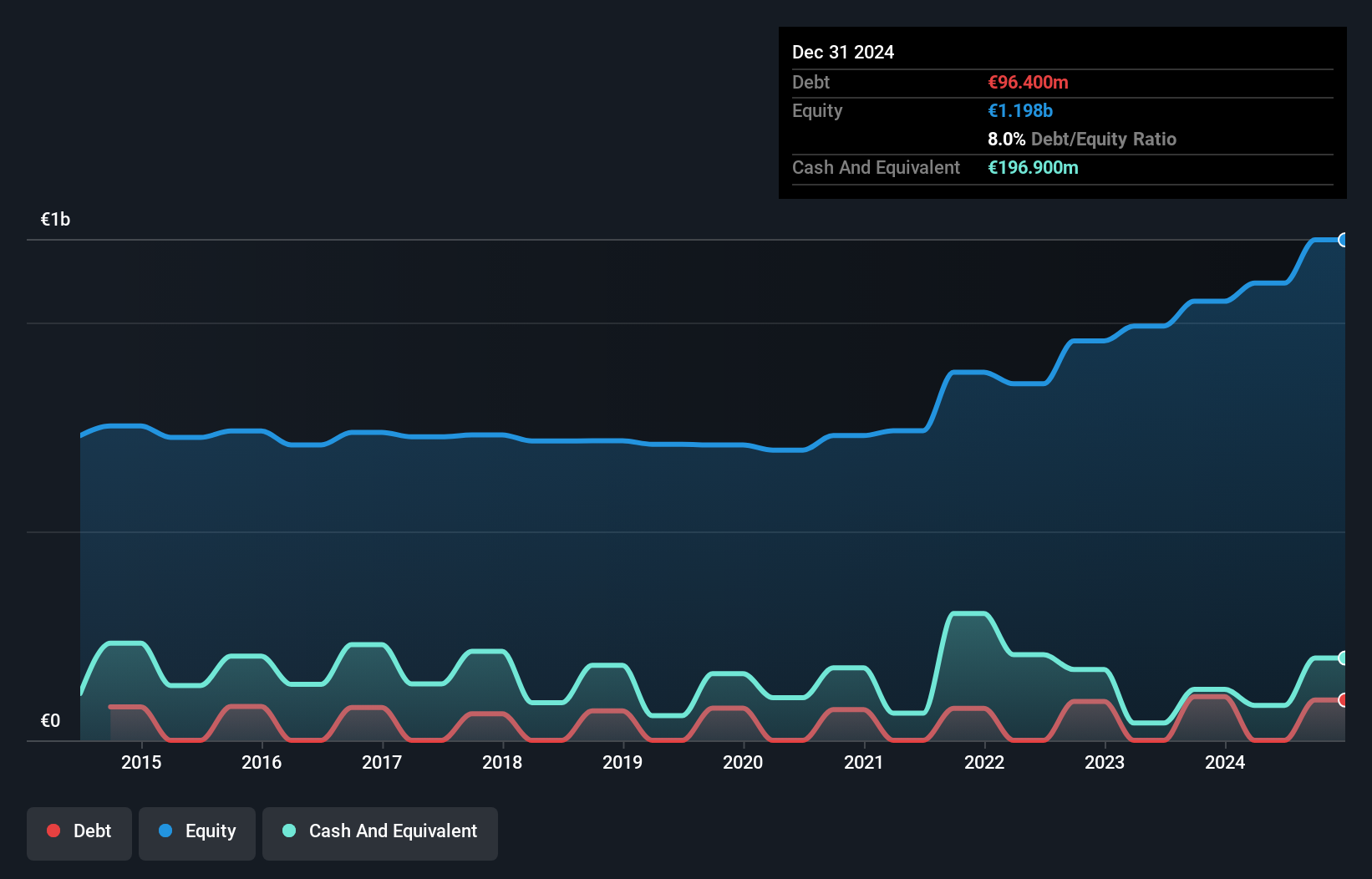

Naturenergie Holding, a nimble player in the energy sector, showcases impressive financials with a 40.5% earnings growth over the past year, outpacing the Electric Utilities industry's -10.9%. This growth is supported by high-quality earnings and a debt-free status for five years, eliminating concerns about interest coverage. The company trades at an attractive price-to-earnings ratio of 10.5x compared to the Swiss market's 20.7x, suggesting good relative value among peers and industry standards. Despite recent fluctuations in free cash flow and capital expenditures impacting performance, Naturenergie seems well-positioned for steady annual earnings growth of 3.28%.

- Delve into the full analysis health report here for a deeper understanding of naturenergie holding.

Understand naturenergie holding's track record by examining our Past report.

Palfinger (WBAG:PAL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Palfinger AG is a global producer and seller of crane and lifting solutions with a market capitalization of €669.61 million.

Operations: Palfinger generates revenue primarily from the sale of crane and lifting solutions worldwide. The company focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on managing production and operational expenses.

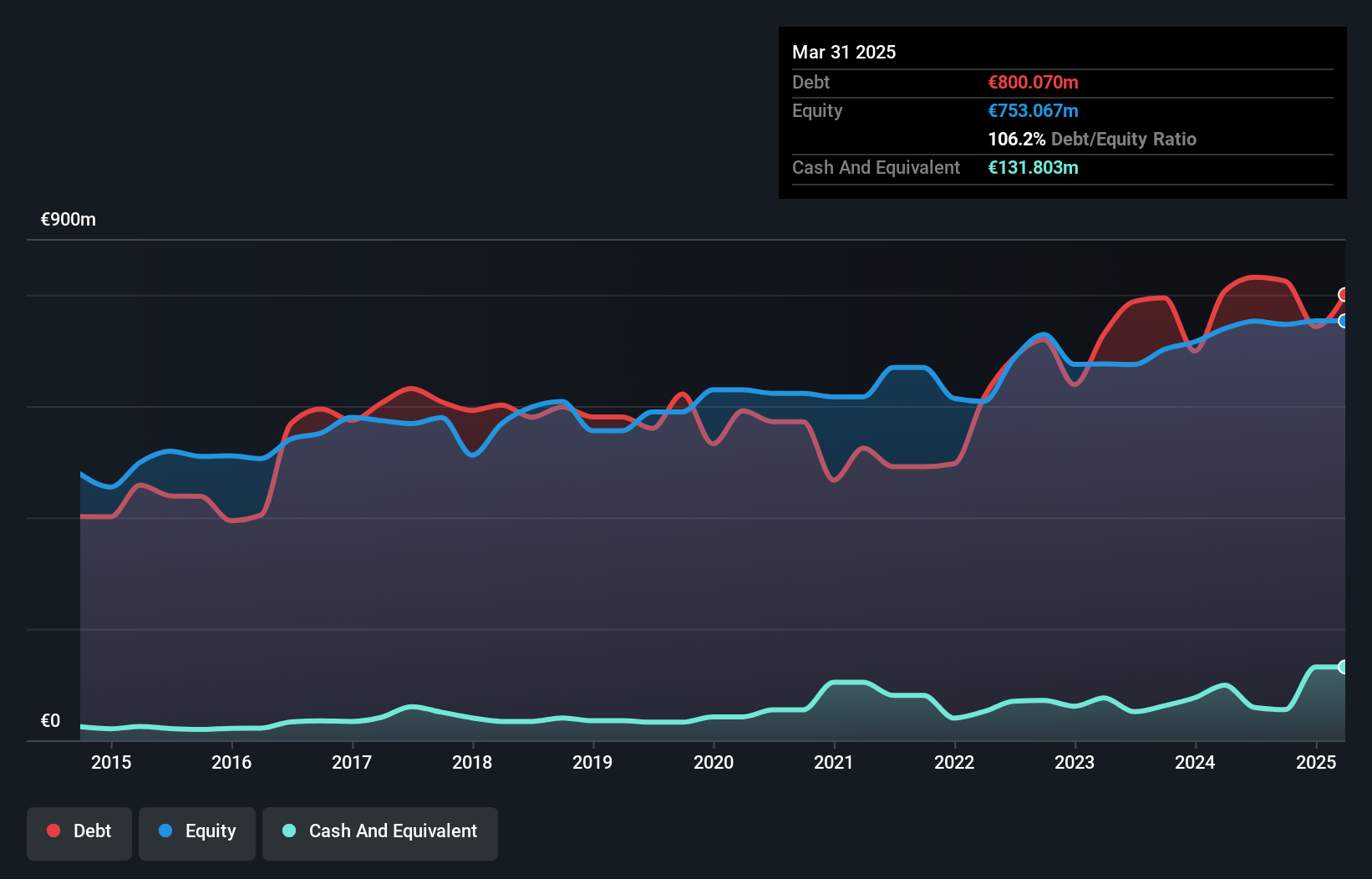

Palfinger, a notable player in the machinery sector, is trading at 18.4% below its estimated fair value, suggesting potential undervaluation. Despite a negative earnings growth of 1.5% over the past year compared to the industry average of 2.5%, Palfinger remains profitable with free cash flow positivity and well-covered interest payments at 4.4x EBIT coverage. However, its debt-to-equity ratio has increased from 105.4% to 110.4% over five years, indicating rising leverage concerns despite high-quality earnings reported consistently. Recent earnings showed net income stability with EUR 90 million for nine months in both current and previous years, reflecting resilience amidst challenges.

- Dive into the specifics of Palfinger here with our thorough health report.

Gain insights into Palfinger's historical performance by reviewing our past performance report.

Summing It All Up

- Investigate our full lineup of 4633 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the research and development, planning, manufacture, and sale of laser systems in Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.